%20(1).jpg)

Reporting cryptocurrency on your taxes can be stressful in any country — the UK is no exception.

As cryptocurrencies like Bitcoin have grown in popularity over the years, so has the amount of people who are making money by investing or trading them.

We know that trying to understand the tax code can feel overwhelming — so we wrote this guide to help UK crypto investors like you better understand HM Revenue and Customs (HMRC’s) guidance on cryptocurrency taxes.

What is cryptocurrency?

If you’re reading this guide, it’s likely that you’ve already dabbled with cryptocurrencies. We won’t do a deep dive on the fundamentals of crypto within this piece, but we will explain how the UK government views assets like Bitcoin and Ethereum.

In their policy paper, HMRC explains that crypto-assets (or ‘cryptocurrency’) are cryptographically secured digital representations of value or contractual rights that can be:

- transferred

- stored

- traded electronically

HMRC does not consider cryptocurrency to be currency or money. Under UK crypto tax rules, profits on cryptocurrency disposals are considered capital gains and are accordingly subject to capital gains taxes.

UK crypto tax basics

From a tax perspective, investing in cryptocurrency is very similar to investing in other assets like stocks, bonds, and real-estate.

This means that capital gains and losses rules apply when you dispose of your cryptocurrency. “Disposal” is a broad term that encompasses any time you get rid of a cryptocurrency.

HMRC explains that disposals include:

- selling cryptocurrency for money

- exchanging cryptocurrency for a different type of cryptocurrency

- using cryptocurrency to pay for goods or services

- giving away cryptocurrency to another person (not including your spouse)

So you officially ‘dispose’ of your crypto whenever you carry out any of these four scenarios, and you are subject to capital gains taxes on any gains you realize—similar to if you were disposing of stocks or other forms of investments.

Here are a few simple examples that show how common disposal events are taxed.

Example 1:

.jpeg)

Example 2:

.jpeg)

Example 3:

.jpeg)

Pro Tip: ‘Many taxpayers are unaware that crypto-to-crypto transactions are taxable. Remember, these transactions should be carefully reported for tax reporting purposes.’ - Richard Baldwyn, TFA Accountants

Are wallet-to-wallet transfers a taxable event?

Wallet-to-wallet transfers are not considered taxable events. However, you should keep a record of these transfers in case you need to calculate your capital gains in a future disposal.

Calculating crypto capital gains

In the examples above, the capital gains calculation is extremely straightforward as there are only two transactions to account for. The formula we use to calculate these capital gains and losses is as follows:

Fair Market Value - Cost Basis = Gain/Loss

Fair Market Value is the market price of the cryptocurrency at the time you sold, traded, or disposed of it. Cost Basis refers to the amount it costs you to acquire the coin.

In our 1st example above, £25,000 is Christopher’s cost basis and £35,000 is the fair market value at the time of the sale. This results in a £10,000 capital gain.

How are transaction fees and gas fees taxed?

Any fees involved in acquiring or disposing of your crypto can be added to your cost basis. This includes any transaction fees and gas fees.

.jpeg)

Reporting fees does have benefits for crypto investors. In the event that you sell your crypto at a profit, a higher cost basis can reduce your capital gains tax.

Shared Pool Accounting

Calculating capital gains and losses from your crypto transactions becomes more complex when you have multiple transactions to account for. The UK requires a specific type of method for calculating the cost basis of your coins known as Shared Pool Accounting.

With the shared pooled accounting method, you are essentially taking an average of the costs you have incurred to acquire your crypto. These averages can be used to calculate your cost basis per coin. Each cryptocurrency has its own shared pool for determining basis.

Example:

Let’s take an example of a crypto investor who buys Ethereum at multiple price points in a given year.

.jpeg)

In this example, Emma has a total pool of 2.5 ETH prior to her October sale. To calculate her cost basis on a per ETH basis, we need to average out her total costs.

Her allowable costs for her total pool of 2.5 ETH are £4,000 (May buy of £1,500 plus August buy of £2,500). We then simply divide her total allowable costs by her total pool of ETH.

£4,000 / 2.5 ETH = £1,600/ETH

As you can see, Emma’s cost basis per ETH in her shared pool is £1,600.

We can use the equation from above to calculate Emma’s capital gain from the sale of her 1 ETH in October.

Fair Market Value - Cost Basis = Gain/Loss

£3,000 - £1,600 = £1,400 Gain

Emma recognizes a £1,400 capital gain from selling her 1 ETH in December.

Can the HMRC track my cryptocurrency?

In recent years, the HMRC has taken steps to curb crypto tax evasion. In the past, the HMRC has requested and obtained customer data from major exchanges and sent ‘nudge’ letters to crypto investors to encourage them to pay capital gains and income tax.

What is the deadline for reporting my crypto taxes?

In the UK, the tax year starts on April 6th and ends on April 5th of the following year.

The deadline for submitting your tax return is different for paper and online submissions. For the 2021-2022 tax year, the paper deadline is October 31st, 2021 and the online deadline is January 31st, 2022.

Same Day and Bed & Breakfast Rule

Things get a bit more complicated when you factor in two additional rules that apply with capital gains in the UK: the Same Day Rule and the Bed & Breakfast Rule.

Each of these rules are designed to prevent wash sales, which is a scenario in which an investor intentionally sells or disposes of an asset that has decreased in value and then buys it back soon after. This behavior maximizes tax benefits and helps the investor minimize his or her capital gains.

The Same Day Rule and the Bed & Breakfasting Rule exist to eliminate the potential tax benefits of wash sales.

The Same Day Rule

If you buy and sell a cryptocurrency the same day, then the sale is considered made from the coins you bought on that same day.

That means the cost basis for your sale will be the acquisition cost of the crypto you bought on the same day. This will be the case even if the acquisition of the crypto takes place after the sale—as long as they are both on the same day.

The Bed & Breakfast Rule

Also known as the 30-day Rule, this rule states that any of the crypto you acquire within 30 days of a sale will be used as its cost basis.

Each of these rules affect which cryptos you “sell” and the order you sell them in—from an accounting perspective.

When calculating your gains and losses and applying these three rules, your cryptocurrency will be treated as being disposed of in the following order:

- Same Day Rule: Coins acquired on the same day as the disposal are consumed first. If you are selling more than you bought, move on to the next rule.

- Bed and Breakfasting Rule: Coins acquired in the 30 days following the day of disposal. If you are selling more than you bought, move on to the next rule.

- Crypto-pool accounting: All previous coins purchased, price averaged.

The challenge for investors

As you can see, capital gains and losses calculations can quickly become tedious when there are a significant number of transactions to account for.

In addition, many cryptocurrency traders have been trading for long periods of time without keeping records of their trades. To properly calculate your capital gains and losses, you need to have records for the price in GBP for every crypto asset you traded or sold at the time of the sale.

Remember, trading one cryptocurrency for another is considered a disposition, and you need to calculate the gain or loss in GBP on the trade.

This can be problematic due to the fact that cryptocurrency exchanges quote most trades in other cryptocurrencies—not necessarily fiat currencies—so trying to track down historical GBP values for all of your trades can become extremely tedious.

This challenge is the reason why many cryptocurrency traders are turning to cryptocurrency tax software to automate the entire capital gains and losses reporting process.

Why can’t my exchanges give me capital gains and losses forms?

Due to the transferable nature of cryptocurrencies, exchanges don’t typically know the cost basis of your assets. This prevents them from being able to give you complete gains and losses reports.

To illustrate this further, let’s look at an example.

Example:

.jpeg)

In this example, Coinsmart has no way of knowing Mark’s cost basis of his 1 BTC. Coinsmart only can see Mark trading his Bitcoin for Ethereum. They have no idea when, for how much, or where that BTC was originally acquired.

Because of this, Coinsmart can’t possibly tell Mark what the capital gain or loss was on his BTC trade for ETH. It’s missing an essential piece of the equation: cost basis.

Remember, cost basis is needed to calculate your capital gains or losses on crypto disposals.

This example demonstrates this problem at a small scale. Transfers happen all of the time, and it’s the transferability of crypto that makes it difficult for cryptocurrency exchanges to report capital gains and losses on your behalf. The reporting burden falls to you as the taxpayer.

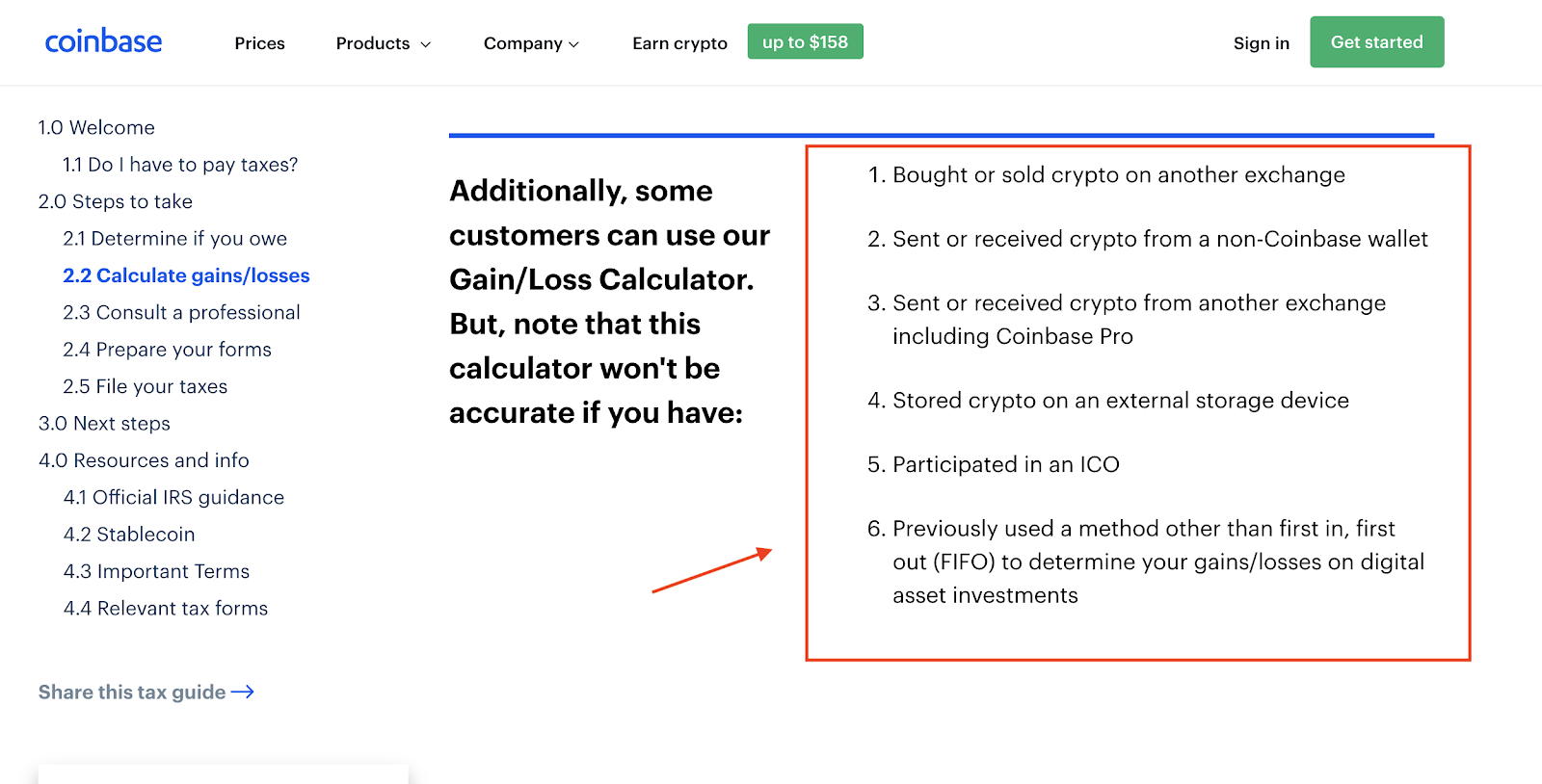

To summarize, the second you transfer crypto into or off of your cryptocurrency exchange, the exchange loses the ability to report on your gains and losses. Coinbase explains this themselves to their users within their company tax guide:

Claiming losses on worthless assets/lost keys

Have you sold your cryptocurrency at a loss or lost your private keys ? In this case, you can claim a capital loss. A capital loss can offset any capital gains for the year and reduce your overall tax liability.

Claiming losses on worthless crypto-assets

If you hold a crypto-asset that becomes worthless, you can file a negligible value claim. This allows you to treat the asset as if you’ve disposed of it, even if you still hold it. You’ll also be able to claim the associated capital loss.

Your negligible value claim should include the following information.

- The type of crypto-asset

- The amount at which the asset should be treated as disposed of (typically £0)

- The date the ‘disposal’ should take place

Claiming losses on lost keys

A negligible value claim can also be filed in the case that you lose your private keys. This claim should be filed in the same year that you lost access to your cryptocurrency.

Taxes on crypto income - mining and staking

Cryptocurrency received from mining, staking, interest, or wages is considered a form of income. The income you recognize is equal to the Fair Market Value of the crypto at the time you gain possession of the coin.

The amount of income recognized then becomes the cost basis in the coin moving forward.

Example:

Here’s an example that highlights how cryptocurrency earned from staking rewards is taxed.

.jpeg)

Of course, it’s also important to remember that your cryptocurrency income from mining and/or staking is classified differently whether you are mining as a hobby or as a business.

Mining as a Hobby

If you are mining as a Hobby, your income has to be declared separately under the heading of "Miscellaneous Income" on your tax return. Appropriate expenses can be deducted from this income before adding it to the taxable income.

Mining as a Business

If you are mining as a business, your mining income will be added to trading profits and be subject to income tax. Appropriate expenses are also deductible.

You can learn if your activity should be classified as a business or as a hobby with HMRC’s guide here.

What if I’ve earned cryptocurrency from my job?

If you earned crypto income in compensation for your work, you will be taxed based on your cryptocurrency’s fair market value at the time it was received.

How are airdrops taxed?

According to the HMRC, cryptocurrency received from airdrops may be considered income if it’s given in exchange for a product or service.

Cryptocurrency from airdrops is not considered income if it meets the following two conditions:

- It’s not part of a trade or business that involves cryptocurrency exchange tokens or mining

- Nothing was done in exchange for the airdropped cryptocurrency.

To better understand how airdrops are taxed, consider the 2021 $ENS airdrop. In this case, anyone who previously used the Ethereum Naming Service was entitled to claim $ENS tokens. It’s likely that this would be considered a taxable event, since the tokens were given in exchange for using a service.

Whether or not your airdrop rewards are considered income, disposing of your airdropped cryptocurrency is considered a taxable event and will require you to incur capital gains or losses.

How are crypto gifts taxed?

Giving a crypto gift to your partner or spouse is considered tax-free. In addition, this will not be counted towards your capital gains allowance for the year.

On the other hand, giving a crypto gift to someone other than your spouse or partner is considered a disposal event. You will need to keep a record of the fair market value of your cryptocurrency at the time the gift was given to calculate your capital gains or losses.

How are crypto donations taxed?

If you choose to donate cryptocurrency to charity, you are entitled to Income Tax relief. If you are a higher rate taxpayer, you’ll be able to claim the difference between your rate and the basic tax rate based on the fair market value of your crypto at the time it was donated.

However, you may be required to pay capital gains in the following circumstances:

- The fair market value at the time of the donation is greater than it was at the time you received it

- In the case of a tainted donation (when a taxpayer makes an arrangement with a charity to obtain a financial advantage)

How are NFTs taxed?

While the HMRC has not released specific guidance pertaining to NFTs, tax experts believe that they will likely be taxed similarly to physical artworks and collectibles.

If you are minting an NFT, it’s likely that any earnings from primary and secondary sales will be considered income and will be taxed accordingly.

.jpeg)

If you are buying an NFT with cryptocurrency, it is likely that you will incur capital gains or losses depending on how the price of the cryptocurrency you are using to make the purchase has fluctuated since you originally received it.

.jpeg)

If you are selling an NFT, it is likely that you will incur capital gains or losses depending on how the price of your NFT has fluctuated since you originally received it.

.jpeg)

‘Many investors have trouble reporting their NFT taxes for one simple reason: they aren’t taking the time to record information such as the cost basis of their NFT or its fair market value at the time it was sold. ’ - Joe David, Myna Accountants

How is DeFi taxed?

At this time, the HMRC has not released specific guidance about DeFi. As a result, reporting certain DeFi transactions fall into a grey area of the tax code.

How are DeFi staking rewards taxed?

It's reasonable to assume that staking rewards are taxed as income based on their fair market value at the time they were received in your wallet.

How are DeFi loans taxed?

Currently, many DeFi protocols offer loans to users. When a user locks up their existing cryptocurrency as collateral, they can receive tokens in return. For example, you could put ETH as collateral and in exchange, receive DAI.

There are two approaches that can be taken when it comes to reporting this situation on your taxes: conservative and aggressive. Typically, tax experts recommend the conservative approach.

The conservative approach is to consider handing ownership of your collateral to the DeFi protocol a taxable event and to incur capital gains based on how the price of your collateral has changed since you originally received it.

The more aggressive approach is to treat the DeFi loan as a non-taxable event, similar to receiving a mortgage loan.

'The reason why many tax experts recommend the conservative approach for reporting crypto loans is because in this case, the ownership of the tokens has changed. Typically, the HMRC views this as a taxable event.' - Shukry Haleemdeen, My Crypto Tax

How to report cryptocurrency on your taxes

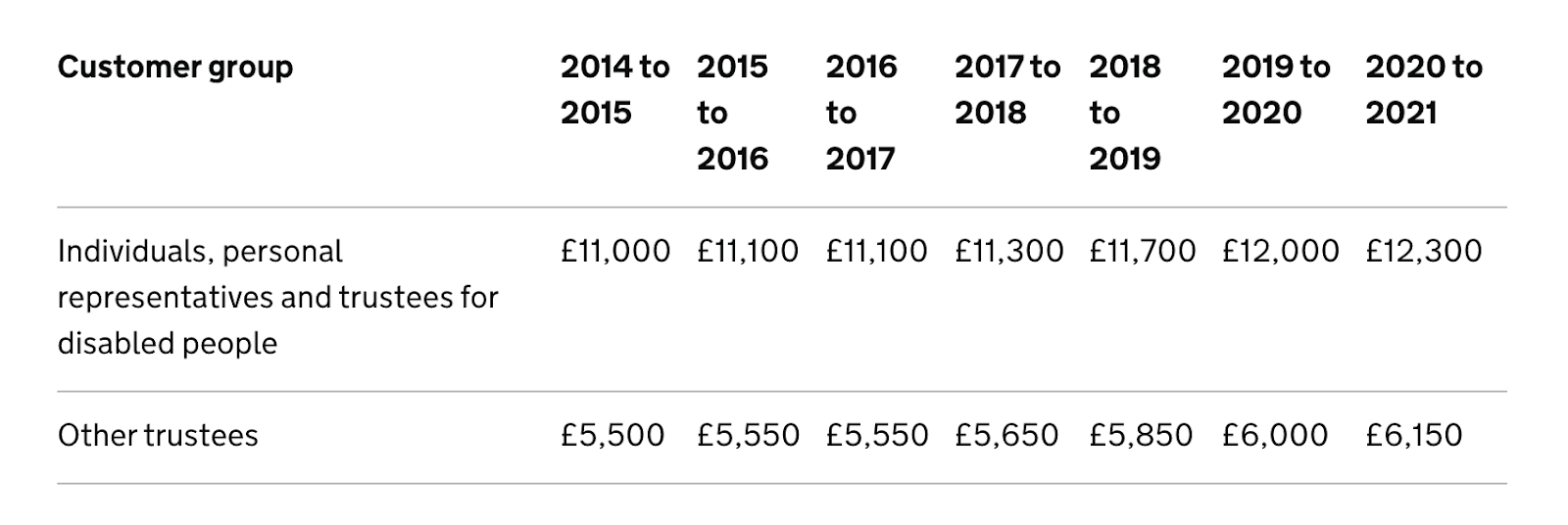

In the UK, you only pay Capital Gains Tax if your overall gains for the tax year (after deducting losses) are above the Annual Exempt Amount (AEA). The Annual Exempt Amounts are pictured below.

To report your crypto transactions and pay your capital gains tax, you can use the HMRC’s Government Gateway online service. Here, you’ll be able to fill out a Self Assessment Tax Return and a Capital Gains Tax Summary.

Keep in mind, HMRC requires you to keep records of all of your cryptocurrency transactions for at least a year after the Self Assessment deadline.

Looking for an easy way to report your cryptocurrency activity on your taxes? Crypto tax software can help you accurately track and report all your crypto activity across multiple wallets and exchanges.

What happens if I don’t report my crypto gains and losses?

Under HMRC rules, taxpayers who do not disclose gains could face a 20% capital gains tax plus any interest and penalties of up to 200% of any taxes due. Those found to have evaded the tax could also face criminal charges and jail time.

There’s no guarantee what will or will not happen if you fail to file your cryptocurrency taxes with HMRC. However, it’s recommended to stay compliant by properly filing all of your capital gains and crypto related income. If you haven’t been reporting your gains or losses in previous years, you can get everything in order by filing an amended self-assessment tax return.

This post is for informational purposes only and should not be construed as tax or investment advice. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)