.jpg)

Key Takeaways

- In Australia, NFTs are subject to capital gains tax and ordinary income tax.

- If you hold your NFT for 12 months or longer, you’ll receive a 50% discount on your capital gains taxes.

Wondering how your NFTs are taxed in Australia? Let’s walk through everything you need to know about how to report your NFT gains and losses to the ATO.

Are NFTs taxable in Australia?

In Australia, NFTs are taxed similarly to other crypto-assets. That means that NFTs are subject to capital gains tax and ordinary income tax.

Let’s walk through a few different examples of events where NFTs are taxed.

- Buying an NFT with cryptocurrency: When you buy an NFT with cryptocurrency, you’ll incur a capital gain or loss depending on how the price of your crypto has changed since you originally received it.

- Selling/trading away an NFT: When you sell/trade away an NFT, you’ll incur a capital gain or loss depending on how its price has changed since you originally received it.

- Earning income from NFTs as a creator: If you created and sold your own NFT, you’ll recognize ordinary income based on proceeds from sales.

If you’re trading NFTs in an ‘organized, business-like manner’’, it’s possible that you will be considered a professional trader. If you fall into this category, your gains from NFT disposals will be taxed as income.

How much tax do I pay on NFTs in Australia?

In Australia, ordinary income and capital gains from disposals under 12 months are subject to the following tax rates.

In Australia, there is a 50% discount on capital gains tax if you’ve held your assets — including NFTs and cryptocurrency — for longer than a year. For example, if you sell an NFT for a $500 profit after holding it for a year, only $250 will be considered taxable income.

What records should I keep for my NFT transactions?

You should keep the following records of your NFT and crypto transactions:

- The date you acquired your asset

- The date you disposed of your asset

- The fair market value of your asset at the time you acquired it

- The fair market value of your asset at the time you disposed of it

- What the transaction was for and the other party involved (even if you just have their wallet address)

You should keep records of your NFT and crypto transactions for at least 5 years after you prepared/acquired your records or 5 years after you completed your transactions (whichever comes later).

How to lodge your NFT taxes

The easiest way to lodge your NFT taxes is through your online myTax account.

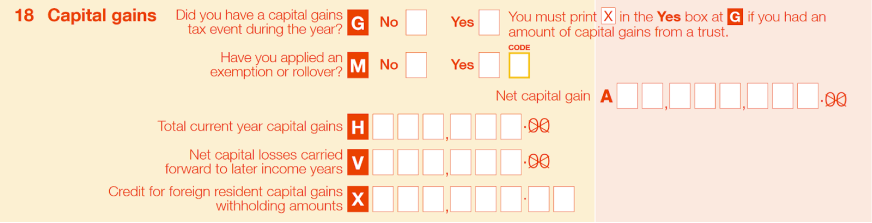

If you prefer to lodge your taxes using paper forms, you can report your capital gains from NFTs on Question 18 of Australian tax forms.

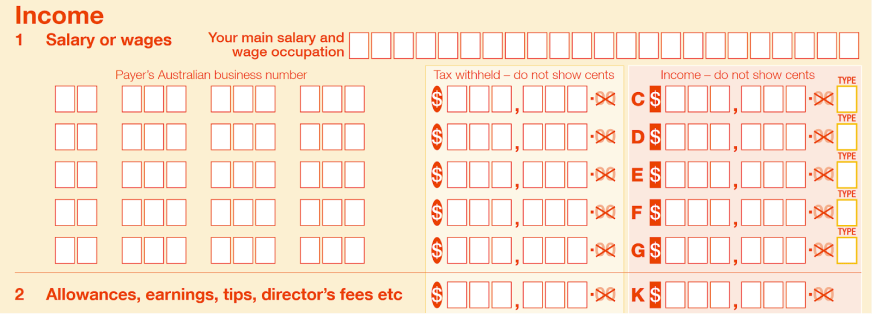

Ordinary income from NFTs can be reported on Question 2 of Australian tax forms.

Should I lodge my taxes manually or automatically?

There’s two options to lodge your NFT taxes: manually or automatically.

If you want to report your NFT taxes manually, you should keep detailed records of your NFT transactions. Then you’ll need to find your total gains and income from your cryptocurrency and NFTs — which can take serious time and effort.

One alternative is to use NFT tax software like CoinLedger to report your taxes automatically. The platform can plug into your wallets and exchanges and generate a complete NFT/crypto tax report in minutes.

How do I save money on NFT taxes in Australia?

Let’s walk through some strategies that can help you save money on your NFT taxes.

Hold your NFTs for the long-run

The easiest way to save money on your taxes is to simply hold your NFTs for the long-run!

In Australia, there is no tax for simply holding your NFTs and other crypto-assets. In addition, you’ll receive a 50% discount on capital gains tax if you hold your NFT for a year or longer before disposing of it!

Buy NFTs with fiat currency

Remember, buying NFTs with cryptocurrency like ETH is considered a taxable event. In this case, you’ll incur a capital gain or loss depending on how the price of your ETH has changed since you originally acquired it.

However, buying NFTs with fiat currency like AUD is considered non-taxable!

Dispose of your NFTs in a low-income year

Consider disposing of your NFTs in a low-income year. Remember, the tax rate you pay on your NFTs is dependent on your total income level for the year. The lower your income level, the lower taxes you’ll pay!

Account for transaction fees

Keep track of blockchain/exchange fees related to acquiring and disposing of your NFTs and cryptocurrency. These fees can be added to your cost base or subtracted from your proceeds. In either case, accounting for fees will reduce your total capital gain!

Get started with CoinLedger

Looking to report your NFT and crypto taxes? Try CoinLedger, the platform trusted by more than 700,000 investors around the world.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)