.jpg)

Thinking about using Koinly to generate a NFT tax report? In this guide, we’ll compare Koinly and CoinLedger to help you find the best NFT tax software for your specific needs!

Is Koinly the best NFT tax software on the market?

While Koinly is a trusted provider of crypto and NFT tax software, it’s not the only option on the market!

If you’re looking for a Koinly alternative for NFT taxes, you should try CoinLedger. CoinLedger is one of the biggest NFT tax platforms on the market, serving more than 700,000 customers. Currently, CoinLedger is rated 4.8 stars on Trustpilot with more than 800 reviews!

Below, we’ll break down the differences between Koinly and CoinLedger in key categories like user experience, pricing, and more. While we admit we’re a bit biased, we did our best to stay objective and give Koinly credit when appropriate. Remember, both platforms are trusted in the industry and are great choices for any NFT investor!

If you’re interested in trying out CoinLedger for free, you can get started with a free account today.

Koinly vs. CoinLedger

User Experience

Winner: CoinLedger

Tax season can be stressful — so it’s important to choose a NFT tax software that’s easy to use! Choosing a platform with a confusing interface may only cause more frustration.

CoinLedger is the best platform on the market when it comes to user experience!

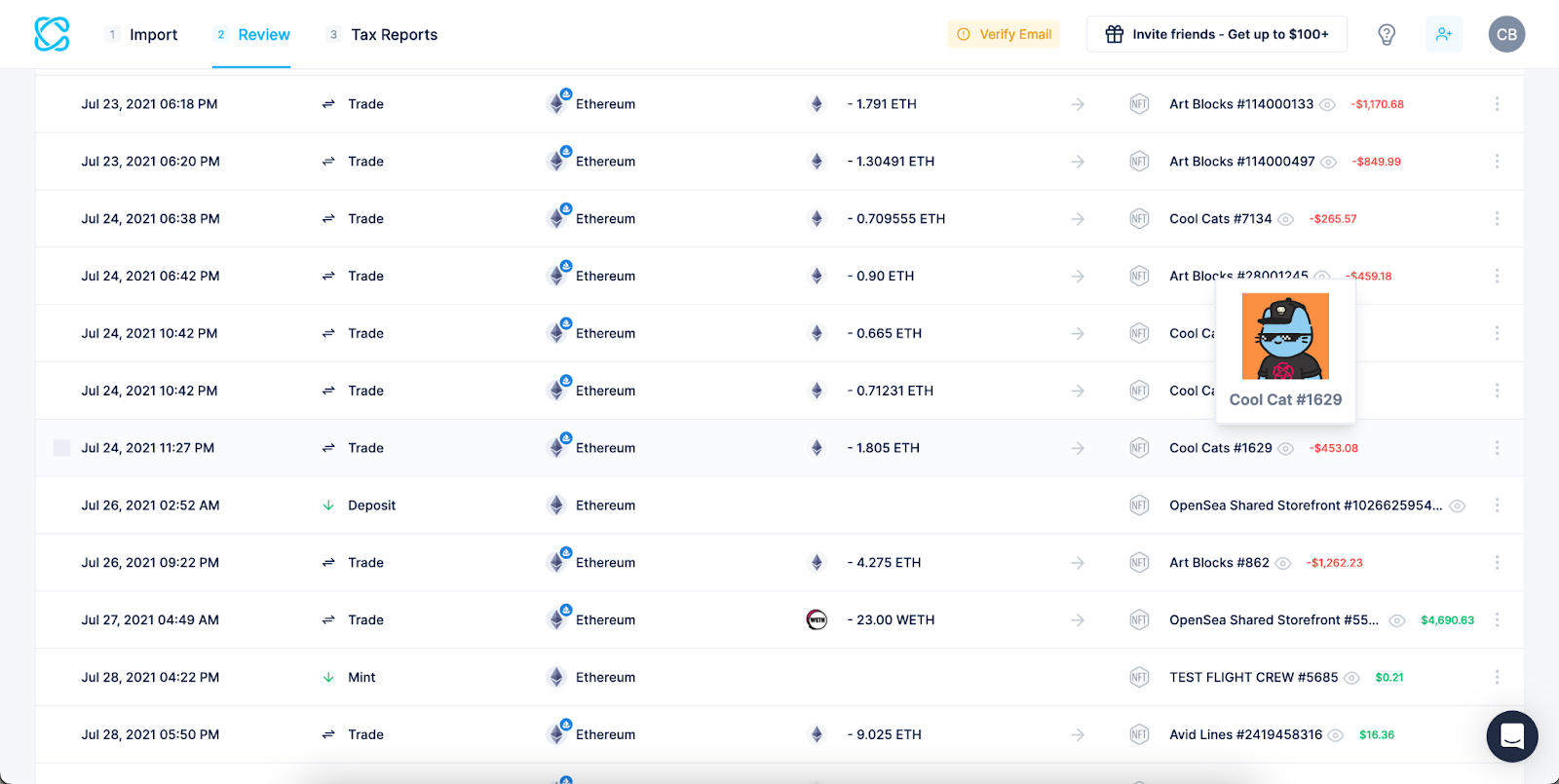

CoinLedger displays all of your NFTs in-app, which makes it easier to sort through your transactions!

When you upload your NFT transactions into Koinly, the platform doesn’t display an image of your NFT. Instead, the platform uses a generic NFT icon. If you traded multiple NFTs in a year, you may have trouble sorting through your transaction history.

Integrations

Winner: CoinLedger

You should choose an NFT tax software with integrations to your preferred blockchains and marketplaces. You’ll be able to automatically import your transactions and calculate your tax bills in minutes!

CoinLedger offers integrations with the world’s biggest blockchains for NFTs — including Ethereum, Cardano, and Solana as well as NFT marketplaces like OpenSea and Blur.

In addition, CoinLedger is one of the few platforms on the market that takes gas fees into account — which can potentially save you thousands of dollars on your taxes.

While Koinly does offer integrations with dozens of blockchains, Koinly customers have reported that the platform has issues with properly pulling NFT cost basis. This can lead to calculation errors on your tax report!

Price

Winner: Tie

Before you choose an NFT tax platform, it’s important to make sure that you’re choosing a platform that balances affordability with reliability!

CoinLedger and Koinly have nearly identical pricing — so this section is a wash!

CoinLedger: Free to track your portfolio and view net gains & losses, $49 for 0-100 transactions, $99 for 101-1,000 transactions, $199 for 1,001-3,000 transactions, and $199+ for more than 3,000 transactions

Koinly: Free to track your portfolio, $49 for 0-100 transactions, $99 for 101 - 999 transactions, $179 for more than 1,001-3,000 transactions, and $279+ for more than 3,000 transactions.

NFT community

Winner: CoinLedger

Before you choose an NFT tax platform, you should do research and find a platform that has a good reputation in the NFT community.

In the past, CoinLedger has partnered with NFT communities like Doge Pound and Dirtybird Flight Club to offer discounted tax reports to NFT holders. CoinLedger’s tax experts have even hopped into community Discords to help answer tax questions!

Koinly has not partnered with NFT communities in the past.

Safety & Security

Winner: Tie

It’s important to choose NFT tax software that will keep your data safe!

CoinLedger and Koinly take steps to make sure that your cryptocurrency data is safe from hackers!

CoinLedger: CoinLedger uses industry-best practices to keep your data safe — including end-to-end encryption, virtual private cloud (VPC) with network access control lists (ACLs), and more!

Koinly: Koinly uses encryption and third-party security tools to protect your data.

Platforms like CoinLedger and Koinly don’t have the ability to make transactions on your cryptocurrency accounts. Both CoinLedger and Koinly scrape publicly available data from the blockchain to calculate your taxes!

When do I have to pay NFT taxes?

When you dispose of an NFT, you’ll incur a capital gain or loss depending on how its price has changed since you originally received it.

When you earn NFT income — such as receiving income from the sale of an NFT you created — you’ll recognize ordinary income subject to income tax.

Do I need an NFT tax software like CoinLedger and Koinly?

You can choose to file your NFT and crypto taxes manually. However, this may take serious time and effort. Remember, you’ll need the following information to file your taxes.

- A description of the crypto-asset you sold (a)

- The date you originally acquired your crypto-asset (b)

- The date you sold or disposed of the crypto-asset (c)

- Proceeds from the sale (fair market value) (d)

- Your cost basis for purchasing the crypto-asset (fair market value) (e)

- Your gain or loss (h)

If you use multiple wallets and exchanges for NFT and crypto transactions, collecting this information may take time. NFT tax software like CoinLedger can help you finish the process in minutes!

How CoinLedger can help

Want to generate a complete crypto & NFT tax report? Get started with CoinLedger, the platform trusted by more than 700,000 investors around the world.

Frequently asked questions

%20(1).png)

.png)