💸 Lost money in crypto last year? You can save thousands on your taxes.

Learn more🔍 SURVEY: Most investors don’t know that crypto losses can lead to massive tax savings!

Learn moreGet an estimate of your tax bill with our free Bitcoin and crypto tax calculator built for Australian investors.

To use our Bitcoin/crypto tax calculator, you’ll need to provide your total income for the year as well as the following information for your individual trades.

If you're looking to calculate your tax bill for the year, you'll need the following information.

Once you've entered your information, we'll estimate your tax liability!

Trying to keep track of the information you need to file your taxes can be difficult if you’re using multiple wallets and exchanges. If you’ve transferred your crypto, you may not know how much you originally paid to acquire it.

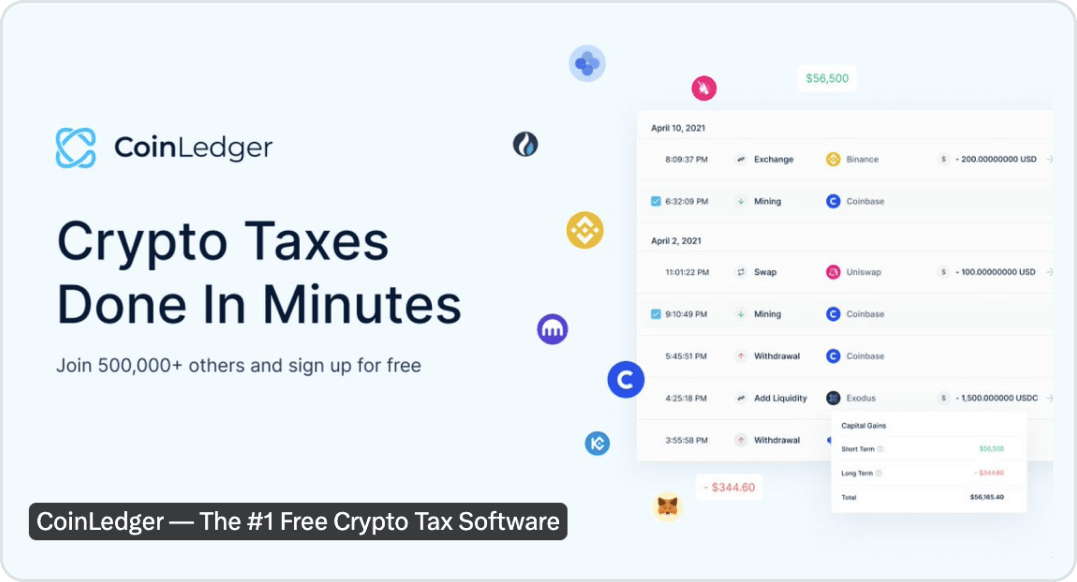

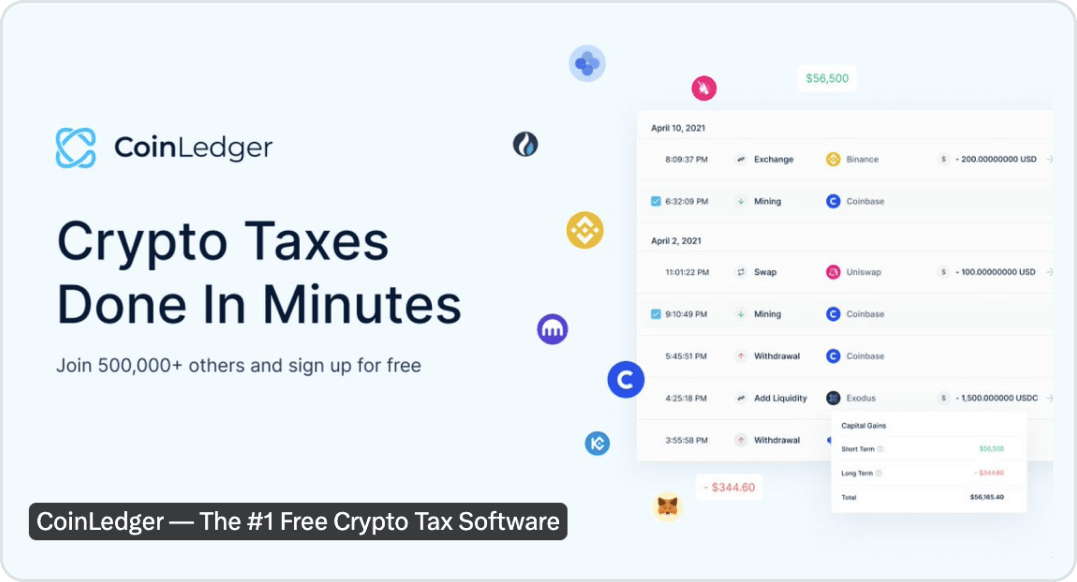

CoinLedger can help. The platform can automatically connect with hundreds of exchanges like CoinSpot and blockchains like Ethereum. You’ll be able to import your transactions and generate a comprehensive tax report in minutes.

More than 500,000 crypto investors use CoinLedger to take the stress out of tax season. Get started with a free account today.

Our free tool uses the following formula to calculate your capital gains and losses.

Once we’ve calculated your gain/loss, we’ll use the information you provided about your holding period and your income for the year to calculate your tax liability.

How is cryptocurrency taxed?

In Australia, cryptocurrency is subject to capital gains and ordinary income tax

When you dispose of cryptocurrency, you’ll recognize a capital gain or loss depending on how the price of your crypto has changed since you originally received it.

When you earn cryptocurrency, you recognize income subject to ordinary income tax.

The calculator above is designed to help you recognize the tax impact of your crypto capital gains and losses.

The tax calculator calculates your taxes based on your income level. In Australia, your income and capital gains from cryptocurrency are taxed between 0-45%. Generally, the higher your income, the more taxes you pay.

If you dispose of your cryptocurrency after 12 months, only 50% of your gain will be considered taxable income. If you dispose of your cryptocurrency within 12 months, 100% of your gain will be considered taxable income.

Capital losses can offset your capital gains for the year. If you have a net loss for the year, you can carry it forward into future tax years.

Fees directly related to acquiring your crypto can be added to your cost of acquisition. Meanwhile, fees directly related to disposing of your crypto can be subtracted from your gross proceeds. In either case, fees reduce your total capital gain.

Trading one cryptocurrency for another is considered a taxable disposal. You’ll incur a capital gain or loss depending on how the price of the crypto you’re trading away has changed since you originally received it.

Here are a few strategies that can help you avoid your cryptocurrency taxes legally.

In Australia, cryptocurrency is subject to capital gains and ordinary income tax.

Your tax rate will vary depending on your personal income bracket and how long you held your crypto. Taxes on crypto range from 0-45%.

The ATO has used data matching to match ‘anonymous’ wallets to known individuals.

Crypto-to-crypto transactions are considered a disposal event. You can calculate your capital gain or loss by seeing how the price of the crypto you’re trading away has changed since you originally received it.

Capital losses can offset capital gains during the year. Any net loss can be used to offset gains in future years.

CoinLedger keeps your data safe through industry best practices like end-to-end encryption, disaster recovery, and full PCI compliance.

CoinLedger is the highest-rated Australian crypto tax calculator on the market — the platform is rated 4.8 stars on Trustpilot with more than 600 reviews!

Just started using this. Had some a few issues that I sent a quick chat request to after 1AM in the morning EST, and they responded pretty instantly, including modifying their import process for a given Exchange due to said exchange changing their format and they made a code change in less than 24 hours to fix the issue. Awesome customer service.

I have a feeling many frustrated people will leave Cointracker and use Coinledger this year! 👍

Important read here… Without @CoinLedger, there is NO way I could have figured out all of the transactions across wallets and exchanges. It’s bad enough with help from software, but impossible without it! Because of the complexity with wallets and the Voyager bankruptcy, I used their Expert Review service this year, and it was worth it!

Great company to work with.

Yuri was very professional and helped solve several issues I encountered. He was very patient even when I asked for some clarifications.

Thank you for all your help Yuri, you are excellent at your job.

Would recommend to anyone and everyone stressing over their crypto taxes. Awesome user friedly software with detailed information & instructions for all experience levels

If anybody needs a solid crypto tax software let me know and I’ll refer you. I just finished mine via @CoinLedger.

They did everything they promised they would, great support, great software, etc. Will continue to use for years to come

Coin ledger is the BEST

Crypto tax time has been made so much better with CoinLedger! Their platform is well-designed and easy to learn. Their tech team is responsive, thoughtful and thorough. I also purchased the Professional Review the last 2 years and felt added assurance before I turned in my tax form.

@CoinLedger thanks for adding it all up for me, very eye opening actually doing my crypto taxes correctly for a change 😂

Coinledger made a great progress in their effort to improve integration across different platforms and exchanges . I was recently able to successfully AUTO import my data from Robinhood ( which was a huge issue prior ) . All together I had to put together data from 5 different platforms and it all worked out . Support team was phenomenal . Very helpful , took me from beginning to the end , making sure each issue was resolved . Karel was very helpful and went out of his way to address any issues that needed to be addressed . Great work guys .

Bloody Awesome experience. Almost 600 transactions were taken care of instantly. Charged me only 100 bucks, and I love it.

Dunno what I would do if I had to manually review all of my crypto buys sell stakes and gains for tax season

I used @CoinLedger to automatically generate all of my crypto tax reports for the year.

This is a GREAT COMPANY! Their Software and Tech Support is awesome also. This Crypto Tax stuff is a real Pain but Coin Ledger makes it WAY easier, and their Tech Support actually gets back to you promptly and is extremely helpful.

Just started using this. Had some a few issues that I sent a quick chat request to after 1AM in the morning EST, and they responded pretty instantly, including modifying their import process for a given Exchange due to said exchange changing their format and they made a code change in less than 24 hours to fix the issue. Awesome customer service.

Outstanding customer service

Outstanding customer service. Ben R has been extremely helpful, and I must say very responsive/timely with assisting me with downloading a couple of issues. The issues we really mine but Ben R took to the time to get me through them, rather than just referring me to the FAQ or Help menu's. The program makes it easy to identify potential issues with no associated cost. This is a welcomed change from the last (ZL) tax software I tried to use.

Bloody Awesome experience. Almost 600 transactions were taken care of instantly. Charged me only 100 bucks, and I love it.

I have a feeling many frustrated people will leave Cointracker and use Coinledger this year! 👍

Dunno what I would do if I had to manually review all of my crypto buys sell stakes and gains for tax season

I used @CoinLedger to automatically generate all of my crypto tax reports for the year.

If anybody needs a solid crypto tax software let me know and I’ll refer you. I just finished mine via @CoinLedger.

They did everything they promised they would, great support, great software, etc. Will continue to use for years to come

Great tools, exceptional service

These tools make life a lot easier and, if you need help with anything at all, the customer service is brilliant. The team replies within a day and they're focused on actually helping you (not just "dealing with" your help request). That's a sign of a solid company.

Coin ledger is the BEST

Great company to work with.

Yuri was very professional and helped solve several issues I encountered. He was very patient even when I asked for some clarifications.

Thank you for all your help Yuri, you are excellent at your job.

Great Customer Experience

I have used Coinledger the past 2 years. This year I had an issue with a missing cost basis, and Benjamin (Ben R) from their support team, saved me many hours of stress by helping solve my issues efficiently and throughly. He also took time to help answer additional questions I had about past and future tax transactions. I strongly recommend using Coinledger for your tax purposes. Great experience!

Great experience with CoinLedger

Great experience with CoinLedger. I've been in crypto for a couple cycles now, and it's always been a nightmare tracking transactions come tax time. Thankfully I came across CoinLedger - the interface is easy to understand, much of the coin tracking is automated, and there is live customer service/ chat if you have a question. Would give 10 stars if I could; highly recommended.

@CoinLedger thanks for adding it all up for me, very eye opening actually doing my crypto taxes correctly for a change 😂