.jpg)

Wondering how the Biden Administration is taxing cryptocurrency?

In this guide, we’ll break down the actions that the Biden Administration has taken on cryptocurrency and how they impact everyday investors like you.

How is cryptocurrency taxed?

Before we jump into how various legislation passed by the Biden Administration impacts your tax bill, let’s break down the basics of how cryptocurrency is taxed.

In the United States, cryptocurrency is subject to capital gains and ordinary income tax.

.jpeg)

It’s important to note that this framework has been in place since the IRS released its first guidance on cryptocurrency in 2014.

For more information, check out our complete guide to how cryptocurrency is taxed.

How does the Build Back Better infrastructure bill impact crypto taxes?

The crypto provisions of the Build Back Better Act of 2021 require cryptocurrency brokers to issue a complete record of capital gains and losses to customers and the IRS through 1099 forms.

It’s important to note that the crypto provisions of the Build Back Better Act do not increase crypto tax rates for retail investors. The act is designed to help the IRS fight crypto tax evasion through accurate tax reporting.

However, it’s important to note that cryptocurrency’s unique properties are likely to cause issues when it comes to reporting capital gains and losses.

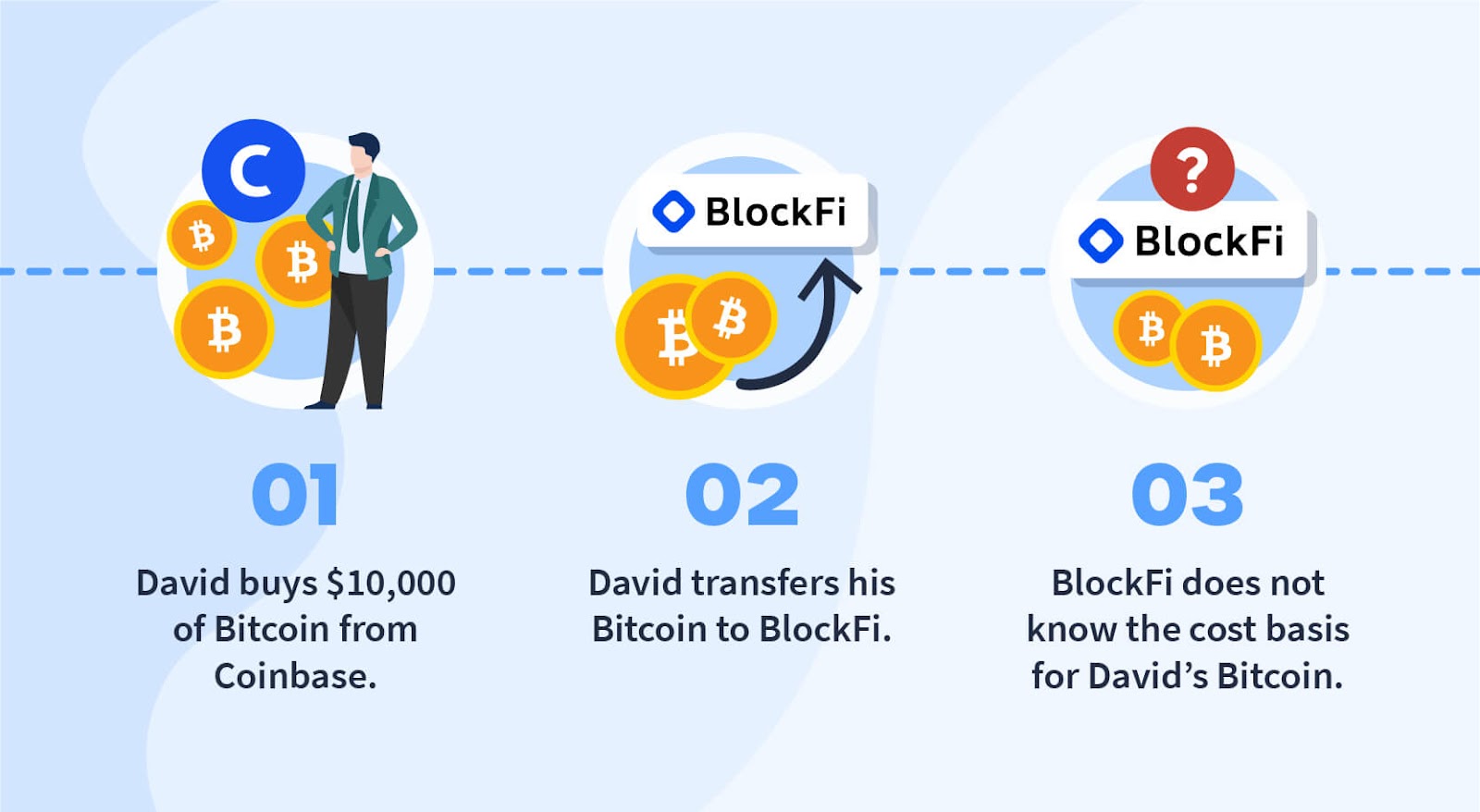

To better understand why, let’s take a look at an example.

In this case, David’s cost basis will likely be reported as ‘0’ or n/a’ on his 1099 form. If he can’t prove that he originally bought his cryptocurrency for $10,000, he may be forced to recognize the entire proceeds of his sale as a capital gain.

Originally, the crypto provisions of the Build Back Better Act were set to go into effect in 2023. However, the implementation of these policies were delayed indefinitely in December 2022.

For more information, check out our blog on how the Build Back Better Act impacts crypto taxes.

How will increased IRS funding impact the cryptocurrency ecosystem?

The Inflation Reduction Act of 2022 gave $80 billion in new funding for the IRS.

As a result, the agency is now equipped to conduct more audits and crack down on tax underreporting.

While there isn’t a specific amount of this funding that’s allocated towards cryptocurrency and digital assets, it’s likely that increased funding will lead to tighter monitoring for crypto investors. In the past, former IRS Commissioner Charles Rettig singled out cryptocurrency as a major contributor to America’s annual tax gap.

Will the Biden Administration tax unrealized crypto gains?

In 2022, the Biden Administration proposed a 20% tax on unrealized gains for all assets (including cryptocurrency). The proposal was shelved because it did not have the votes necessary to pass through Congress.

For more information, check out our guide on crypto unrealized gains tax.

How does Biden’s executive order impact the crypto ecosystem?

In March 2022, President Biden signed an executive order which directed federal agencies to provide recommendations on how the United States could be a leader in the digital assets space while addressing potential risks.

In the months after the executive order, the departments of Treasury, Justice, and Science and Technology Policy released reports on cryptocurrency and digital assets.

It’s important to remember that the executive order won’t immediately impact the vast majority of crypto investors. It's main purpose was to kickstart the process of developing a framework on how to regulate cryptocurrency.

What steps is the government taking to fight crypto tax evasion?

In addition to mandatory 1099 forms and increased funding for the IRS, the federal government has worked with contractors like Chainalysis to analyze blockchain transactions and identify ‘anonymous’ wallets.

For more information, check out our blog: Can the IRS track cryptocurrency?

When is crypto regulation coming?

It’s important to remember that exchanges like Coinbase are already subject to government regulations as financial services and publicly-traded companies. Still, it’s likely that the collapse of FTX will likely lead to increased regulations for cryptocurrency exchanges in the near future.

However, it’s not clear when these regulations will go into effect. As discussed earlier, the crypto provisions of the Build Back Better Act have been delayed indefinitely.

It’s important to note that it’s unlikely that upcoming regulations will impact investors’ ability to buy and trade cryptocurrency. It’s more likely that regulations will be directed at how cryptocurrency exchanges use customer funds and report taxes.

How crypto tax software can help

It’s clear that the federal government is paying close attention to the cryptocurrency ecosystem. That means it’s more important than ever for investors to accurately report their crypto taxes.

Crypto tax software like CoinLedger can help. More than 700,000 crypto investors around the world use the platform to take the stress out of tax season.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)