.jpg)

Did you pay exchange fees this tax year?

If the answer is yes, you may be able to use your fees to reduce your tax liability.

In this guide, we’ll break down everything you need to know about how exchange fees are taxed and show you an easy way to include fees on your tax return.

What are exchange fees?

Cryptocurrency exchanges often charge their users fees for buying, selling, and transferring their cryptocurrency. Major exchanges like Coinbase, Gemini, and Kraken use these exchange fees to support their business.

Are exchange fees tax deductible?

Businesses can write off exchange fees if they are a necessary expense. However, exchange fees cannot be treated as an itemized deduction for individuals.

However, exchange fees directly related to a trade can be added to your cost basis or subtracted from your gross proceeds, which can potentially reduce your capital gains tax.

How capital gains tax is calculated

To better understand the tax benefits of exchange fees, let’s review the basics of how capital gains tax is calculated.

Typically, crypto investors incur a capital gain or loss when they dispose of their cryptocurrency. To determine their capital gain on these transactions, investors can use the following formula:

Capital gain/loss = Gross Proceeds - Cost Basis

In this formula, gross proceeds is the amount you receive when you dispose of your cryptocurrency. Meanwhile, cost basis is the amount you originally paid for the cryptocurrency.

.jpeg)

For more information on how cryptocurrency taxes are calculated, check out our complete guide to cryptocurrency taxes.

How exchange fees can reduce your capital gains

Paying exchange fees for buying cryptocurrency

Any exchange fees that you pay when you buy cryptocurrency can be added to your cost basis. This can reduce your capital gain or increase your capital loss in the case of a future disposal.

.jpeg)

Paying exchange fees for selling cryptocurrency

Any exchange fees that you pay when you sell cryptocurrency can be subtracted from your gross proceeds. This can reduce your capital gain or increase your capital loss.

.jpeg)

Can transfer fees reduce capital gains?

In the past, the IRS has said that fees can only be added to cost basis or subtracted from gross proceeds in the following scenarios.

1. They are directly related to buying and selling.

2. They increase the underlying value of the asset.

Since transfer fees don’t fall into either category, it’s reasonable to assume that fees for transferring cryptocurrency from one wallet or another do not reduce an individual taxpayer’s liability.

However, businesses may be able to write off transfer fees as an expense if wallet-to-wallet transfers are a necessary part of their operations.

Do the same rules apply for network/gas fees?

Yes. If you paid network/gas fees to carry out a transaction on the blockchain, you may be able to add these fees to your cost basis or reduce them from your gross proceeds if they were directly related to buying or selling an asset.

For more information, check out our guide to network/gas fee taxes.

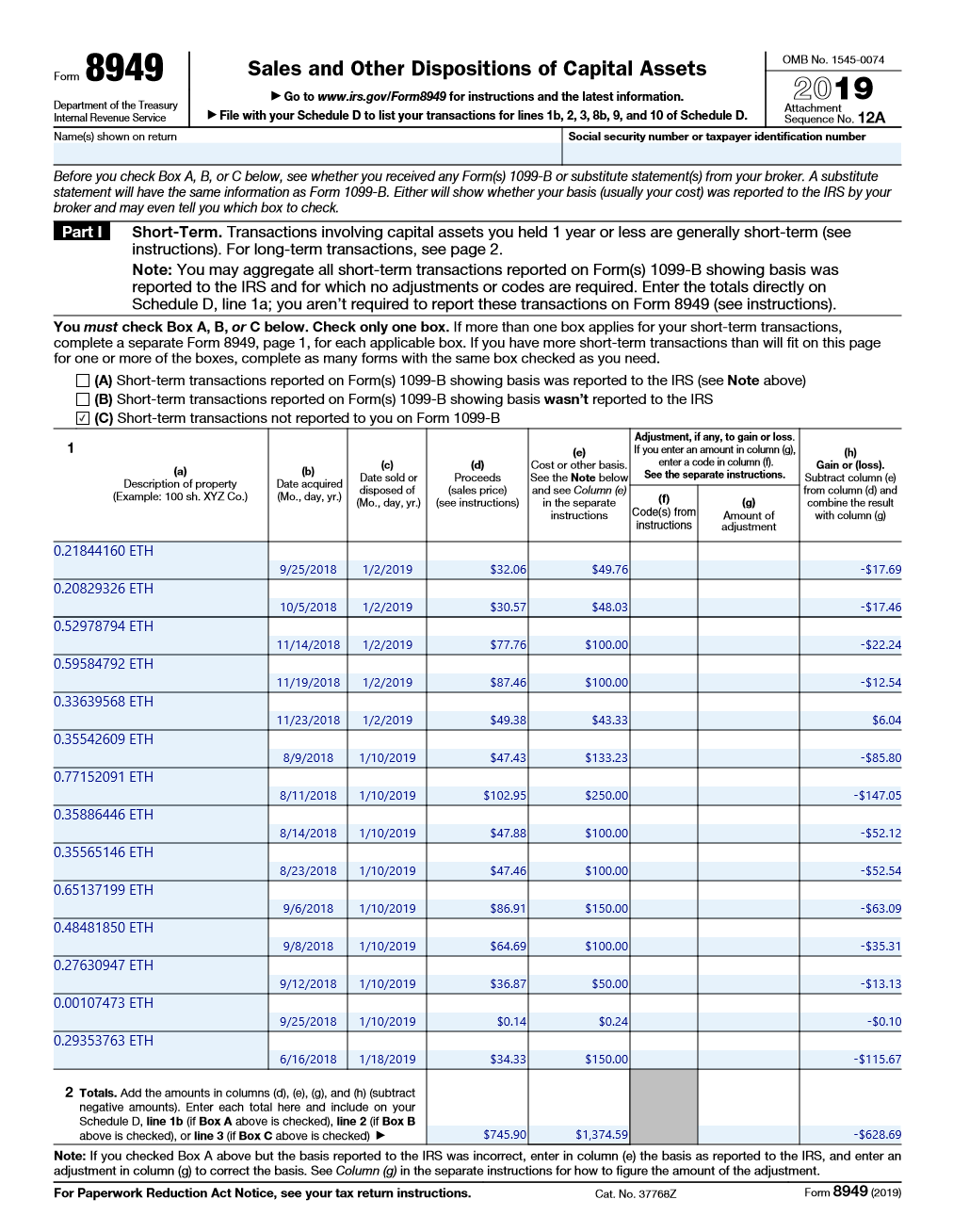

How do I report exchange fees on my tax return?

Typically, capital gains and losses are reported on Form 8949. Exchange fees can be included within your cost basis and gross proceeds in columns (d) and (e) respectively.

For more information on how to fill out Form 8949, check out our guide to reporting cryptocurrency on your taxes.

How to report exchange fees on your tax return

If you have dozens, hundreds, or even thousands of trades, it can be difficult to keep track of the exchange fees that you’ve paid.

Luckily, there’s an easier way. With CoinLedger, you can automatically import trades from exchanges like Coinbase, Kraken, and Gemini. Once you’ve imported all of your transactions, you can generate a complete tax report which includes relevant exchange fees.

Simplify your crypto tax reporting

For many investors, it’s simply not viable to manually fill out your tax forms. You may have too many transactions or might not have the time to file your taxes by yourself.

Luckily, crypto tax software like CoinLedger can help. More than 700,000 crypto investors trust CoinLedger to help them file their tax returns in minutes.

Get started today and generate a free preview report.

Frequently asked questions

Let’s cap things off by answering a few frequently asked questions about crypto exchange fee taxes.

Should I report cryptocurrency on my taxes?

Yes. In the past, major exchanges like Coinbase and Kraken have been subject to John Doe Summons by the IRS.

Do I pay taxes on cryptocurrency fees?

Cryptocurrency fees will not increase your tax bill. In fact, they can reduce your taxes if they are directly related to buying and selling cryptocurrency.

Do crypto fees count as losses?

Crypto fees cannot be claimed as a capital loss. However, they can be used to reduce your gross proceeds and increase your cost basis, which can reduce your net capital gains.

Can transfer fees reduce my taxes?

It’s likely that fees for transferring cryptocurrency between wallets or exchanges cannot be used to reduce capital gains tax.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)