.jpg)

Key Takeaways

- When you hold your cryptocurrency for longer than 12 months, you take a 50% discount on your capital gains— a simple strategy that can save you thousands.

- Donating crypto, harvesting losses, and choosing the right cost basis method are all legal ways to reduce your tax bill and keep more of your gains.

1. Hold your cryptocurrency for the long-term

Holding onto your cryptocurrency for the long-term can lead to thousands of dollars worth of savings.

When you dispose of your cryptocurrency after 12 months or more of holding, only 50% of your gain will be considered taxable income. Meanwhile, 100% of the gains from cryptocurrency disposed of after fewer than 12 months is considered taxable income.

2. Donate to a registered charity

Donating your cryptocurrency to a registered charity comes with tax benefits.

Donating cryptocurrency is one of the few times when disposing of your cryptocurrency is not taxable. In addition, you’ll be able to deduct the fair market value of your cryptocurrency at the time of the donation.

3. Harvest your losses

While losing money on cryptocurrency trades is never the goal, crypto losses can offset your capital gains for the year and reduce your tax liability.

Capital losses can’t be used to offset income, but they can be used to offset up to 100% of other capital gains. If you have a net loss for the year, it can be rolled over indefinitely to offset capital gains in future tax years.

4. Pick the best cost basis method for you

The ATO allows investors to choose multiple different cost basis methods including first-in-first-out (FIFO), last-in-last-out (LIFO) and highest-in-first-out (HIFO). These methods help you determine your capital gains and losses in a disposal event.

To understand why your cost basis method can impact your tax bill, let’s take a look at an example.

In this case, the answer is dependent on what cost basis method Jack decides to use. If he chooses FIFO, the Bitcoin that he sells is the first Bitcoin he acquired. That means his capital gain is $15,000.

However, if Jack chooses LIFO, the Bitcoin that he sells is the last Bitcoin he acquired. That means his capital gain is $5,000.

As you can see, your cost basis method can make a big difference on your tax bill!

5. Take advantage of your SMSF

.jpeg)

Remember, super funds are designed to help you build wealth while minimizing your tax burden.

Income that you withdraw from your super fund is taxed at a flat rate of 15%. Meanwhile, the tax rate you typically pay on taxable income can be as high as 45%. In addition, you can claim contributions to your super fund as tax deductions.

While you can’t directly hold cryptocurrencies in standard super funds, you can use a Self Managed Super Fund (SMSF) to hold crypto and reap tax benefits.

Still, it’s important to remember that SMSFs do come with costs and potential risks.

6. Deduct relevant costs

Australia allows taxpayers to deduct the cost of certain expenses on their tax returns.

For example, taxpayers can deduct work-related travel expenses and costs related to managing their tax affairs — including the cost of accountants and tax preparation software. That makes it essential to keep records and receipts that you can use to claim these deductions!

7. Use crypto tax software

Remember, inaccurately reporting your taxes can lead to penalties and fines. The easiest way to avoid this issue is to get started with crypto tax software.

Thousands of Australian investors use CoinLedger to save money during tax season. Just connect your wallets and exchanges, and let the platform generate a comprehensive tax report with the click of a button!

Get started with a free preview report.

How is cryptocurrency taxed in Australia?

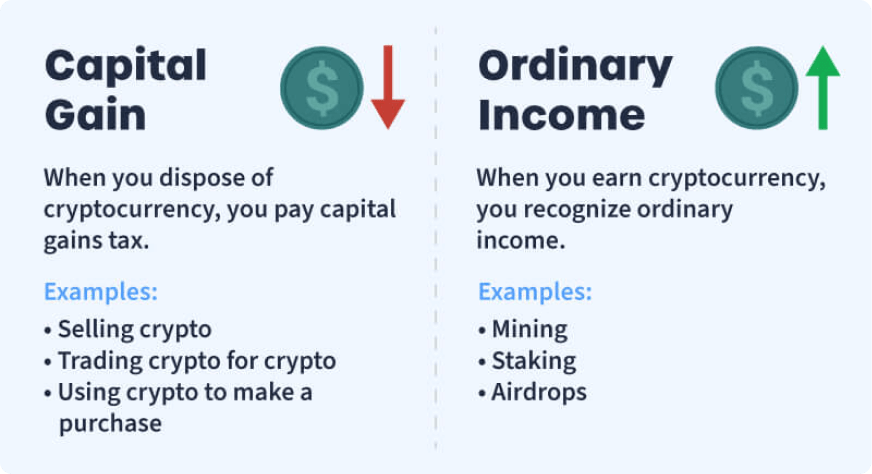

In Australia, crypto is subject to capital gains and ordinary income tax.

For more information, check out our ultimate guide to how cryptocurrency is taxed in Australia.

Can you evade crypto taxes in Australia?

There is no way to legally evade your cryptocurrency taxes in Australia.

Remember, Australian exchanges are required to share customer information with the ATO. In the past, the ATO has used this information to send warning letters to thousands of Australian crypto investors.

Frequently asked questions

- Is crypto tax-free in Australia?

No. Cryptocurrency is subject to capital gains and ordinary income tax in Australia.

- Can you claim crypto losses in Australia?

Yes. Losses from cryptocurrency can be used to offset capital gains from cryptocurrency, stocks, and other assets.

- What’s the best way to avoid crypto tax?

One of the simplest ways to legally reduce your crypto tax is to hold your cryptocurrency for longer than 12 months. In cases like these, you can discount your taxable income from cryptocurrency disposals by 50%.

- Is swapping crypto taxable?

Yes. Crypto-to-crypto trades are considered taxable disposals subject to capital gains tax.

- How much tax do I pay on crypto in Australia?

Cryptocurrency taxes in Australia can range from 0-45% depending on factors like your total income and how long you held your cryptocurrency.

- What’s the best crypto tax software for Australia?

CoinLedger is consistently rated highly by crypto investors across the globe. The platform has 4.6 stars on Trustpilot with more than 1,200 reviews!

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)