.jpg)

Key Takeaways

- While FinCEN has not yet required FBAR reporting for cryptocurrency, the conservative approach is to report foreign crypto accounts if your total balance exceeds $10,000.

- If you have accounts on foreign exchanges like Binance.com, KuCoin, or Bitfinex, you may need to report them on FBAR.

In this guide, we’ll break down what the FBAR is and lay out a straightforward step-by-step process for reporting your foreign digital assets.

What is the FBAR?

FBAR is an abbreviation for Foreign Bank Account Report. You’ll need to file this report with FinCEN, the US Treasury Department’s Financial Crimes Enforcement Network. The form is designed to track taxpayers’ foreign financial assets and stop potential tax fraud and tax evasion.

Who needs to file an FBAR?

Traditionally, FBAR has applied to foreign bank accounts, retirement accounts, and securities accounts.

In December 2020, FinCEN released a statement stating that digital assets would need to be reported in the near future. As of 2025, the agency has not released an update. While there’s no definitive guidance, the conservative approach is to report each individual foreign cryptocurrency account if your total balance is greater than $10,000.

Remember, FBAR requirements don’t just apply to American citizens. The rule applies to “U.S. persons”, which includes the following:

- U.S. citizens

- U.S. green cardholders

- Aliens who have lawfully immigrated to the U.S.

- Partnerships and corporations incorporated under American law

- Trusts with at least one trustee who is a U.S. person

It’s important to keep in mind that the penalties associated with not filing FBAR are harsh. If you have significant crypto holdings within foreign exchanges, we recommend speaking to a tax professional regarding FBAR reporting.

What about joint ownership?

If one or more of your cryptocurrency accounts share joint ownership, it’s likely that you will need to report all of the owners on your tax form once FinCEN updates its regulations around digital assets. In addition, you will likely need to report individual and joint accounts if your total balance in foreign accounts is greater than $10,000.

What are the penalties for not filing my FBAR?

Though there is currently no penalty for not reporting digital assets on the FBAR, this is likely to change in the near future. Currently, FinCEN charges the following penalties for taxpayers who do not file the FBAR.

Non-willful penalty: If you do not file the FBAR because you were not aware of your obligation, you will need to pay penalties of $10,000 per violation.

Willful penalty: If it’s determined that you purposely avoided filing the FBAR, you will need to pay penalties up to $100,000 per violation.

What is the deadline for filing my FBAR?

If you meet the requirements for filing the FBAR, you will need to submit it before the deadline to avoid the penalties mentioned in the previous section. This will be April 15 following the calendar year that you are reporting.

How to file your FBAR

What do I need to file the FBAR?

To file the FBAR, you’ll need the following information.

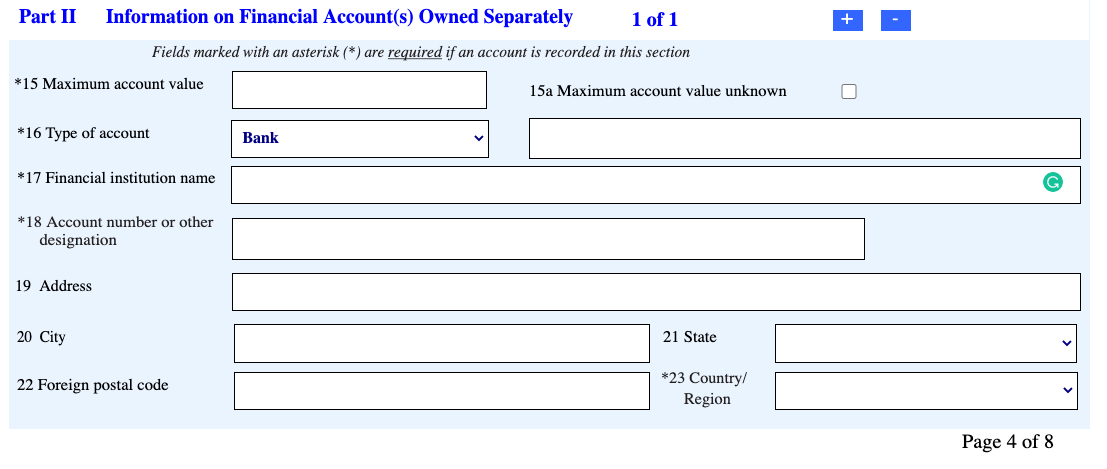

- Maximum value (converted to USD using the end of the year conversion rate) of each account during the tax year

- The name of the account holder

- The account number/other designation

- The name and address of the person/financial institution that maintains the account

A 4-step guide to filing your FBAR

In the future, cryptocurrency holders will likely need to file the FBAR. Here’s a simple 4-step guide to completing the process online.

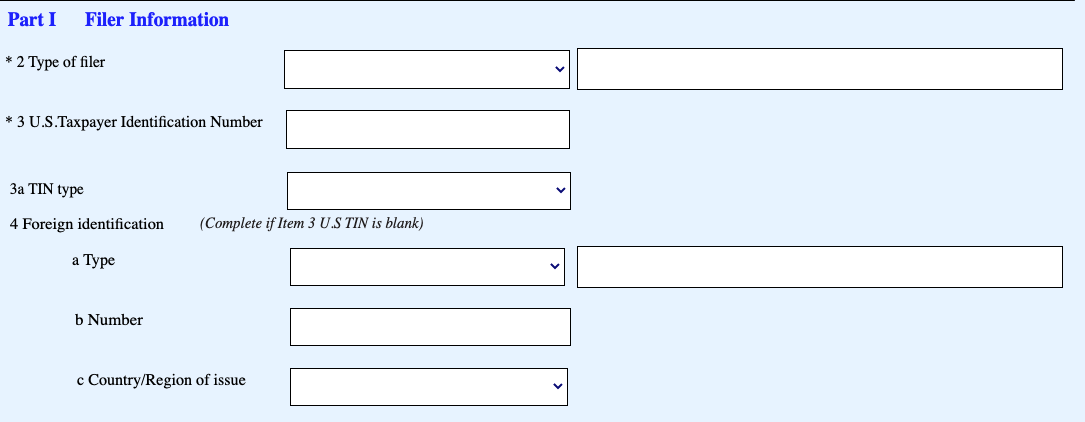

1. In the first part of the form, you’ll be asked to submit personal identification.

2. Next, you’ll be asked to submit information on your foreign cryptocurrency exchanges. If you are a single filer, you should use Part II of the form. If you are reporting a joint account, you should use Part III.

3. If you need to add multiple accounts on either Part II or Part III, you can add an account by selecting the + button on the top of the form.

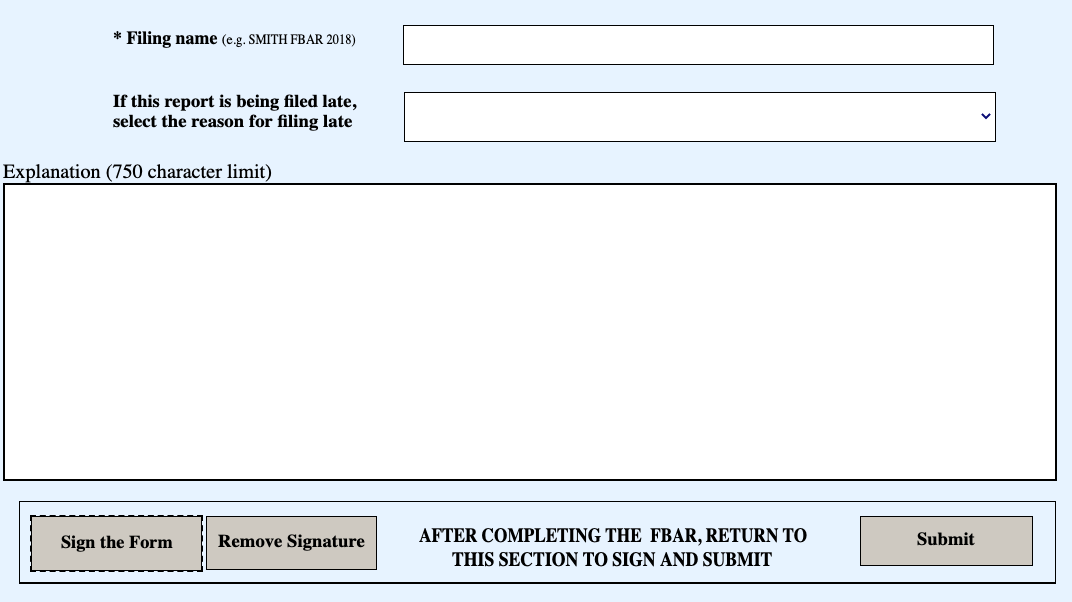

4. Once you’re finished adding all of your relevant accounts, sign the form and hit “Submit”.

What is Form 8938?

Depending on the value of the assets you hold in foreign accounts, you may be required to fill out Form 8938.

While Form 8938 is designed for many of the same purposes as the FBAR, it has a few key differences. While the FBAR is filed with FinCEN, Form 8938 is filed with the IRS. In addition, Form 8938 has higher reporting thresholds than the FBAR.

For more information on the differences between the two forms, check out the IRS’s complete breakdown of Form 8938 vs. FBAR.

Do I need to file Form 8938 for my cryptocurrency?

Here’s a breakdown of the different reporting thresholds for Form 8938.

Single filers: Must file if their foreign assets are worth more than $50,000 on the last day of the tax year or worth more than $75,000 during any time during the tax year.

Married individuals filing separately: Must file if their foreign assets are worth more than $50,000 on the last day of the tax year or worth more than $75,000 during any time during the tax year.

Married individuals filing jointly: Must file if their foreign assets are worth more than $100,000 on the last day of the tax year or worth more than $150,000 during any time during the tax year.

Remember, filing Form 8938 does not eliminate the need to file FBAR. If you fall above the specified thresholds, you will need to fill out both forms.

Do I need to file Form 8938 for crypto?

You should file Form 8938 if the total value of your foreign financial assets (including crypto) exceed the reporting thresholds.

Which of my exchanges are foreign-based?

Not sure which of the crypto exchanges you are using are based in foreign countries? Here’s a list of popular foreign and American exchanges.

Popular foreign crypto exchanges

Remember, if you have more than $10,000 in your combined foreign accounts, you’ll likely need to report each one on your FBAR. Here are some examples of foreign crypto exchanges:

- Binance.com

- KuCoin

- Bitfinex

- ByBit

- Huobi

- BitMex

- OKEx

- CEX.io

- Gate.io

- MexC

Popular US-based exchanges

Because these exchanges are based in the US, you will not need to report assets held on these exchanges in an FBAR now or in the future.

- Binance.US

- Cash App

- Coinbase

- Gemini

- Kraken

- Robinhood

- Uphold

What about decentralized exchanges like Uniswap?

It’s likely that interacting with decentralized protocols will not need to be reported on the FBAR as long as the taxpayer and their wallet are based in the USA.

Want to stay on top of your cryptocurrency taxes?

Looking for an easy way to stay on top of your crypto taxes?

Try CoinLedger — the crypto tax software trusted by more than 700,000 investors across the globe. The platform can automatically import your transactions from hundreds of wallets and exchanges.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)