Key Takeaways

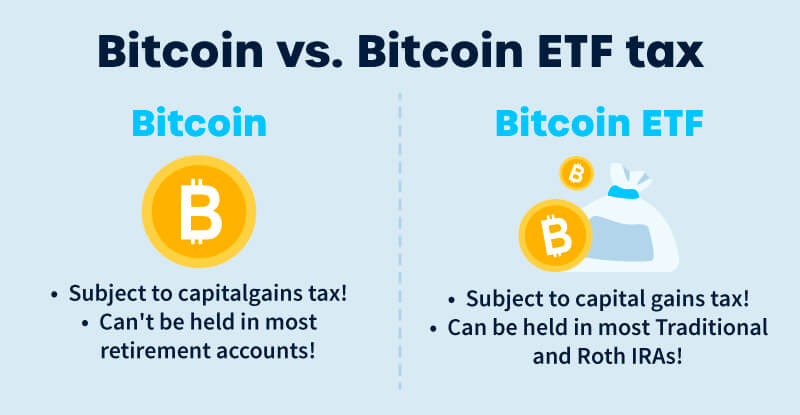

- Just like BTC, Bitcoin ETFs are subject to capital gains tax.

- Most tax-advantaged retirement account providers allow you to hold Bitcoin ETFs.

How are the Bitcoin ETFs taxed?

Let’s walk through the basics of how your Bitcoin ETF is taxed.

When do I pay tax on my Bitcoin ETF?: Bitcoin ETFs are subject to capital gains tax when you dispose of it (for example, when you sell it for USD). There is no tax for simply holding a Bitcoin ETF.

What tax rate do I pay on my Bitcoin ETF?: The tax rate you pay on your Bitcoin ETF disposals varies on a variety of factors including your income, how long you held your assets, and whether you are holding a spot or futures ETF.

How are spot ETFs taxed?

Spot Bitcoin ETFs, like Ark 21Shares Bitcoin ETF and VanEck Bitcoin ETF, hold Bitcoin on behalf of investors, and offer shares tracking the price of BTC. When you dispose of spot ETF shares, you’ll incur a capital gain or loss.

Short-term capital gains: If you held your ETF shares for less than a year, your capital gains are taxed at ordinary income tax rates, ranging from 10% to 37%.

.jpeg)

Long-term capital gains: If you hold your ETF shares for more than a year, your capital gains are taxed at long-term capital gains tax rates of 0%, 15%, or 20%, depending on your income bracket.

.jpeg)

How are futures ETFs taxed?

Futures-based Bitcoin ETFs — like Global X Blockchain & Bitcoin Strategy ETF and ProShares Bitcoin Strategy ETF — track the price of Bitcoin through Bitcoin futures contracts. These ETFs are subject to different tax rules.

Futures ETF tax: With futures ETFs, 60% of your gain will be considered a long-term gain while 40% of your gain will be considered a short-term gain — regardless of the holding period.

Are Bitcoin ETFs taxed at a lower rate than BTC?

BTC and Spot Bitcoin ETFs are both subject to short-term/long-term capital gains tax — depending on your holding period. Spot Bitcoin ETFs are not taxed at a different rate.

What’s the tax advantage of Bitcoin ETFs?

Bitcoin ETFs can be held in tax-advantaged retirement accounts, such as a Roth or Traditional IRA.

At this time, most major IRA providers don’t support the option to hold BTC directly. While you can set up a self-directed IRA for this purpose, this can take time and effort.

Why Buy a Bitcoin ETF Instead of Bitcoin?

Investing in a Bitcoin ETF vs. Bitcoin comes with the following advantages:

- Convenience: Bitcoin ETFs are a great option for investors new to crypto. Investors can buy and sell Bitcoin ETFs through their brokerage accounts, and do not need to be responsible for managing the security of their crypto-assets.

- Retirement accounts: As stated earlier, Bitcoin ETFs can be held in most Crypto IRAs, offering potential tax benefits that direct Bitcoin holdings cannot provide.

How Do I Report My Bitcoin ETF Taxes?

You can use the following forms to report your gains and losses from Bitcoin ETFs:

- Form 8949: Use this form to report capital gains and losses from your Bitcoin ETF transactions. You'll need to detail each transaction, including date of acquisition and disposal, and the price of your Bitcoin ETF when you acquired it and when you disposed of it.

- Schedule D: Summarize the information from Form 8949 on Schedule D, which is attached to your tax return.

If you are trading Bitcoin ETFs through your brokerage account, it’s likely that you’ll get a Form 1099-B detailing your capital gains and losses.

Tax planning strategies for Bitcoin ETF holders

Let’s walk through a few strategies that can help you minimize your taxes on your Bitcoin ETF.

Hold your ETF shares for the long-term: Consider holding your ETF shares for a year or longer. As noted earlier, you’ll pay lower tax rates if you hold your ETF shares for longer than 12 months.

Hold your ETF shares in an IRA: Most IRA providers allow you to invest in crypto ETFs. IRAs are a great option to minimize taxes for those planning to hold their assets for the long-term.

Use tax-loss harvesting: Capital losses can offset up to $3,000 of income and an unlimited amount of capital gains for the year. Because of these tax benefits, some investors strategically use tax-loss harvesting — intentionally selling Bitcoin ETF shares and other assets at a loss — to reduce their tax bill during a market downturn.

Frequently asked questions

- Are Bitcoin ETFs tax-free?

No. Bitcoin ETFs are subject to tax.

- How is a crypto ETF taxed?

Just like stocks and cryptocurrencies, crypto ETFs are subject to capital gains tax upon disposal.

- Which Bitcoin ETF is best?

IBIT is considered one of the best Bitcoin ETFs due to its low annual fees.

- What are fees on a Bitcoin ETF?

While there’s no tax for simply holding a Bitcoin ETF, you will be required to pay annual fees to cover management, marketing, and other costs. These fees will vary based on your provider but are typically less than 1%.

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

%20(1).png)

.png)