%20(1).jpg)

Key Takeaways

- Cryptocurrency losses can be used to offset capital gains and reduce your tax bill.

- If you sell and re-purchase an asset solely for tax purposes, your loss may be disallowed as a wash sale.

Are crypto losses tax deductible?

In Australia, losses from cryptocurrency can be used to offset capital gains from crypto, stocks, and other forms of property.

If you have a net loss for the year, you can carry your loss forward to offset capital gains in future tax years.

What is tax-loss selling?

Because of the tax benefits, many investors choose to intentionally sell their cryptocurrency and other assets at a loss for the tax benefits. This strategy is known as ‘tax-loss harvesting’ or ‘tax-loss selling’.

Can I carry forward my crypto losses?

If you have a net loss for the year, you can carry your losses forward to offset gains in future tax years.

While there’s no limit to how many years you can carry your losses forward, you are required to use them to offset gains at the earliest available opportunity.

Can I carry back my crypto losses?

In Australia, you are not allowed to carry back crypto losses to previous tax years.

Are there any limits to crypto tax loss harvesting in Australia?

In recent years, the ATO has cracked down on ‘wash sales’ — the practice of selling an asset, claiming a capital loss, and then acquiring the same asset or a substantially similar one.

Unlike the U.S., where a 30-day window between selling and re-buying an asset defines a 'wash sale,' the ATO doesn’t set any specific timeframe. Instead, Australian tax law focuses on intent.

A crypto transaction may be considered a wash sale if you sell a cryptocurrency at a loss and repurchase the same or a substantially identical asset soon after, with no genuine change in your financial position.

Can I use crypto losses to offset my income?

Individuals cannot use crypto losses to offset regular income (you can only offset other capital gains). However, businesses can treat crypto losses as a deductible expense.

How do I claim crypto losses on my taxes?

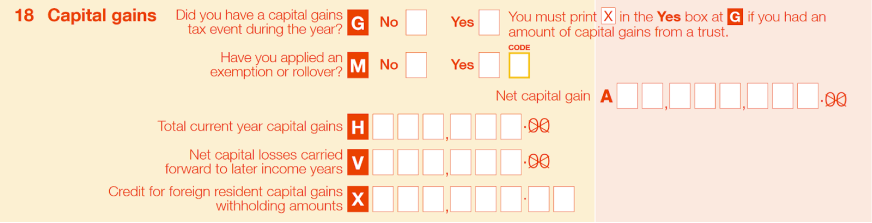

You should use the Capital Gain or Capital Loss Worksheet to calculate your net gain/loss for the year.

If you end the year with an overall net capital gain (after subtracting your capital losses from your capital gains), report this amount on H item 18 of your tax return.

If you instead have an overall net capital loss for the year, leave the net capital gain section blank and report your net capital loss on V item 18.

How is cryptocurrency taxed in Australia?

Before we discuss how crypto losses can reduce your tax bill, let’s review the basics of cryptocurrency taxation.

In Australia, cryptocurrency is subject to capital gains tax and ordinary income tax.

When you dispose of cryptocurrency, you incur a capital gain or loss depending on how the price of your crypto has changed since you originally received it.

When you earn cryptocurrency, you’ll recognize ordinary income based on the fair market value of your crypto at the time of receipt.

For more information, check out our complete guide to how cryptocurrency is taxed in Australia.

How CoinLedger can help

Trying to keep track of your cryptocurrency gains and losses manually can be difficult. CoinLedger can help.

CoinLedger automatically connects with exchanges like CoinSpot and blockchains like Ethereum, so you can generate a comprehensive tax report in minutes. More than 700,000 investors around the globe use CoinLedger to simplify the tax reporting process.

Frequently asked questions

- Do you pay taxes on crypto losses?

No. Crypto losses can reduce your capital gains and your overall tax liability.

- How much crypto losses can you claim?

There is no limit to the amount of losses you can claim on your tax return. If you have a net loss for the year, it can be carried forward to future tax years.

- Does tax-loss selling apply to crypto?

Yes. Tax-loss selling cryptocurrency can potentially help you save thousands of dollars on your tax bill.

- How long can capital losses be carried forward?

There is no time limit on how long you can carry forward your capital losses. However, they must be used to offset gains at the earliest possible opportunity.

- How do I avoid crypto taxes in Australia?

While there’s no legal way to evade your cryptocurrency taxes, strategies like tax-loss selling can help you reduce your tax bill legally.

- Do you pay tax on crypto only when you cash out?

There are some situations where you are required to pay tax on crypto even if you never ‘cash out’ to fiat currency. Examples include earning staking income and crypto-to-crypto trades.

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)