Wondering how to report your Dogecoin transactions on your taxes?

By the time you finish reading this article, you’ll know how to correctly report Dogecoin profits and losses. We’ll also discuss a special situation where selling Dogecoin can even reduce your tax bill.

What is Dogecoin?

Dogecoin is a cryptocurrency that was created in 2013 by software engineers Billy Marcus and Jackson Palmer. The cryptocurrency was modeled after ‘Doge’, a popular meme at the time.

In the following years, the cryptocurrency took on a life of its own. In May 2021, Dogecoin’s market cap soared upwards of $20 billion, after it was publicized by celebrities like Elon Musk and Mark Cuban.

How is Dogecoin taxed?

Just like other cryptocurrencies, Dogecoin is considered property by the IRS. That means Dogecoin is subject to both capital gains tax and income tax.

Capital gains tax: Selling your Dogecoin or using it to purchase goods and services is considered a disposal event. You will incur capital gains or capital losses depending on how the price of your Dogecoin has fluctuated since you originally received it.

Income tax: If you earn Dogecoin through mining or through work, this is considered ordinary income. You will be required to pay income tax on your earnings.

Three common Dogecoin taxable events

Let’s run through a few common scenarios where you’ll need to report Dogecoin on your taxes.

I sold my Dogecoin for a profit.

Selling Dogecoin at a profit means that you’ll be required to pay capital gains based on how much the value of your Dogecoin has increased since you originally received it.

.jpeg)

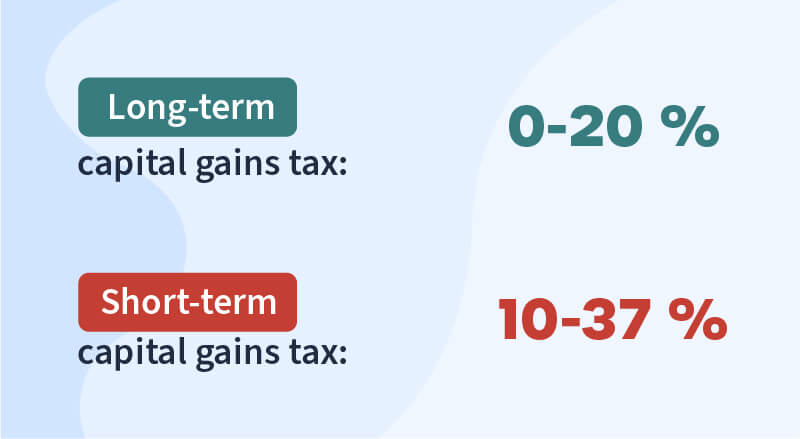

Remember, capital gain tax varies depending on how long you’ve held your Dogecoin. If you’ve held it for longer than 12 months, you’ll pay taxes at the long-term capital gain rate. If you held your Dogecoin for less than 12 months, you’ll need to pay taxes at the short-term capital gain rate, which is higher.

I sold my Dogecoin at a loss

When you sell Dogecoin at a loss, you’ll incur capital losses depending on how much the value of your Dogecoin has decreased since you originally received it.

Reporting capital losses comes with a tax benefit. Capital losses can offset your capital gains and up to $3000 of your personal income for the year. Additional capital losses can be rolled forward to future tax years.

.jpeg)

For more information, check out our guide to crypto tax-loss harvesting.

I traded my Dogecoin for goods and services/other cryptocurrencies

Trading your Dogecoin for goods and services or other cryptocurrencies is considered a disposal event. You’ll incur capital gains or capital losses based on how much the price of your Dogecoin has fluctuated since you originally received it.

.jpeg)

I earned Dogecoin through mining

The rewards you earn from mining Dogecoin will be considered income. However, the form you need to fill out varies depending on whether it was mined as a hobby or through a business.

If you mine Dogecoin as a hobby, you’ll report it as “other income” on line 21 of Form 1040 Schedule 1.

On the other hand, if you mine Dogecoin through a business, you will report the income on Schedule C.

For more information, check out our complete guide to crypto mining taxes.

I transferred my Dogecoin to another wallet

Transferring your Dogecoin from one wallet to another is not considered a taxable event. You will not be required to pay income or capital gains taxes for doing this.

Manage your Dogecoin taxes with CoinLedger

Looking for a simple way to report taxes on Dogecoin and other cryptocurrencies?

CoinLedger can help. More than 700,000 investors use the software to track all of their cryptocurrency gains and losses. With just a few clicks, you’ll be able to import transactions from exchanges like Coinbase, Kraken, and Gemini.

Get started today with a free preview report. There’s no need to enter your credit card information until you’re 100% sure your transaction data is correct!

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)