.jpg)

Wondering how to report your cryptocurrency transactions on H&R Block?

In this guide, we’ll break down everything you need to know about reporting your cryptocurrency on H&R Block. We’ll break down the basics of cryptocurrency taxation and share a simple step-by-step process to help you import all of your cryptocurrency transactions into H&R Block on both the desktop app and web version!

Does H&R Block support cryptocurrency?

H&R Block’s premium version does support cryptocurrency disposals. However, it’s important to remember that H&R Block wasn’t explicitly built for cryptocurrency taxes. As a result, the platform can have trouble integrating with and tracking crypto across different blockchains and exchanges.

That’s why many investors choose to import their transactions into crypto tax software like CoinLedger. Once you’ve connected your wallets and exchanges, you’ll be able to generate a complete crypto tax report including full capital gains, losses, and income breakdowns based on all of your transactions. You can import these reports directly into your H&R Block account in minutes.

What is the best crypto tax software to use with H&R Block?

Looking for crypto tax software to use with H&R Block? Here’s why more than 700,000 investors around the world use CoinLedger.

Make your tax season stress-free

We know that trying to file your crypto taxes can be stressful. That’s why we took our time to design a platform that makes the process easy and intuitive. You’ll be able to import your wallets and exchanges in minutes — even if you’re not a tech or finance expert.

Use a world-class platform at an unbeatable price

At CoinLedger, we believe that no one should be left out of the crypto-economy. Our cheapest tax reports start at just $49, and you can try out our platform by importing your transactions and tracking your portfolio for free!

Get help from our support team

If you have any questions during any step of the process, our support team is ready to help. They’re trained on the ins and outs of the platform and are available for all of our customers!

If you’re interested in getting started, get started with a free CoinLedger account today.

How to report your cryptocurrency transactions on the H&R Block Desktop app

If you’re using the desktop version of H&R Block, you can follow the following steps to report your transactions. If you're using the online version, skip to the section below.

1. Import your cryptocurrency transactions into CoinLedger. Then, generate your tax report.

2. When you’re done, download the file labeled ‘H&R Block (TXF)’. You’ll be able to upload this file into your H&R Block Premium account.

3. Open the Premium version of H&R Block on your desktop.

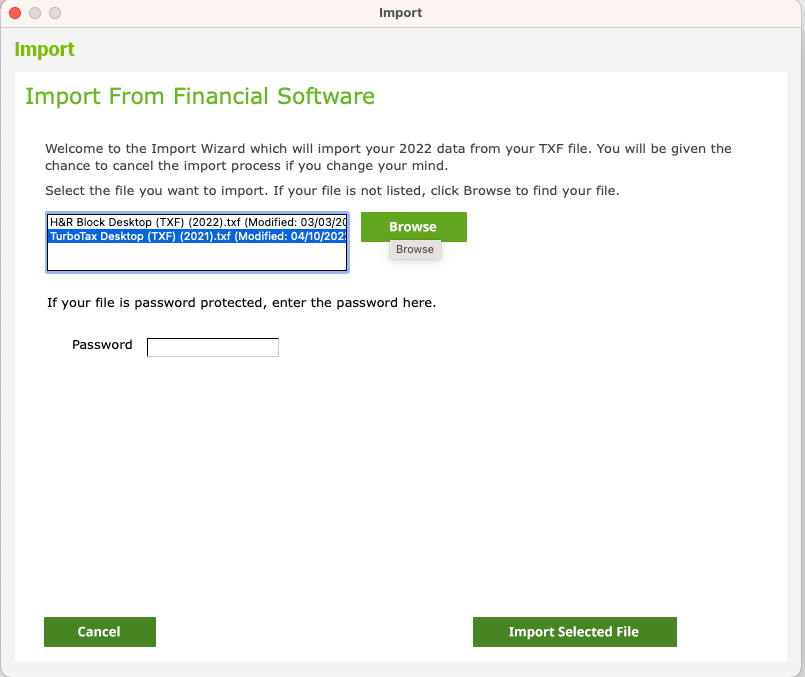

4. Click ‘File’ on the top left corner, then select the option ‘Import Financial Information’.

5. Click Browse, then select your H&R Block txf file that you downloaded from CoinLedger for import. Then, click ‘Import Selected File’.

8. Next, you can decide which transactions to import. It’s likely that you’ll want to keep all the transactions on your txf file.

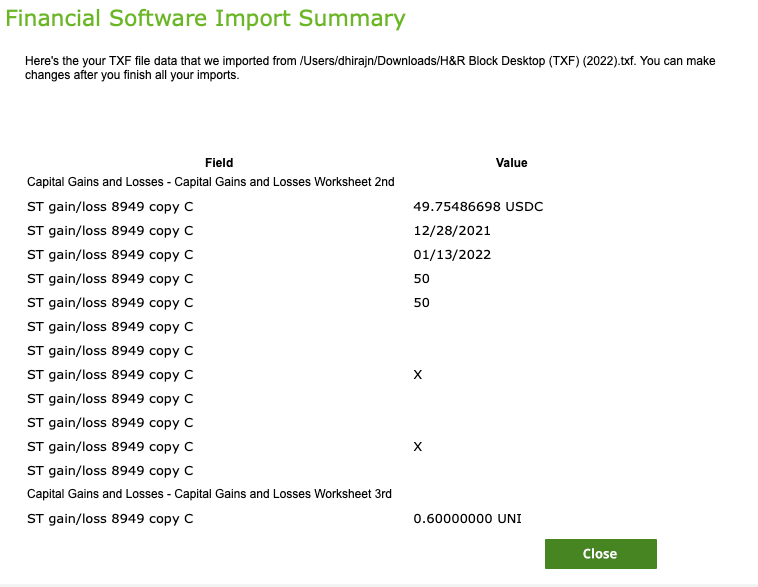

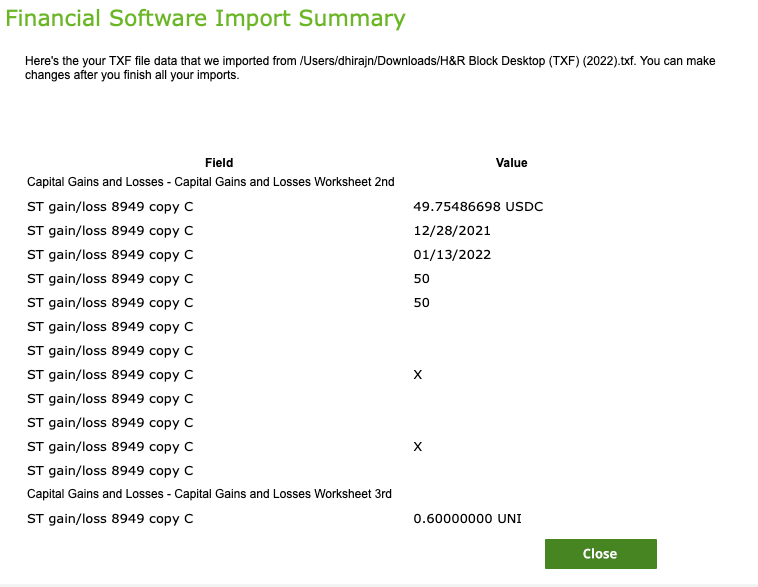

9. You’ll then be provided with a Financial Software Import Summary.

And that’s it! Once you’ve completed these steps, you’ll be able to see a complete record of your cryptocurrency gains and losses within H&R Block.

How to report your cryptocurrency on H&R Block online

Here’s how you can report your cryptocurrency transactions on the online version of H&R Block.

1. Import your cryptocurrency transactions into CoinLedger. Then, generate your tax report.

2. When you’re done, go to IRS Forms and download the Form labelled ‘Form 8949’.

3. Log in to H&R Block on the web. While you’ll need the Premium version to report cryptocurrency, you don’t need to pay until you submit your taxes.

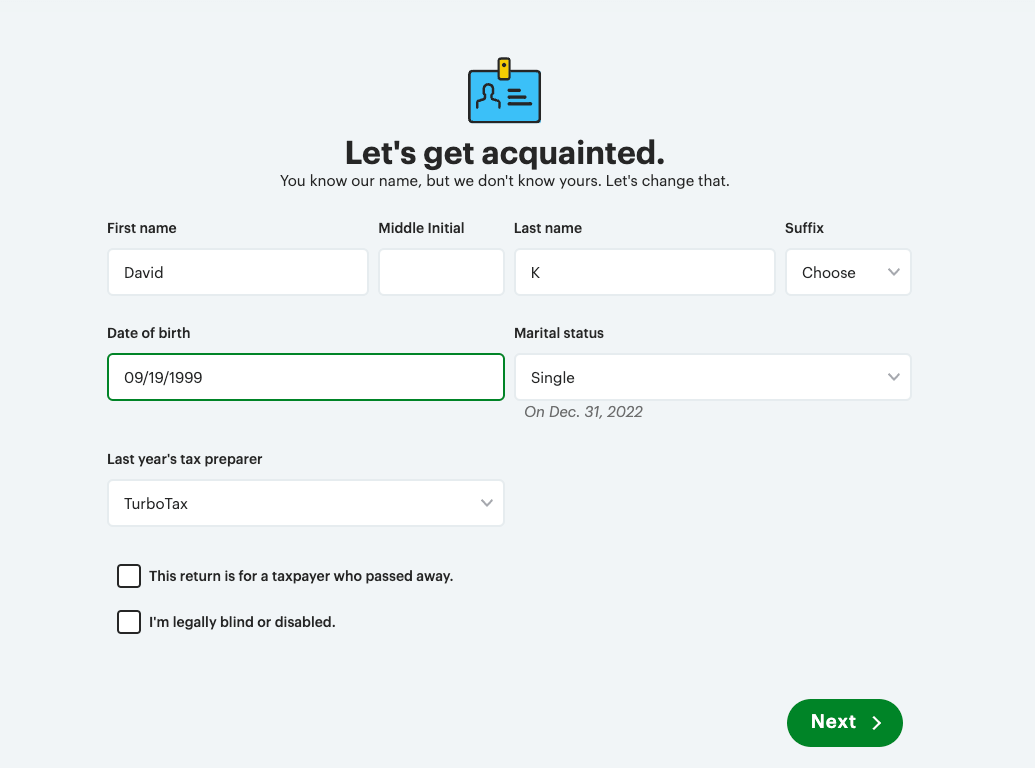

4. Start a new Federal return and enter your personal information.

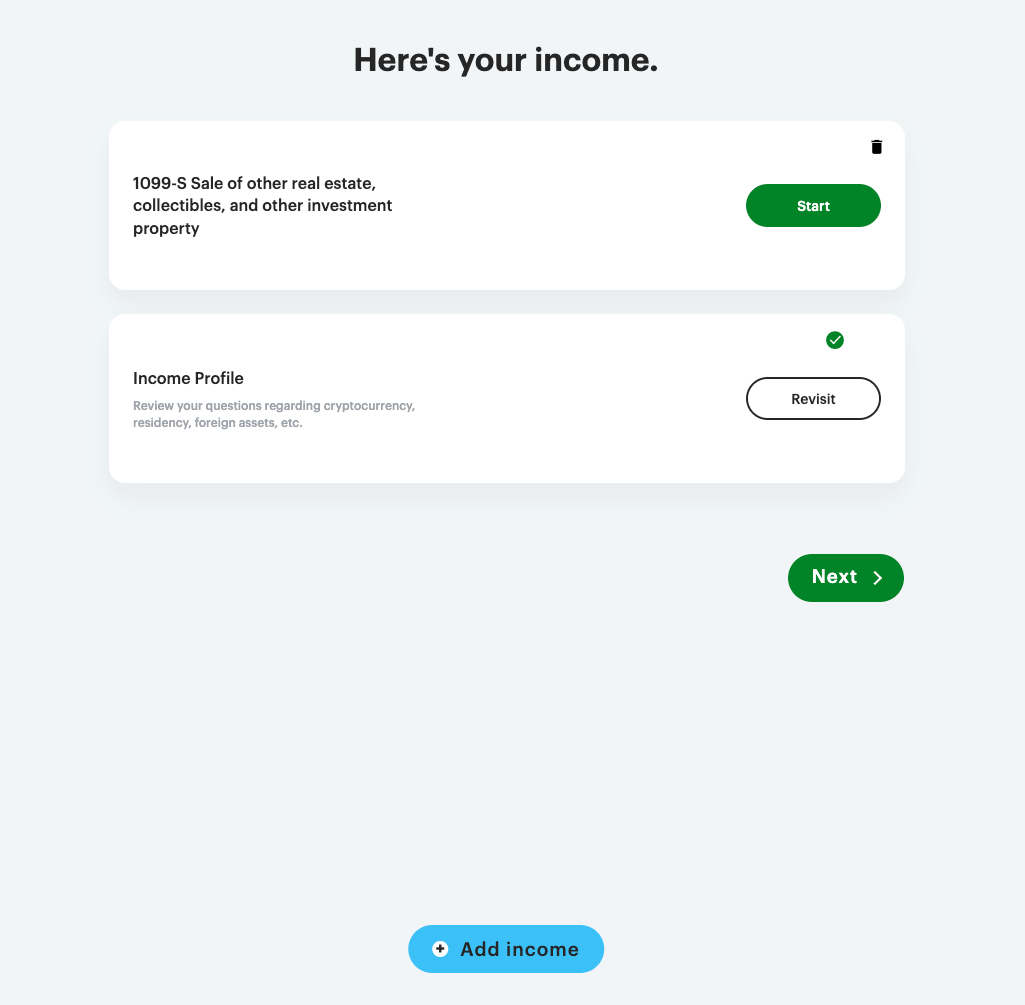

5. Once you’re done entering your personal information, go to the ‘Income’ tab. Click the blue button labeled ‘Add Income’ at the bottom of the screen.

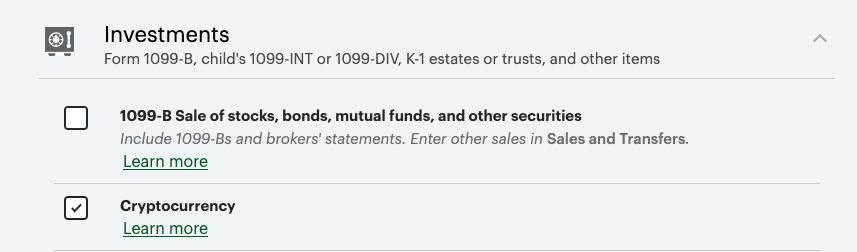

6. Click Investments, then click the checkbox labelled Cryptocurrency.

7. Press the ‘Start’ button on the section labelled Cryptocurrency.

%20copy.png)

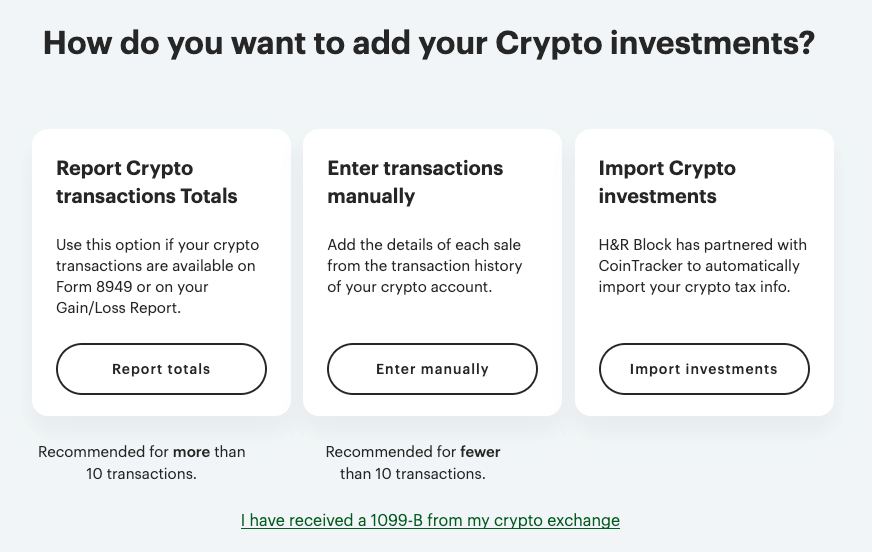

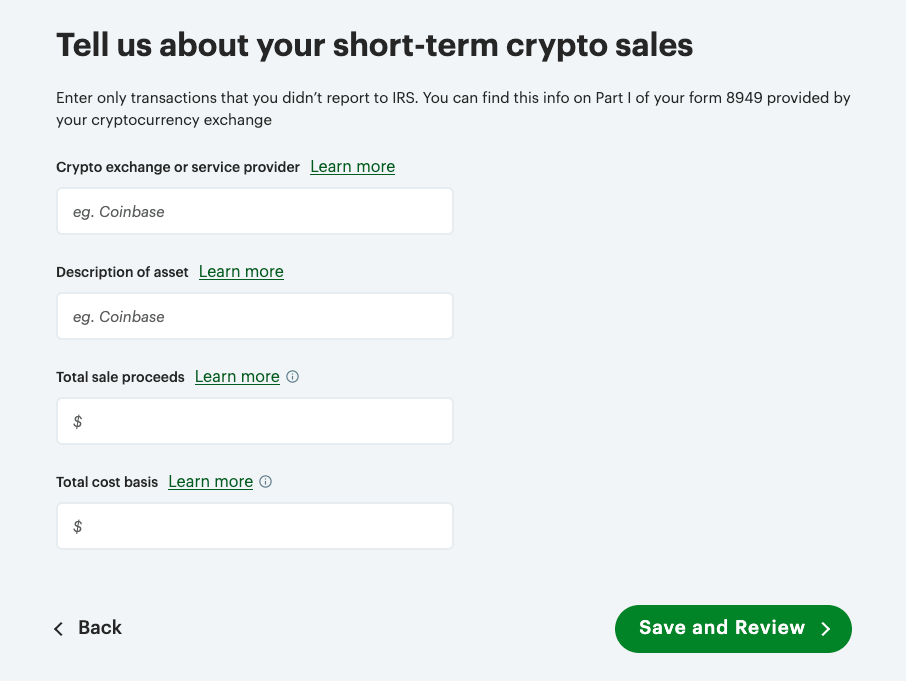

8. At this point, you’ll see a screen with multiple options. If you have more than 10 transactions, you should choose the option labeled ‘Report Totals’. If you have fewer than 10 transactions, you should choose the option labeled ‘Enter manually’.

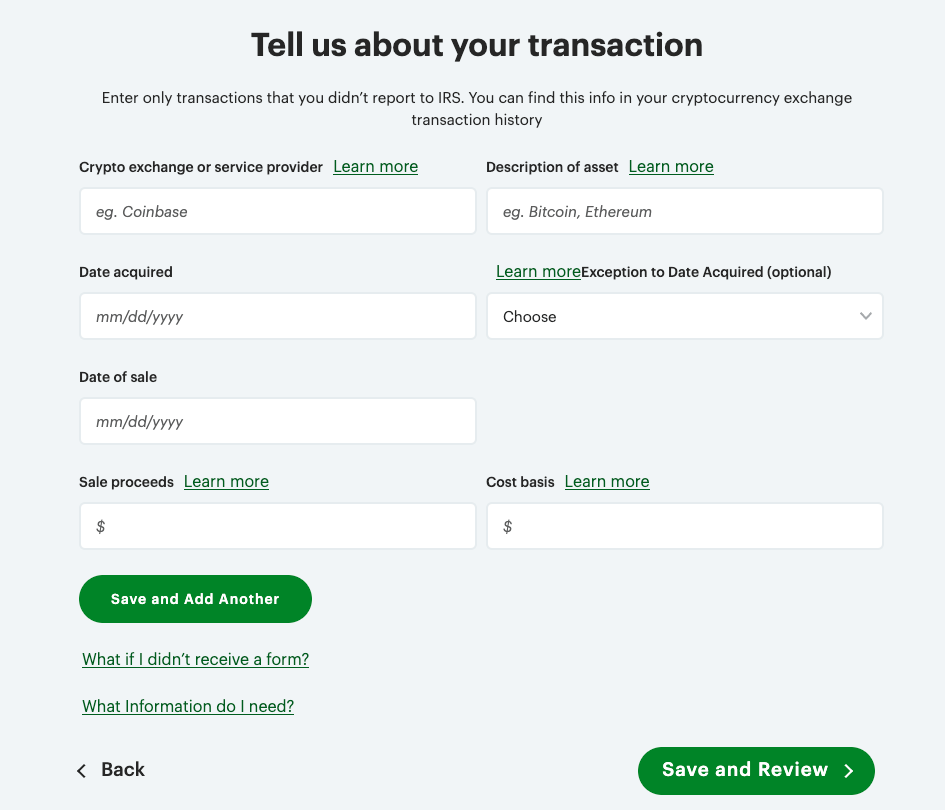

9. If you choose the ‘Enter manually’ option, you can copy your information from your cryptocurrency disposals from your CoinLedger tax report. In the service provider section, you can type in ‘CoinLedger’.

10. If you choose the ‘Report Crypto Transactions Totals’, you will be directed to specify whether your crypto transactions are Long-term, Short-term, or Both.

11. Using the data in your CoinLedger tax report, enter the total gain and loss that you had on each individual crypto-asset.

12. If you chose the ‘Report Crypto Transaction Totals’ option, you’ll need to attach a pdf of your Form 8949 or mail it in.

And that’s it! Once you’ve completed these steps, you’ll be able to see a complete record of your cryptocurrency gains and losses within H&R Block.

What if I have more than 2,500 transactions?

At this time, the maximum number of transactions you can import in an electronic filing from H&R Block is 2,500.

If you have more than 2,500 transactions, you can get a consolidated version of your Form 8949 by asset type. If you choose this option, you’ll be required to submit a line-by-line breakdown of your cryptocurrency transaction history to the IRS.

For more information, check out our complete guide to submitting your Form 8949 to the IRS.

Get started with CoinLedger

Looking to import your cryptocurrency transactions into H&R Block? Get started with CoinLedger, the crypto tax software trusted by more than 700,000 investors around the world!

Get started with a free preview report — there’s no need to enter your credit card details until you’re 100% sure your information is accurate!

Frequently asked questions

How do I report cryptocurrency on my taxes?

Cryptocurrency disposals should be reported on Form 8949. Cryptocurrency income should be reported on Schedule 1 or Schedule C, depending on the specifics of your situation.

Can H&R Block help with cryptocurrency?

Yes. You can report your cryptocurrency transactions using H&R Block Premium.

How do I report cryptocurrency on H&R Block?

Because H&R Block was not specifically built for cryptocurrency, many investors choose to import their transactions from crypto tax software like CoinLedger.

Do I need to report all of my cryptocurrency transactions on H&R Block?

You can report a consolidated version of your cryptocurrency transactions through H&R Block. However, you are required to send the IRS a complete record of your crypto transaction history separately.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)