%20(1).jpg)

Looking to report your cryptocurrency taxes on TaxSlayer?

In this guide, we’ll cover everything you need to know about how to report cryptocurrency on TaxSlayer. We’ll break down a step-by-step process to help you report your crypto transactions on TaxSlayer in minutes.

Does TaxSlayer support cryptocurrency?

Yes. TaxSlayer allows users to manually import cryptocurrency-related transactions and include them with your tax return.

Why can’t TaxSlayer directly import my cryptocurrency transactions?

While TaxSlayer is one of the best tax platforms on the market, it’s important to remember that it wasn’t built specifically for cryptocurrency. As a result, it may not have the full functionality you need to report your cryptocurrency taxes.

Luckily, there’s an easier way. Crypto tax software like CoinLedger allows you to automatically import your transactions from all of your wallets and exchanges. Then, you can generate a comprehensive crypto tax report that you can export into platforms like TaxSlayer!

How to report cryptocurrency gains and losses on TaxSlayer

Here’s how you can use CoinLedger to import your cryptocurrency tax reports into TaxSlayer.

1. Connect your wallets and exchanges to CoinLedger.

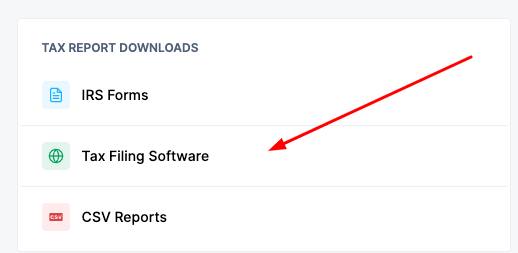

2. Click the button labeled Tax Filing Software on the right hand side of the ‘Tax Reports’ section.

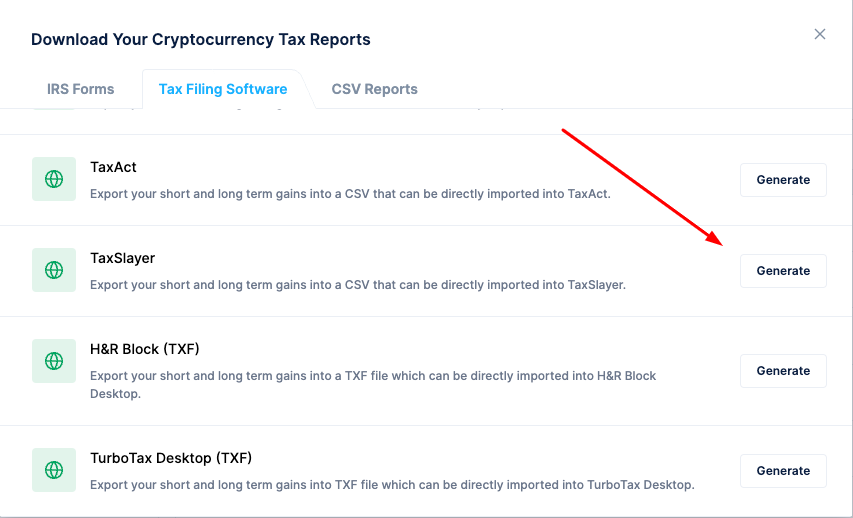

3. Download your TaxSlayer csv file from CoinLedger.

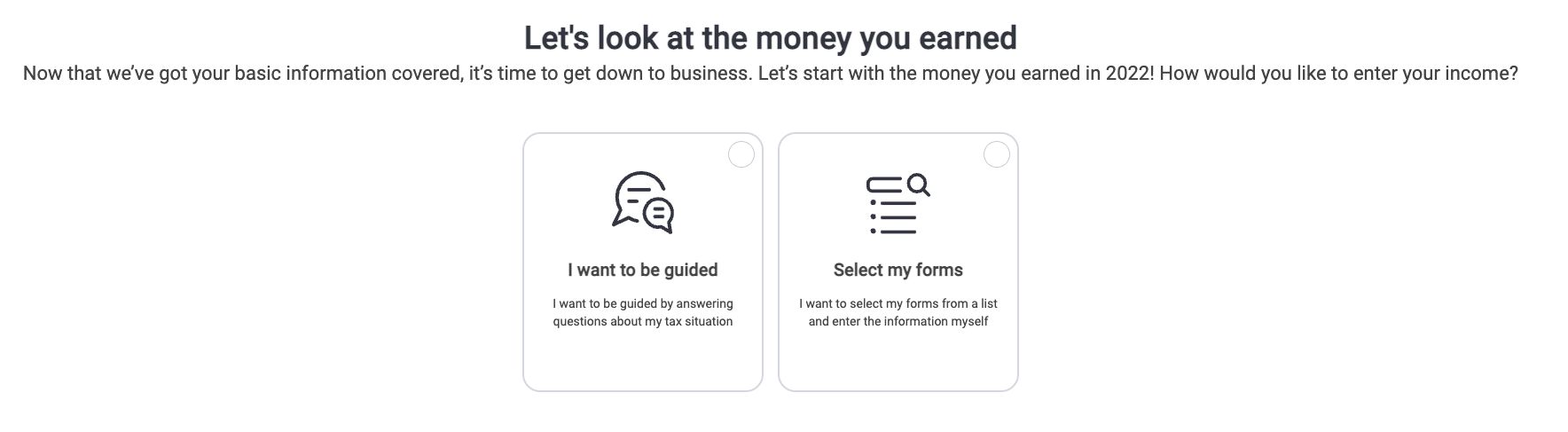

4. Within your TaxSlayer account, open your Tax Return. Click the ‘Federal’ tab on the left hand side. Select the option labeled ‘Select my forms’ and click ‘Continue’.

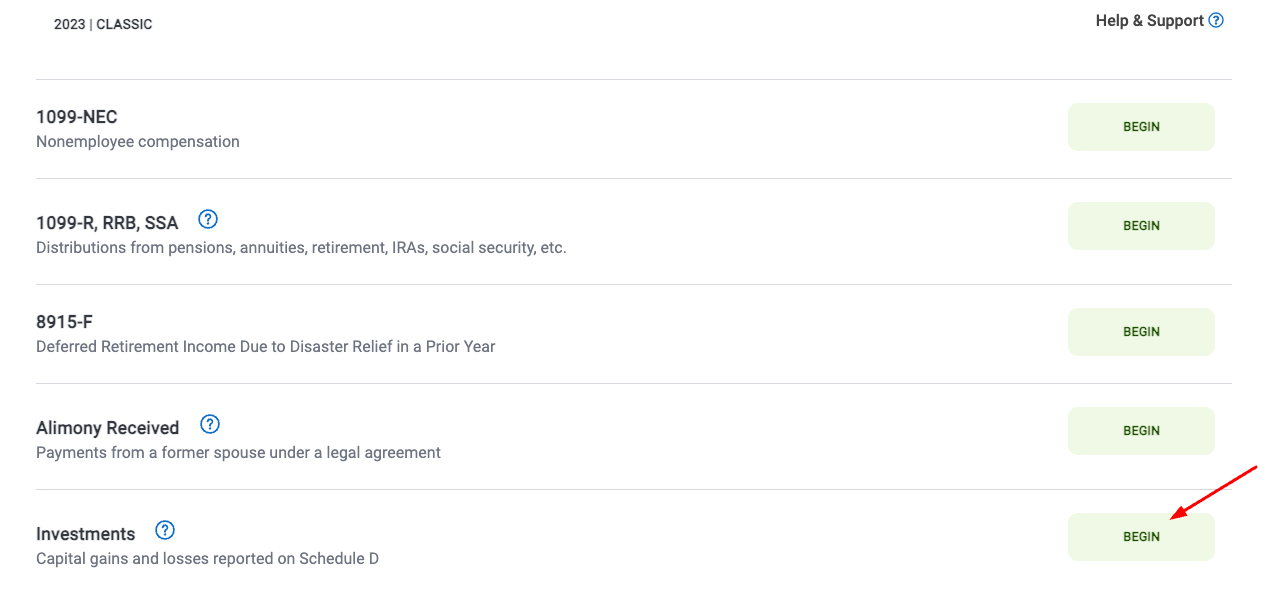

5. From the next screen, click ‘Begin’ on the option labeled ‘Capital Gains and Losses’.

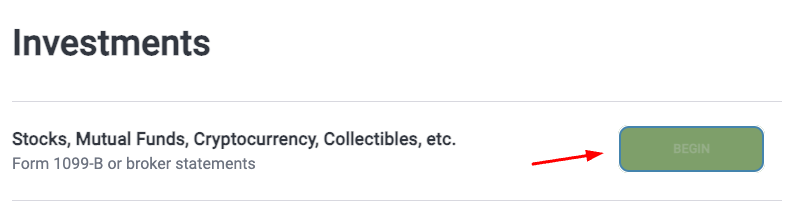

6. Click ‘Begin’ on the section labeled ‘Stocks, Mutual Funds, Cryptocurrency, Collectibles, etc.’

7. Click the option labeled ‘Upload a CSV of sales’

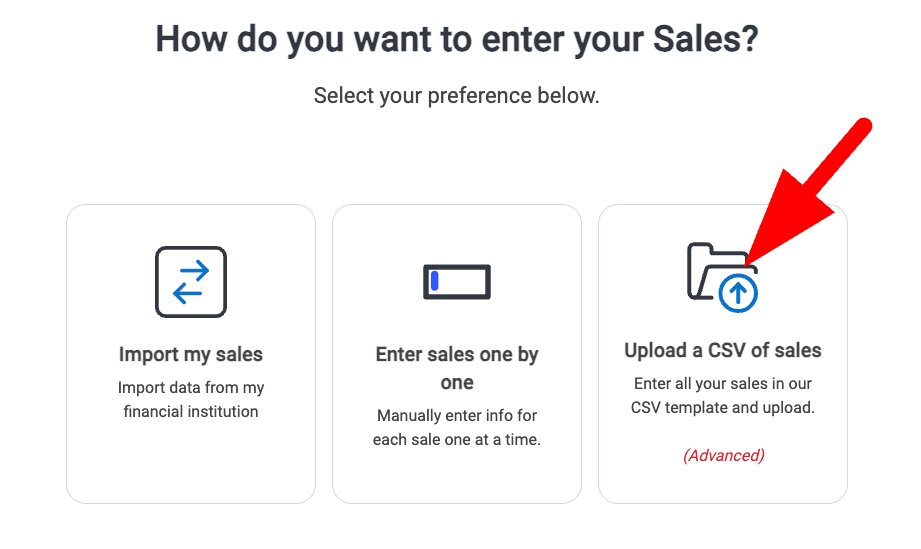

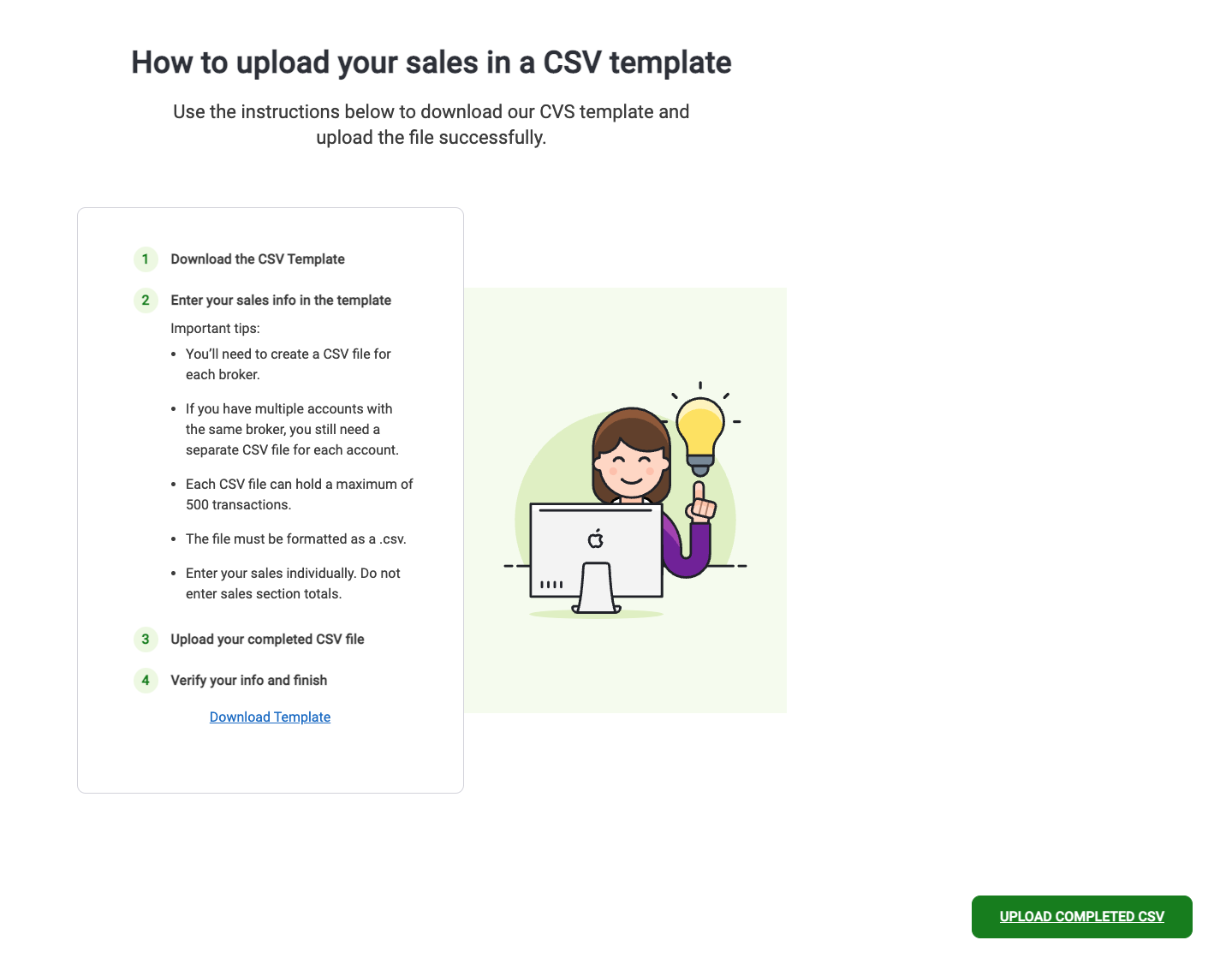

8. Click the green button on the bottom right corner labeled ‘Upload Completed CSV’.

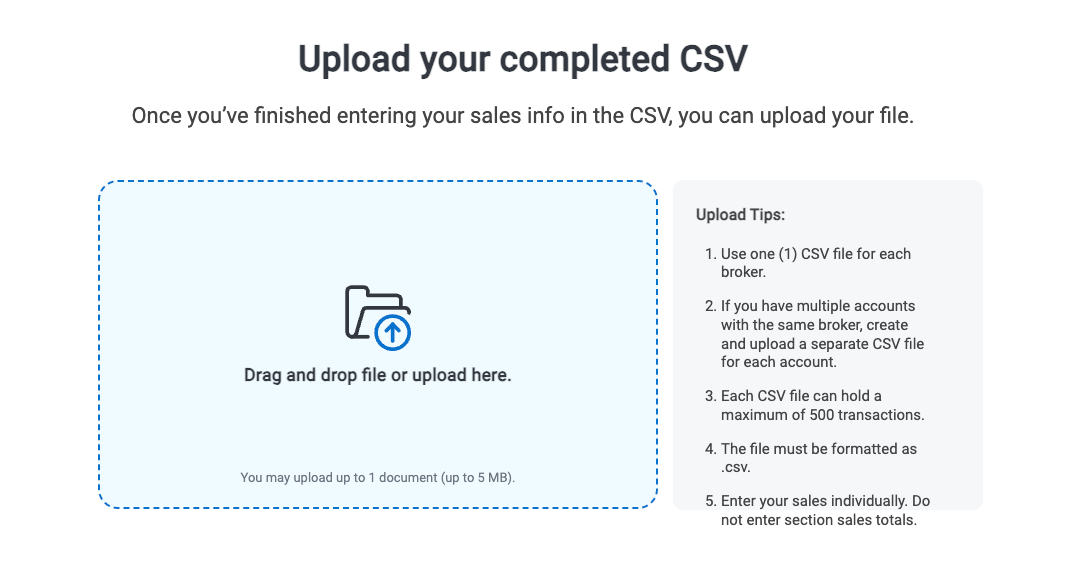

9. Click the button labeled ‘Drag and drop file or upload here’. Select the TaxSlayer csv you downloaded from CoinLedger, then click ‘Upload’.

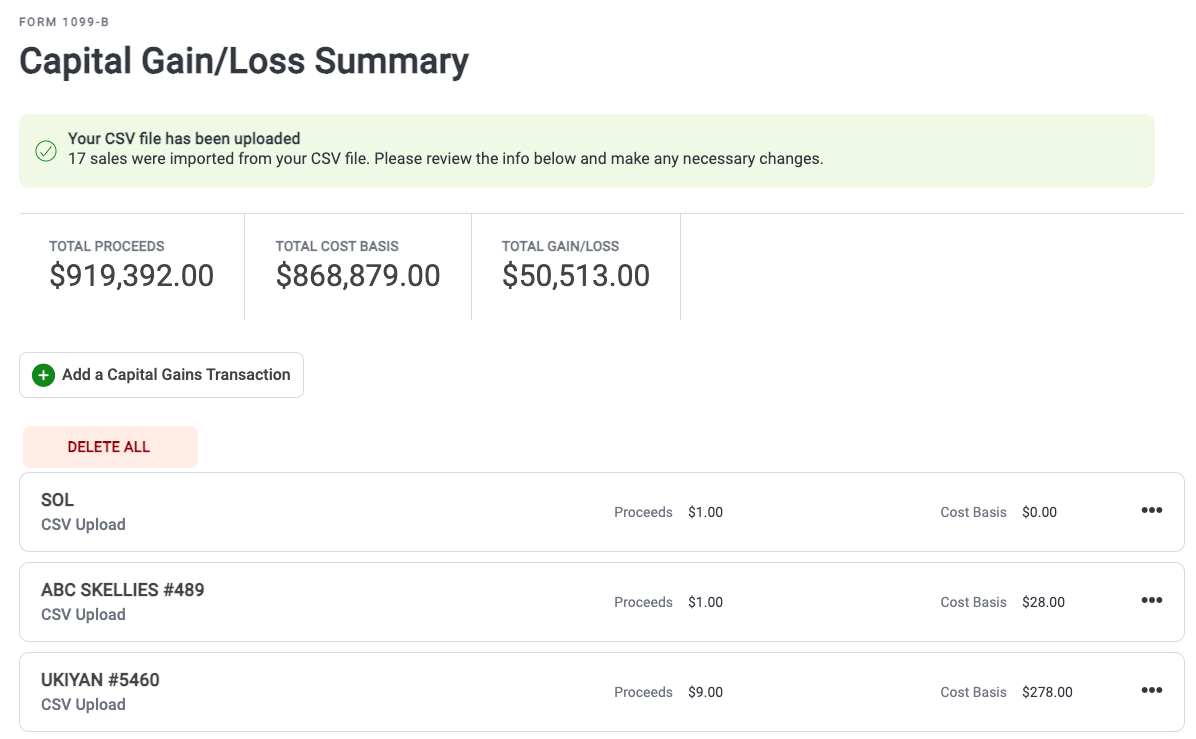

10. Once the import has executed successfully, click ‘Continue’. If you receive an error message on this step, re-upload your csv and try again.

That’s the end of the process! Once you’ve completed the steps above, you’ll have a complete record of your crypto gains and losses within TaxSlayer.

What’s the best crypto tax software to use with TaxSlayer?

Interested in getting started with a crypto tax software that integrates with TaxSlayer? Here’s why more than 500,000 investors across the world choose CoinLedger.

Integrations with exchanges & blockchains

CoinLedger can help you save hours of time and effort this tax season. The platform integrates with exchanges like Coinbase and blockchains like Ethereum, allowing you to import thousands of transactions in minutes.

Easy to use

We designed our platform to be easy to navigate for anyone — even if you’re not a tech or finance expert. Whether you choose to connect your wallets and exchanges automatically or upload your transactions through a csv file, the process is designed to be as stress-free as possible.

Affordable pricing

We believe that nobody should be left out of the crypto-economy. Anyone can get started with the platform for free, and tax reports can be downloaded for as low as $49.

Interested in getting started? Try out CoinLedger for free.

What if I have more than 500 transactions?

Currently, TaxSlayer only allows users to upload a maximum of 500 transactions in a csv file upload.

If you have more than 500 transactions, CoinLedger can consolidate your transactions by asset type. If you choose this method, you are required to send the IRS a full record of your cryptocurrency transaction history seperately.

For more information, check out our guide to sending Form 8949 to the IRS.

Get started today!

Don’t wait until the tax deadline to generate your crypto tax report. Try CoinLedger and get a head start on reporting your taxes.

Frequently asked questions

- Where do I report crypto on Taxslayer?

You can report your cryptocurrency disposals in the ‘Investments’ section on TaxSlayer.

- Can the IRS track your cryptocurrency?

Major exchanges like Coinbase report to the IRS. In addition, the IRS works with contractors to analyze public blockchain transactions and identify tax cheats.

- What happens if I don’t tell the IRS about my crypto?

Tax evasion is considered a felony. The maximum penalty for tax evasion is 5 years in prison and a fine of $100,000.

- Do I have to report every crypto transaction?

While there’s no need to report holding cryptocurrency or transfers between wallets you own, you should report every time you ‘earned’ or ‘disposed’ of cryptocurrency.

- How do I track crypto for tax purposes?

You can track your cryptocurrency transactions manually through a spreadsheet, or automatically through crypto tax software like CoinLedger.

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)