.jpg)

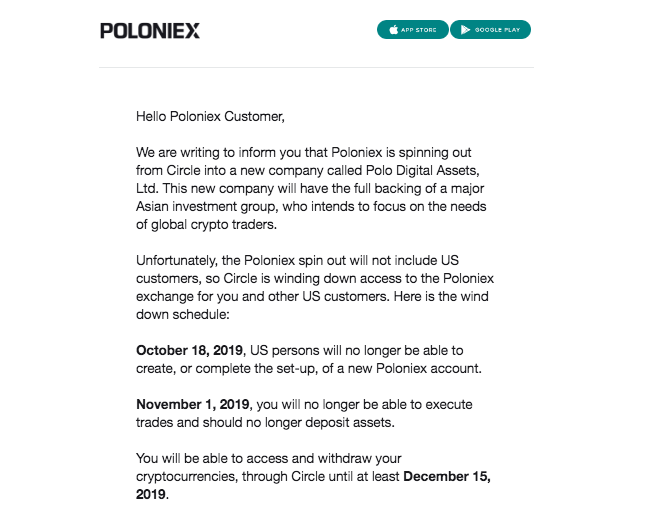

Popular cryptocurrency exchange Poloniex recently announced that it will be shutting down US operations and no longer providing services to US users.

In their email announcement, Poloniex noted that they are spinning out from Circle (their parent company) to form Polo Digital Assets which will focus on the needs of global traders. This guide discusses how you should prepare from both a trading and a tax reporting perspective.

Poloniex US Shutdown Timeline

October 18, 2019 - US persons will no longer be able to create or complete the set-up of a new Poloniex account.

November 1, 2019 - US users will no longer be able to execute trades and should no longer deposit assets.

December 15, 2019 - US users will be able to withdraw their crypto at least through this date.

How You Should Prepare From a Trading Perspective

If you are a trader on Poloniex, you should be aware of which assets you are going to lose access to. Here is a list of all assets that Poloniex offers. Take account of which assets you have in Poloniex and figure out where you plan to send them whether that is to another exchange or an outside wallet.

You also should be aware of which assets you will no longer be able to trade or cash out of. If alternative exchanges that you use don’t support specific cryptos that you are holding on Poloniex, you may want to convert to BTC or another popular asset. You don’t want to end up holding onto something that you have no way of exchanging.

At the minimum, make sure to withdrawal all of your funds out of Poloniex by December 15th, 2019.

How To Prepare From A Tax Reporting Perspective

It sounds like US based Poloniex users will still have access to their accounts through Dec. 15th. It’s best practice to pull all of your trade history files from the exchange prior to this date so that you have records of your complete trading history.

Remember, getting your crypto taxes done without your proper historical data is essentially impossible, so we believe it’s better to err on the side of caution and download your transaction history as soon as possible.

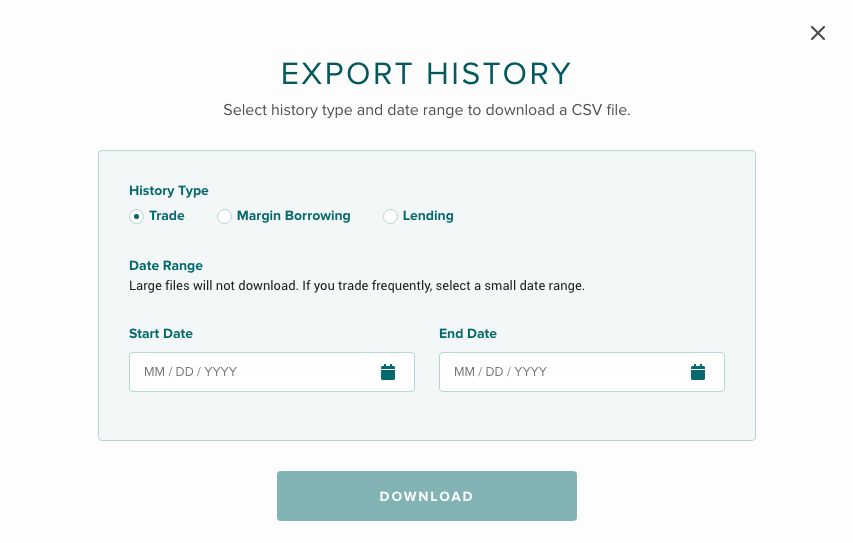

To download your historical transaction data from Poloniex, simply follow these steps:

1. Login to your Poloniex account

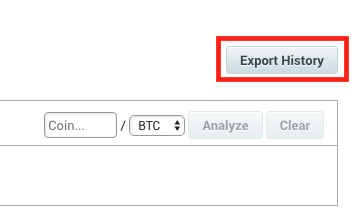

2. Select "My Trade History & Analysis" from the Orders drop down

3. Select "Export History"

4. Select the "Trade" option and export your trade history from ALL years of trading using Poloniex's date ranges. (You may have to export multiple files to capture all of your history. Make sure dates do not overlap to avoid duplicates).

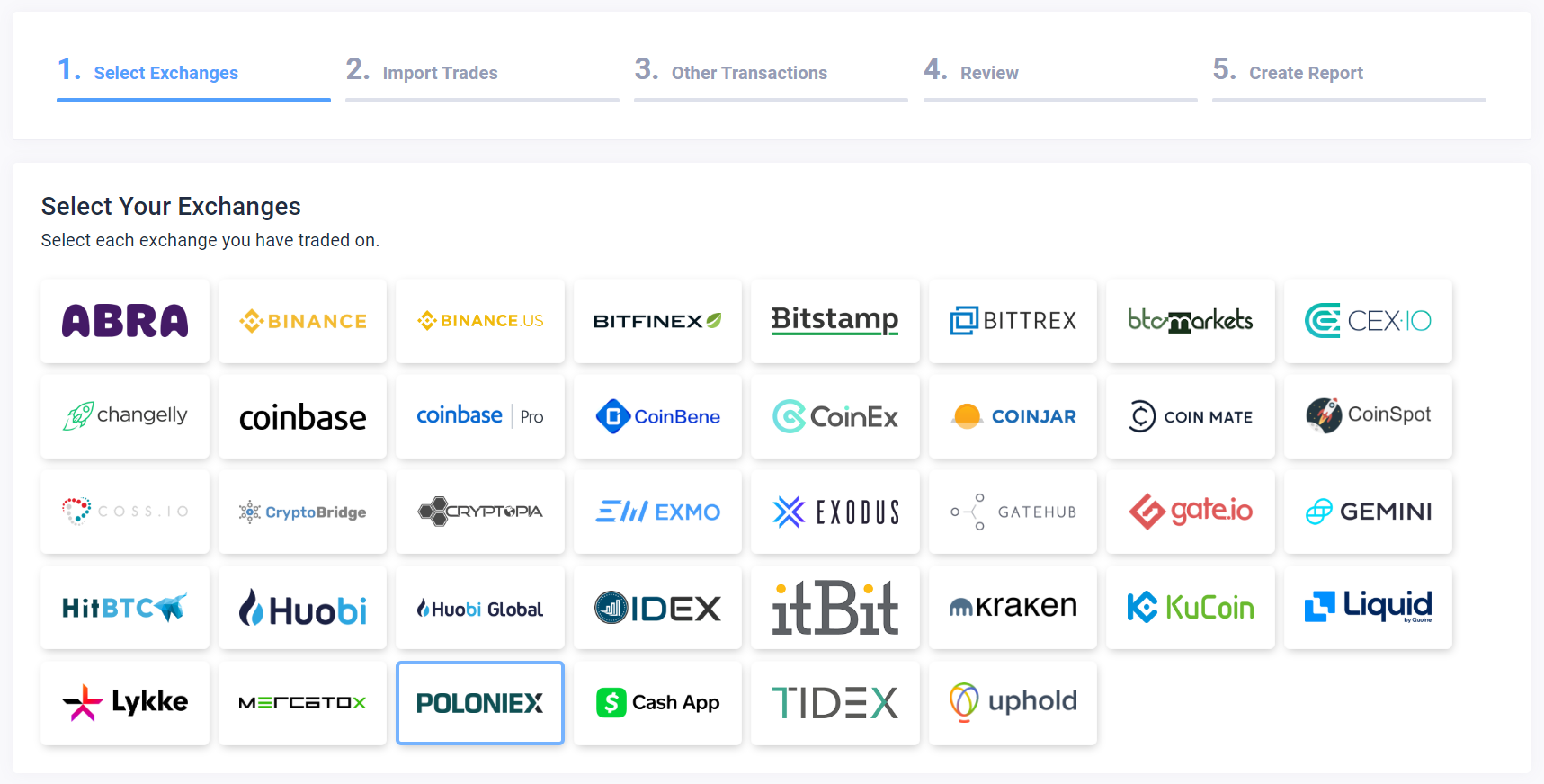

Import Your Transaction History Into CoinLedger

Once you have your Poloniex transaction history file, you can automatically import the file into crypto tax software like CryptoTrader.Tax for one-click tax reporting.

CoinLedger automates the entire crypto tax reporting process by integrating with your exchanges and generating your capital gains and losses as they need to be reported on Form 8949. Once you generate your crypto tax reports, you can import them into filing software like TurboTax or TaxAct, or send them to your accountant to file on your behalf.

In Conclusion

It’s important to keep records of your cryptocurrency activity. Because US users will be losing access to Poloniex, they should download their transaction history prior to Dec. 15th. In addition, it’s important that traders withdraw all of their assets off of the platform prior to this deadline to avoid losing access to funds.

For a complete understanding of how cryptocurrencies are treated from a tax perspective, you can check out our Complete Guide to Cryptocurrency Taxes.

Disclaimer - This post is for informational purposes only and should not be construed as tax or investment advice. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)