.jpg)

Are you an Australian investor buying and selling cryptocurrencies on Binance?

In the past few years, the cryptocurrency ecosystem has made headlines all over the world. That means tax agencies like the ATO are playing closer attention than ever to transactions made on Binance.

In this guide, we’ll break down how Binance transactions are taxed as well as the exchange’s current tax reporting policies. We’ll also share a simple tip that can help you file your cryptocurrency taxes in minutes.

What is Binance?

Binance is a Hong Kong-based cryptocurrency exchange that allows users to buy, sell, and trade cryptocurrencies. The company was founded in 2017 by Changpeng Zhao.

Today, Binance is one of the largest and most popular exchanges in Australia. It’s been estimated that Binance has more than 30 million users worldwide.

How are my Binance transactions taxed?

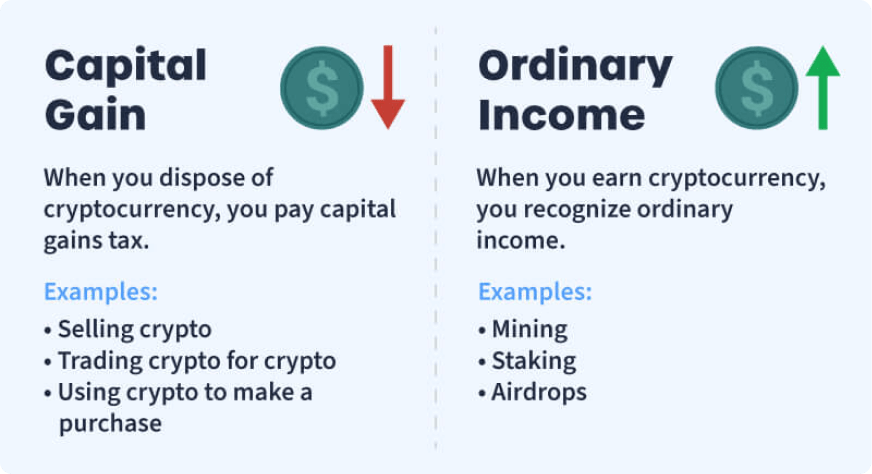

In Australia, crypto transactions on Binance and other platforms are subject to capital gains and ordinary income tax.

For more information, check out our guide to how cryptocurrency is taxed in Australia.

Is Binance legal in Australia?

While Binance has pulled out of certain countries like the US on regulatory grounds, the exchange legally operates in Australia.

Does Binance have KYC?

Binance Australia is registered with AUSTRAC, a financial enforcement company. As a result, users are required to provide personal information when signing up for an account. This information may be turned over to the Australian government at any time.

What does the ATO do with the information that Binance provides?

Since 2019, the ATO has used data matching to crack down on crypto tax fraud. The ATO uses information provided by exchanges like Binance to track crypto transactions and identify individuals who have not met their tax obligations.

In the past, the ATO has used this information to send warning letters to hundreds of thousands of cryptocurrency investors.

How do I avoid Binance taxes in Australia?

Remember, there is no way to legally evade your taxes in Australia. However, there are strategies like tax-loss selling that can help you save thousands of dollars legally.

For more information, check out our guide to avoiding taxes in Australia.

Does Binance provide tax reports for users?

Like many other cryptocurrency exchanges, Binance does not provide tax reports for users.

Because investors often transfer their cryptocurrency between different wallets and exchanges, it’s difficult for exchanges to accurately track gains and losses. As a result, the burden for tracking taxes typically falls on the investor.

While tracking your cryptocurrency taxes manually can be difficult, there’s an easier way. Crypto tax software like CoinLedger can automatically connect to your wallets and exchanges and help you generate a comprehensive tax report with the click of a button.

Get a Binance tax report today

With CoinLedger, you can import your Binance transactions through a csv file or through an API import. Whichever method you choose, you’ll be able to complete the process in minutes!

Once you’re done, you can file your taxes yourself or send off your crypto tax report to your accountant!

Interested in getting started? Join the 700,000 investors across the globe who use CoinLedger to simplify their tax season.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)