Written by:

Miles Brooks

Irish citizens are investing more money in cryptocurrency, and Ireland’s Revenue Commissioners are taking notice.

In this guide, we’ll break down everything you need to know about how crypto-assets are taxed in Ireland and share a few simple tips to help you save money on your tax bill.

Yes. In Ireland, cryptocurrency is subject to capital gains and income tax.

When you dispose of cryptocurrency, you’ll incur a capital gain or loss depending on how the price of your coins has changed since you originally received them.

You can calculate your gain/loss using the following formula.

Here’s an example of the formula in action.

Here are a few examples of disposals subject to capital gains tax.

If you’re trading cryptocurrency as a business or earning cryptocurrency, you’ll recognize income.

Here are a few examples of crypto income events.

Not sure whether your transactions will be subject to tax? The following transactions are tax-free in Ireland.

In Ireland, capital gains are subject to a standard tax of 33%.

Your first €1,270 of capital gains are tax-exempt.

If you earn crypto income, you’ll pay taxes based on your income tax rates.

In addition, you will pay the Universal Social Charge (USC) on your gross income if it exceeds €13,000. Once income is over this limit, you pay a certain percentage on all income, which includes the income from your job as well as any gains you’ve made from cryptocurrency and other assets.

There is no way to legally avoid cryptocurrency taxes. However, there are simple strategies that can help you legally reduce your cryptocurrency tax burden.

Cryptocurrency exchanges operating in Ireland are required to register as VASPs (Virtual Asset Service Providers) with the Central Bank. VASPs are required to carry out Customer Due Diligence and provide information to the Irish government upon request.

Starting in January 2026, DAC8 will go into effect across the EU. This expands the reporting requirements for crypto exchanges to report on domestic and cross-border crypto transactions.

In addition, it’s important to remember that transactions on blockchains like Bitcoin and Ethereum are publicly visible. Tax agencies around the world use data matching to track transactions and identify ‘anonymous’ wallets.

If you’re trading cryptocurrency as a business, all profits will be subject to income tax rather than capital gains tax.

There are various factors that may be used to determine whether your cryptocurrency activity reaches the level of a business known as the ‘Badges of Trade’. This includes:

It’s likely that most Irish crypto investors won’t reach the level of sophistication required to be considered a ‘business’ for tax purposes

When you dispose of your cryptocurrency, you can calculate your capital gains through the FIFO (First-In First-Out) method. This essentially means that the first cryptocurrency that you acquired is also the first that you dispose of.

Here’s an example of how this works.

One exception to this rule is in the case where you dispose of your crypto within 4 weeks of acquiring it. In this case, the crypto you disposed of is the crypto you most recently acquired.

Due to the complexity that can arise when making these calculations, many investors opt to use crypto tax software to automate all of their crypto tax calculations.

In Ireland, the tax year runs from January 1 - December 31.

The deadline for filing your cryptocurrency taxes is October 31.

If you made gains on cryptocurrency from January 1 - November 30, you’ll need to pay taxes due by December 15.

If you made gains on cryptocurrency in the month of December, your deadline to pay taxes is January 31.

Buying cryptocurrency with fiat like EUR is not considered a taxable event. However, you should keep records of these transactions so that you can easily calculate your capital gains and losses in the case of a future disposal.

Selling cryptocurrency is considered a taxable disposal. You’ll incur a capital gain or loss depending on how the price of your coins has changed since you originally received them.

Trading one cryptocurrency for another is considered a taxable event. You’ll incur a capital gain or loss depending on how the price of the crypto you’re trading away has changed since you originally received it.

Paying for goods and services with cryptocurrency is considered a taxable disposal. You’ll incur a capital gain or loss depending on how the value of your crypto has changed since you originally received it.

In addition, you’ll pay the 23% Value Added Tax (VAT) when you buy goods and services with crypto.

Typically, fees associated with acquiring and disposing of your cryptocurrency are considered allowable expenses that can reduce your capital gain.

If you dispose of cryptocurrency at a lower cost than you originally received it, this is considered an ‘allowable loss’. Allowable losses can be used to offset any capital gains you have during the same tax year.

If you have more losses than gains during the tax year, you can roll forward your losses to offset future capital gains. Alternatively, you can make a request to transfer your losses to your spouse or civil partner.

If you get paid in cryptocurrency in compensation for labour, you will recognize income based on the fair market value of your coins at the time of receipt.

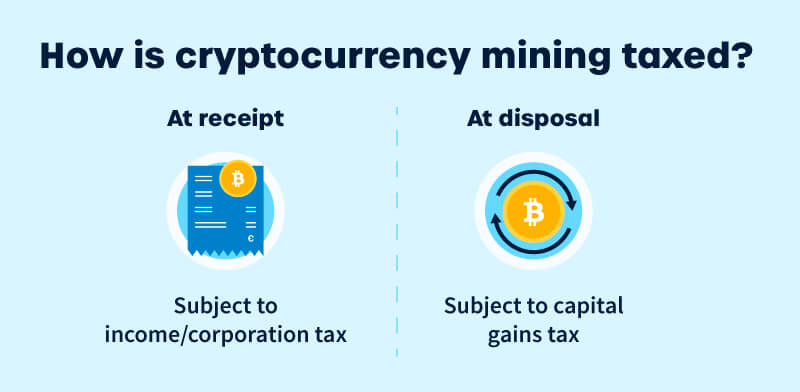

Profits from cryptocurrency mining are likely subject to income/corporation tax at the time of receipt for businesses and individuals.If you sell your mined coins at a later date, you will likely incur a capital gain or loss depending on how the value of your crypto has changed since you originally received it.

At this time, there is no guidance available on how staking is taxed. It’s likely that staking rewards will be considered income at the time of receipt. Like mined coins, you will incur a capital gain or loss upon disposal based on how the value of your crypto has changed since you originally received it.

It’s likely that tokens that you receive from airdrops will be considered income based on their fair market value at the time of receipt.

If you dispose of them in the future, you’ll incur a capital gain or loss depending on how the value has changed since you originally received them.

At this time, Revenue Ireland has not provided any guidance on how NFTs are taxed. It’s likely that they will be taxed similarly to cryptocurrencies.

Buying NFTs with cryptocurrency is subject to capital gains tax, based on how the price of your crypto changed since you originally received it.

On the other hand, buying NFTs with fiat currency is not considered taxable.

When you sell an NFT, you’ll incur a capital gain based on how the price of your NFT has changed since you originally received it.

In the event that you create and sell your own NFTs, you’ll likely recognize income based on revenue from primary and secondary sales.

At this time, Revenue Ireland has not provided guidance on how DeFi transactions are taxed. In general, it’s likely that DeFi transactions will be taxed similarly to other types of crypto transactions. That means:

Despite the fact that stablecoins are designed to track the price of fiat currencies, they are taxed the same as other cryptocurrencies. When you dispose of a stablecoin, you’ll incur a capital gain or a loss (though it’s likely that this will be close to 0).

Gifting a cryptocurrency is considered a taxable disposal. You’ll incur a capital gain or loss depending on how the price of your coins has changed since you originally received it.

If you inherit or receive a cryptocurrency gift, you’ll be required to pay capital acquisitions tax of 33% based on the fair market value of your crypto at the time of receipt.

A cryptocurrency rebranding takes place when a coin or blockchain changes its name, but does not issue new coins or make changes to the underlying technology. One example is the Matic Network changing its name to Polygon in February 2021.

If you are holding a cryptocurrency that has rebranded, you will not incur any tax liability.

To report your cryptocurrency taxes, you can use Revenue Online Service (ROS) or MyAccount.

If you are a Pay As You Earn (PAYE) worker, you should report your capital gains from cryptocurrencies and other assets on Form CG1.

If you are Self Employed or a Chargeable Person (more than €5,000 in assessable non-PAYE income or more than €30,000 in total gross non-PAYE income), you should report your capital gains on Form 11.

To ensure that you’re accurately reporting your taxes, it’s recommended that you keep detailed records of your cryptocurrency transactions. You should keep the following information for at least 5 years:

Trying to track this information on your own can be difficult, especially if you’ve transferred your cryptocurrency across different wallets and exchanges.

Many investors use crypto tax software to integrate their wallets and exchanges and easily track their cryptocurrency gains, losses, and income across their portfolios. Crypto tax software can save you hours of time and effort.

Looking for an easy way to file your cryptocurrency taxes? CoinLedger can help you finish the process in 3 simple steps.

Step 1: Connect your wallets and exchanges.

.png)

Step 2: Let the platform pull your transactions!

.png)

Step 3: Download your tax report!

.png)

Whether you’re using exchanges like Coinbase or KuCoin or blockchains like Ethereum, CoinLedger can help you download a crypto tax form in minutes! Once you’re done, you can report your taxes yourself, or send your tax report to your accountant!

Get started with CoinLedger and join the 700,000 investors worldwide who use the platform to take the stress out of tax season!

Let’s cap things off by answering some frequently asked questions about cryptocurrency taxes.

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

This guide breaks down everything you need to know about cryptocurrency taxes, from the high level tax implications to the actual crypto tax forms you need to fill out.