%20(1).png)

Private keys, recovery phrases, no ways to file disputes — storing and managing your cryptocurrency can be incredibly confusing. This only gets worse when you consider how valuable your crypto becomes over time and the fact that transactions are irreversible. This quick refresher on the best places to store your crypto explains everything you need to know and is good for beginners and veterans alike.

Exchanges (Least Secure)

Keeping your cryptocurrency on exchange services, such as Coinbase, Binance, and others, is a necessary evil if you are actively trading. The problem with exchanges is that they hold onto the crypto for all their users. Therefore, they become a huge honeypot for hackers to try and break into.

For example, in 2019, Binance, then the world’s largest exchange by trading volume, got hacked for 7,000 Bitcoin (about $40 million at the time). Luckily, Binance had enough funds to cover their losses but not every exchange was as lucky. Popular bitcoin website Buy Bitcoin Worldwide notes that in 2019 alone exchange hackers ran off with $283 million in crypto.

If keeping crypto on exchanges for trading is a necessity, consider only keeping what you need to trade on exchanges and nothing more.

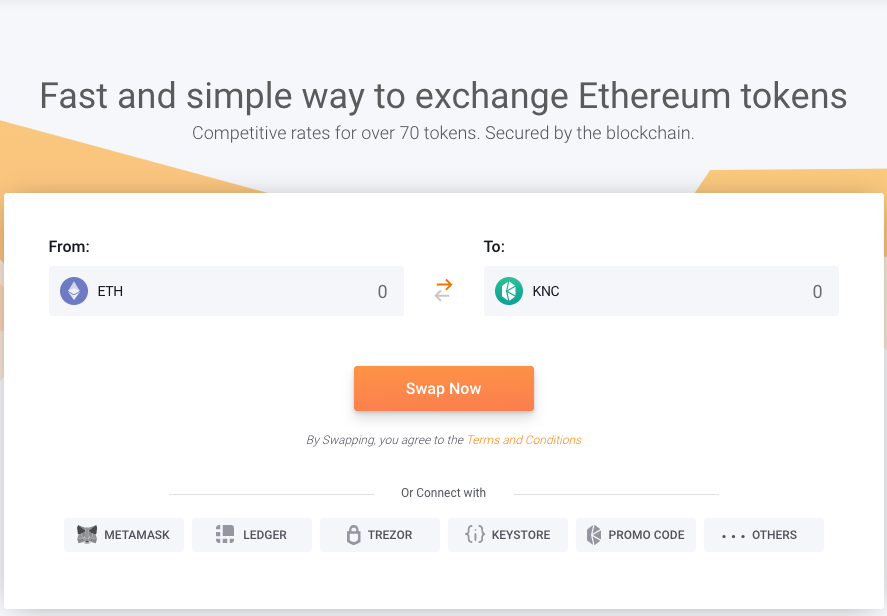

Another option is to consider decentralized exchanges (DEXes), which don’t require you to give up control of your private keys. While DEXes have a long way to go before they match centralized exchanges (CEXes) in terms of things like liquidity and speed, they have come a long way in recent years. Some that you can consider include KyberSwap (swap Ethereum and ERC20 tokens), dYdX (ETH margin trading), and Synthetix (ETH derivatives).

KyberSwap offers a simple way to swap Ethereum tokens without giving up control of your crypto.

Software Wallets (Somewhat Secure)

Software wallets for desktop and mobile are another option for storing your crypto assets. While you don’t have to worry about an exchange getting hacked, running off with your money, or otherwise mismanaging your crypto, software wallets are only as safe as your device.

For many people, exchanges might actually be more secure than their desktop or mobile device. However, if you maintain best security practices as well as store any private keys and recovery phrases offline, software wallets are better than exchanges - at least for smaller amounts of crypto. For bigger amounts, consider a hardware wallet (discussed in the next section).

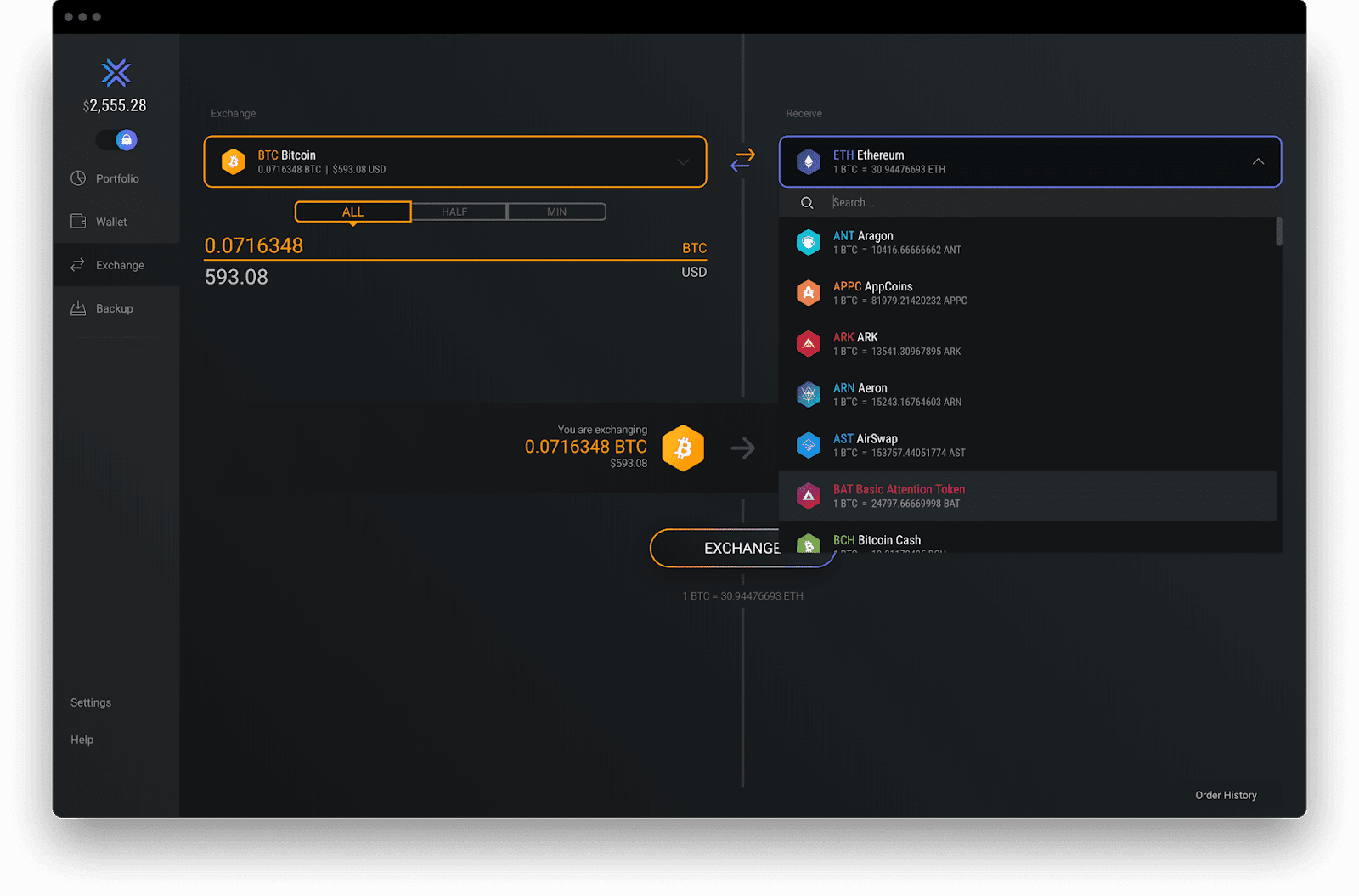

Some popular software wallets include Exodus, Jaxx Liberty, Guarda, and Atomic Wallet. The wallets mentioned also allow you to exchange assets right from your wallet. Though the fees are usually higher than on centralized exchange services.

Some software wallets like Exodus allow you to trade assets right from your wallet.

Hardware Wallets (Most Secure)

Hardware wallets are considered the most secure way to store your crypto. This is because your private keys, which allow for the spending of your crypto, physically cannot leave the hardware wallet device due to how hardware wallets are designed. In addition, you must also confirm transactions on the device, giving you a 2nd layer of protection before transactions are broadcasted to the blockchain.

The downside to hardware wallets is that they are better for long-term holding than they are active trading. Unless you’re using your hardware wallet with an exchange (usually only DEXes) or other service that allows trading with your hardware wallet, you’ll first have to transfer assets from your hardware wallet elsewhere before trading.

Another downside is that hardware wallets cost money. Nevertheless, if the value of your assets exceeds $55 (the price of the entry model Trezor One hardware wallet), a hardware wallet is a worthy investment to safeguard your funds.

From bottom left to right: Trezor One, Trezor Model T, Ledger Nano S, Ledger Nano X. Trezor and Ledger are the 2 most popular hardware wallets. Top left is a KeepKey, another hardware wallet that’s popular but not as popular as the Trezor or Ledger.

Bonus Tip: Multisignature Wallets

Another way to store your cryptocurrency is with a multisignature wallet. As the name would suggest, multisignature wallets require more than 1 signature for transactions to be approved.

For instance, if you and a business partner managed some crypto funds together, you could create a multisignature wallet that required 2/2 transactions for transactions to go through.

The major downside to multisignature wallets is that they are definitely inconvenient and wouldn’t be suitable for active, everyday use. A more suitable use case would be something like a treasury fund that required multiple stakeholders to sign off on transactions.

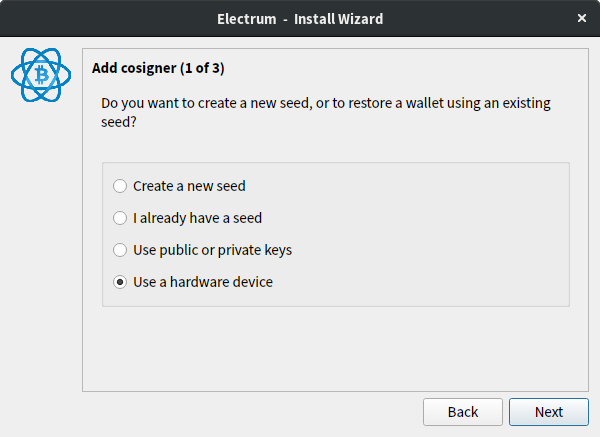

Popular multisignature wallets include Electrum and Armory.

Electrum allows you to create multisignature wallets using hardware wallets as cosigners.

Conclusion

Storing your cryptocurrency properly can be an extremely foreign concept, considering that you have to completely rethink how you manage your money. Hopefully this quick guide filled in some of the knowledge gaps or gave you a quick refresher on best practices.

About the author: Exodus is the world’s leading crypto wallet with over 4 million downloads and supports desktop, mobile, and hardware wallet integration.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)