.jpg)

If you’re reading this, you probably just imported all of your transaction history from your cryptocurrency exchanges and generated your crypto tax reports with CoinLedger — nice work. You’re one step closer to submitting your tax return.

At this point, you might be wondering what to do next. This article will walk you through three different options for completing the tax reporting process.

- Option #1: Import your tax report to TurboTax, TaxAct, or other tax filing software

- Option #2: Invite your accountant or tax professional to review and download your tax forms

- Option #3: File your report yourself

1. Importing Your Reports Into TurboTax, TaxAct, or Other Tax Filing Software

If you use TurboTax, TaxAct, or another tax prep platform, you can import your crypto tax reports directly. Once you import these files, your work is done! TurboTax and TaxAct can take care of the rest of your tax return for you.

TurboTax Import

If you are completing your taxes in TurboTax Online, you should download the “TurboTax Online” CSV through the download option on your report dashboard. You will then simply import this CSV file into the cryptocurrency section of the TurboTax app.

For a step-by-step walkthrough of the process, check out our complete guide to importing your CSV to TurboTax Online.

If you are using the Desktop version of TurboTax, you will download the “Tax Exchange Format”. For more information, read this guide which walks through the step-by-step import process for TurboTax Desktop.

TaxAct Import

If you use TaxAct to file your taxes, you can take the same approach but instead download the “TaxAct” file by using the download option on your report dashboard. For more information, check out our TaxAct guide.

Other Software

If you are using software other than TaxAct or TurboTax, it is likely that you can still import your gains and losses into the program. Typically, you need to find an option to import a file into the “Investments” section of your preferred tax platform. You should then import your “Short Term Gains” and “Long Term Gains” CSV files from CoinLedger.

2. Invite Your Tax Professional

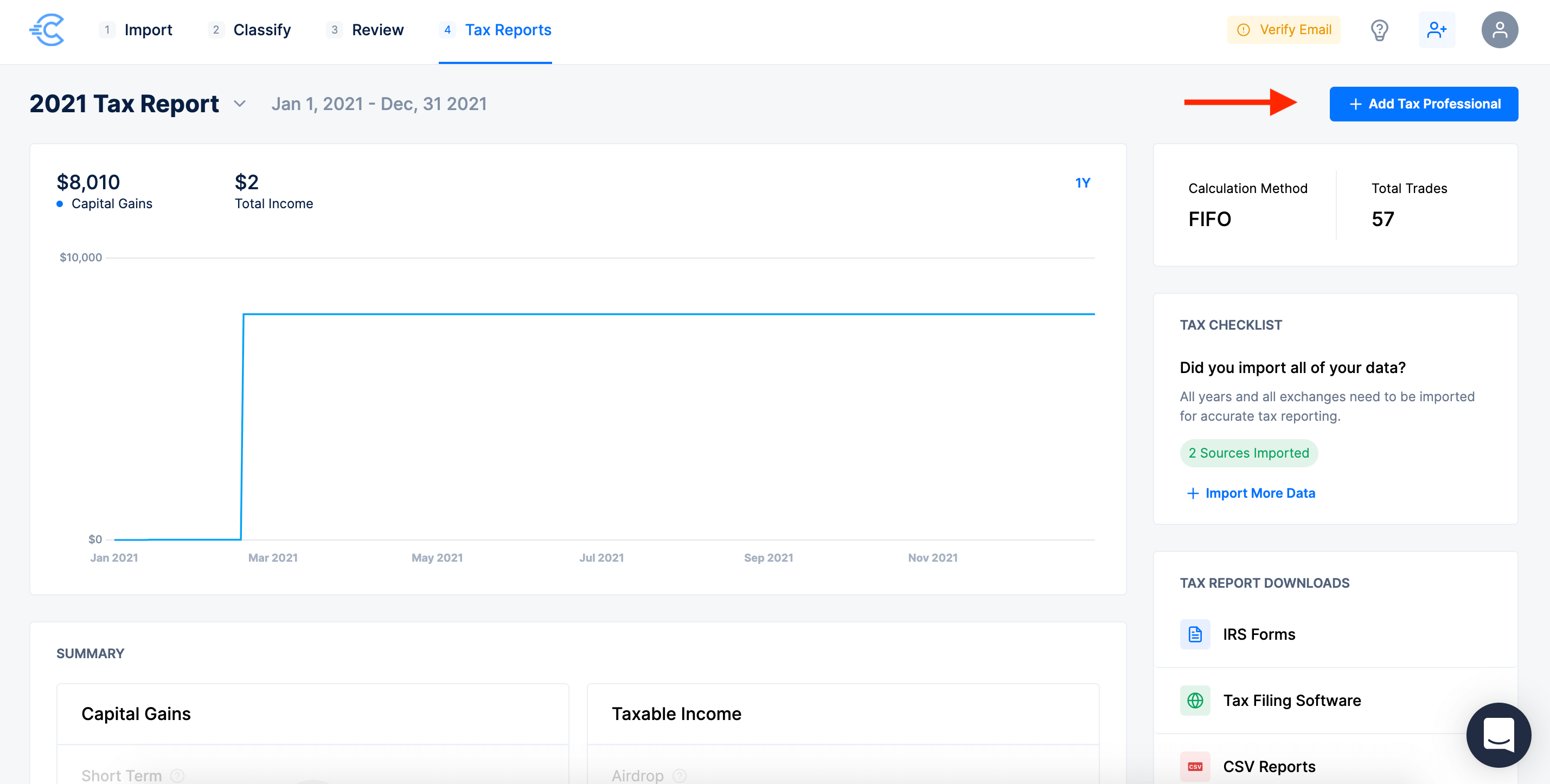

If you have an accountant who typically files your tax return for you, you can invite them to review your tax report and download it directly from CoinLedger. You can do this by simply clicking the ‘Invite Tax Professional’ button on your report dashboard.

Inviting your tax professional will automatically send out an email to him or her. From this email, your tax pro can login and review your information and download the necessary reports that they need to file your taxes.

3. Filing Your Taxes Yourself

If you file your taxes yourself, you should download the 8949 Form from your downloads options. Then, transfer your net capital gain or loss from this form onto your 1040 Schedule D.

If you have any ordinary income from cryptocurrency (mining, staking, etc), you will find that in your “Income Report”. Be sure to include this in the income section of your tax return. Typically, this should be reported on Schedule 1 for individuals and Schedule C for businesses.

For more information, check out our complete guide on how to file your cryptocurrency taxes.

My 8949 is Only One Line

CoinLedger automatically consolidates your transactions on Form 8949 when you have a high volume of trades.

IRS guidelines state that you can summarize your transactions in this manner. However, you are required to include or attach a detailed line-by-line transaction history with your tax return filing. You can find this information on your Short Term or Long Term Gains CSV.

If you e-file your return with the consolidated Form 8949, you should mail in your complete Short Term or Long Term Gains CSV to the IRS. For more information, check out our step-by-step guide on mailing in your detailed transactions here.

Disclaimer - This post is for informational purposes only and should not be construed as tax or investment advice. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. For a more detailed look at how cryptocurrencies are taxed, please read our guide: The Complete Guide to Cryptocurrency Taxes.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)