.jpg)

Key takeaways

- Crypto losses can offset $3,000 of income and an unlimited amount of capital gains for the year.

- Additional losses can be rolled forward and offset gains and income in future tax years.

- To claim a cryptocurrency loss, you need to realize your loss by disposing of your cryptocurrency.

Lost money on cryptocurrency this year? We have good news for you: you may have the opportunity to save thousands on your tax bill.

In this guide, we’ll break down everything you need to know about cryptocurrency capital losses. We’ll guide you through the steps you can take to calculate and report your losses on your tax return.

Can you write off crypto losses on taxes?

Cryptocurrencies such as Bitcoin are treated as property by the IRS, and they are subject to capital gains and losses rules.

This means that when you realize losses after trading, selling, or otherwise disposing of your crypto, your losses offset your capital gains and up to $3,000 of personal income.

Any net losses exceeding $3,000 in a given year can be rolled forward into future tax years.

It’s possible that you may be able to claim losses in other circumstances, such as losing your crypto in an exchange bankruptcy or if the value of your crypto has fallen to 0. We’ll cover the tax implications of these scenarios later in this article.

How do I calculate my capital losses?

You can use the following formula to calculate your capital loss from a cryptocurrency disposal.

Capital Gain/Capital Loss = Proceeds - Cost Basis

In this case, your cost basis is how much you originally paid to acquire your cryptocurrency. Meanwhile, your proceeds are how much you received for disposing of your cryptocurrency.

How much can you save by claiming crypto losses?

Whether you’re offsetting capital gains or income, crypto losses can lead to large tax-savings:

Capital gains: As stated earlier, crypto losses can offset an unlimited amount of capital gains. The tax rate you pay on gains varies depending on whether they are short-term (taxed between 10-37%) or long-term (taxed between 0-20%). If you have a large amount of capital gains, you can potentially avoid a large tax liability.

Income: Depending on your tax bracket, ordinary income is taxed between 10-37%. If you write off the full $3,000 of income for the year, your tax-savings will range between $300 for those in the lowest bracket to $1,110 to those in the highest bracket.

Do you have to report crypto losses to the IRS?

.png)

Many investors believe they only need to report cryptocurrency on their taxes if they’ve made gains. This is not true.

All taxable events need to be reported to the IRS. In addition, not reporting your cryptocurrency losses means that you won’t be able to claim the associated tax benefits.

Remember, you are required to report cryptocurrency on your tax return even if you have not received relevant 1099 forms from your exchanges.

How to report cryptocurrency losses on your taxes

Let’s walk through how you can report crypto losses on your taxes.

- Keep an accurate record of your cryptocurrency transactions — including any disposals. This way, you’ll be able to easily find the necessary information to report your taxes.

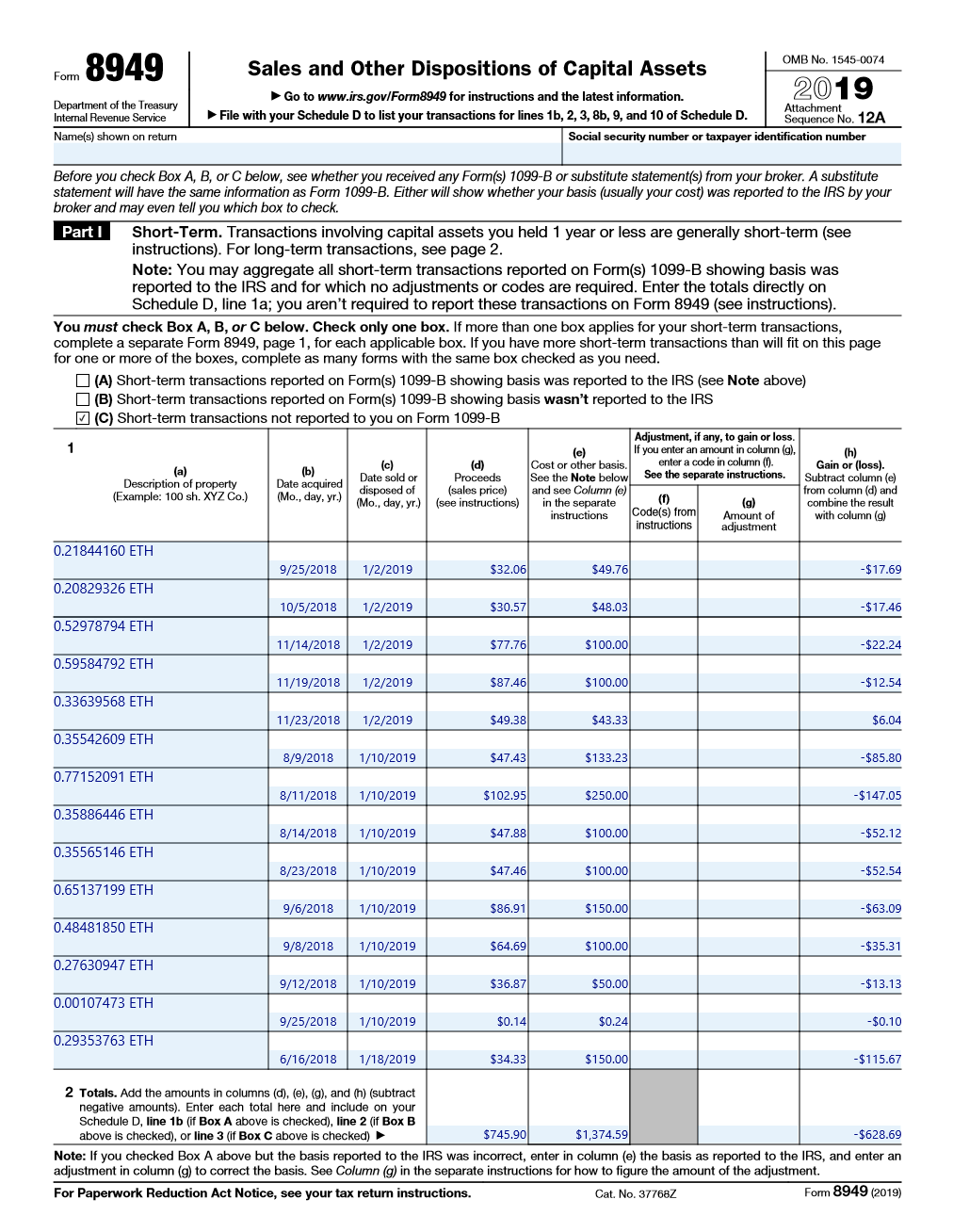

- Report your crypto disposals on Form 8949. You should also include the date you acquired and disposed of your crypto, the price of your crypto in USD at the time of receipt and disposal, and your net gain/loss.

- Once you have filled out lines for each of your taxable events, sum them up and enter your total net gain or loss at the bottom of Form 8949 (pictured below).

- Carry over your net gain/loss to Schedule D of Form 1040.

For a step-by-step walkthrough detailing how to report crypto on your tax forms, check out our blog post: How To Report Crypto On Taxes.

Can I sell cryptocurrency at a loss and buy it back?

Because of the advantages of reporting capital losses, some investors choose to intentionally sell their cryptocurrency at a loss to reduce their tax liability. This strategy is known as tax-loss harvesting.

Because cryptocurrency is so volatile, you likely will have multiple opportunities to harvest your losses in a year.

Tax-loss harvesting is a well-known strategy in the world of stocks and equities. However, cryptocurrency does have one major advantage over other asset classes when it comes to tax-loss harvesting: the lack of a wash sale rule.

What is the wash sale rule?

The wash sale rule states that capital losses cannot be claimed on stocks and other securities if they are bought 30 days before or after a sale. At this time, the wash sale rule likely does not apply to cryptocurrencies since they are considered properties, not securities. That means that crypto investors can sell their holdings, claim a capital loss, and buy back their assets shortly after.

It’s likely that the wash sale rule will be introduced to crypto in the future. In recent years, Congress has made multiple attempts to close the ‘wash sale loophole’ for cryptocurrency.

Why is it so difficult to report my cryptocurrency losses?

If you have been trading frequently, calculating your losses for each of your cryptocurrency trades and reporting them on your taxes can be quite tedious.

Crypto exchanges like Coinbase and Binance have trouble providing gains and losses reports to customers in the case of wallet-to-wallet transfers. Consider the example below.

In this case, David should incur $3,000 of capital loss. However, if he hasn’t kept records of the original cost basis of his cryptocurrency, he won’t be able to report his capital loss to the IRS.

Luckily, there’s an easier way. Crypto tax software like CoinLedger can help you generate complete tax reports and identify your tax-saving opportunities in minutes.

Do capital losses offset short-term or long-term capital gains?

In the United States, cryptocurrency is taxed at a lower rate when it is sold after a holding period of 12 months.

When you dispose of cryptocurrency after 12 months or more of holding, you'll pay long-term capital gains tax (0-20% depending on your income level). When you dispose of cryptocurrency after less than 12 months of holding, you'll pay ordinary income tax (10-37% depending on your income level).

It’s important to remember that short-term capital losses first offset short-term capital gains, and long-term capital losses first offset long-term capital gains. If you have any net capital losses remaining, it can then be used to offset capital gains of the other type.

Can you claim a capital loss if you haven’t sold your crypto?

Remember, you need to actually realize your loss for it to count as a capital loss that can be written off on your taxes. To realize a loss, you must incur a taxable event—in other words, you need to actually dispose of your crypto to realize the loss.

Examples of disposals include the following:

- Trading or selling crypto for fiat currency (like USD)

- Trading one crypto for another cryptocurrency

- Spending crypto to buy a good or service

That means that if your cryptocurrency has simply lost value while you hold it, you won’t be eligible to offset capital gains and income.

Unrealized losses explained

If your cryptocurrency is worth less than when you received it and you haven’t sold it, it’s considered an unrealized loss. To better understand this concept, let’s look at an example.

In this case, Sara has an unrealized loss of $5,000 (20,000 - 15,000). Because she is still holding her assets, she cannot write off her loss on her tax return.

Remember, Sara only realizes her loss in the asset when she disposes of it.

What if I earned crypto income and the price went down?

Cryptocurrency that is earned from mining, staking, and airdrops is taxed as personal income based on its fair market value at the time it was received. This holds true even if the fair market value of your cryptocurrency drops after you receive it.

If you continue to hold your cryptocurrency income after its value drops, it will be considered an unrealized loss. However, if you decide to sell, you can claim a capital loss based on how much the value of your crypto income has fallen since you originally received it.

Can I write off lost or stolen cryptocurrency?

Occasionally, investors may lose access to their cryptocurrency due to events such as a hack or a lost wallet key.

After the Tax Cuts and Jobs Act of 2017, these types of casualty and theft losses are no longer considered tax deductible.

For more information, check out our guide to reporting lost or stolen cryptocurrency.

Can I write off cryptocurrency in the case of an exchange bankruptcy?

In cases where you lost access to your cryptocurrency permanently due to an exchange bankruptcy, you may be able to write off your losses on your taxes.

For more information, check out our guide to losing cryptocurrency in the case of an exchange bankruptcy.

Can I report NFT losses on my taxes?

NFTs are taxed similarly to other crypto-assets. When you sell your NFT at a loss, you can claim a capital loss on your tax return.

For more information, check out our complete guide to NFT taxes.

Looking for a way to dispose of your worthless NFTs? Use CoinLedger’s free NFT Tax Loss Harvestooor — designed to help investors like you dispose of your NFTs safely and easily.

How are crypto losses taxed internationally?

In most countries, cryptocurrency losses can be used to offset capital gains. However, countries outside the US typically restrict the ability to claim losses on cryptocurrency wash sales.

If you’re interested in learning more about how crypto losses are taxed internationally, check out the guides below!

- Crypto Losses Tax Australia

- Crypto Losses Tax Canada

- Crypto Tax Australia

- Crypto Tax UK

- Crypto Tax Canada

Report your capital losses with crypto tax software

Want to claim your crypto losses on your tax return? CoinLedger can help.

Just connect your wallets and exchanges and let CoinLedger generate a complete tax report including your gains, losses, and income! Once you’re done, you can export your tax report to platforms like TurboTax and H&R Block or send it to your tax professional!

In addition to your reports, CoinLedger offers a full tax-loss harvesting module that will help you identify which cryptocurrencies in your portfolio have the most significant unrealized losses and offer the largest tax savings potential.

.png)

One trader saved over $10,000 on his tax bill by leveraging the CoinLedger tax loss harvesting tool. You can learn more about how CoinLedger works here.

Frequently asked questions

- Can you write off crypto losses on your taxes?

Yes. Cryptocurrency losses can be used to offset your capital gains and $3,000 of personal income for the year.

- How much crypto losses can you claim?

There is no limit to how much cryptocurrency losses you claim. If your loss exceeds your net gain and $3,000 of income for the year, it can be rolled forward into future tax years.

- How much taxes do you pay on crypto capital gains?

The tax rate you pay on cryptocurrency is dependent on several factors, such as your income and the length of time you held your crypto.

- Can crypto capital losses offset stock capital gains?

Yes. Capital losses from cryptocurrency can be used to offset capital gains from stocks and equities.

- How do I not pay taxes on crypto?

There is no legal way to avoid cryptocurrency taxes. However, strategies like tax-loss harvesting can reduce your tax liability.

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

- Got Losses on Stocks, Bonds or Crypto? There’s a Silver Lining at Tax Time (2022) https://www.wsj.com/articles/tax-loss-harvesting-rules-stocks-bonds-crypto-bitcoin-11654826590

- US Crypto Traders Avoiding Billions in Tax by ‘Loss Harvesting’ (2023) https://www.bloomberg.com/news/articles/2023-05-03/us-crypto-traders-avoiding-billions-in-tax-by-loss-harvesting#xj4y7vzkg

- Topic No. 409, Capital Gains and Losses (nd) https://www.irs.gov/taxtopics/tc409#:~:text=You%20have%20a%20capital%20gain,%2C%20aren't%20tax%20deductible

- Planning opportunities for the final tax return (2017) https://www.journalofaccountancy.com/issues/2017/jul/tax-planning-opportunities-final-tax-return.html

.png)