.jpg)

Key Takeaways

- At this time, the wash sale rule does not apply to cryptocurrency. Taxpayers are likely allowed to claim capital losses on cryptocurrency if they buy it within 30 days of selling it.

- It’s likely that the cryptocurrency wash sale ‘loophole’ will be closed in the future.

A cryptocurrency tax loophole that’s helped investors save millions of dollars may be closing in the near future.

In this guide, we’ll walk through everything you need to know about the crypto wash sale rule — including how it can help you save money on your tax bill and whether Congress will end this ‘loophole’.

What is the wash sale rule?

Before we jump into discussing the wash sale rule, it’s important to understand the rules around capital losses.

What is a capital loss and how can it reduce my tax bill?

When you sell an asset (such as stocks or cryptocurrency) for a lower price than you originally acquired it, you’ll incur a capital loss.

Capital losses can offset capital gains and up to $3,000 of your personal income. Additional losses above this amount can be rolled forward to future tax years!

As a result, many investors claim capital losses on stocks, cryptocurrencies, and real estate to minimize their tax bills, a strategy commonly referred to as tax loss harvesting.

How does the wash sale rule impact capital losses?

The wash sale rule says investors are not allowed to claim capital losses on a security if they buy the same security 30 days before or after the sale.

The purpose of the law is to prevent people from selling securities simply to reduce their tax liability.

Currently, the wash sale rule applies only to securities (like stocks). However, Bitcoin and other cryptocurrencies are not considered securities. Cryptocurrency is classified as property by the IRS.

As a result, it’s reasonable to assume that the wash sale rule does not apply to cryptocurrency at this time.

How does the wash sale rule impact my tax bill?

For years, investors who’ve taken profits on stocks and cryptocurrencies have used cryptocurrency wash sales to reduce their tax liability.

Because cryptocurrency is so volatile, some investors choose to harvest their losses multiple times in a given year, then re-enter the same positions shortly afterwards while claiming capital losses on their tax returns.

For more information, check out our complete guide to crypto tax-loss harvesting.

What is the economic substance doctrine?

It’s important to remember the economic substance doctrine places some restrictions on claiming wash sales on cryptocurrency.

Due to the economic substance doctrine, the IRS may not allow you to claim capital losses if there is no ‘economic substance’ behind the transaction other than reducing your tax liability. For example, selling cryptocurrency and then immediately re-purchasing it will likely be seen as a transaction without substance.

According to tax experts, selling and then rebuying your cryptocurrency after a few days should ensure that you pass the ‘economic substance’ test. Because the cryptocurrency market is so volatile, it can be reasonably argued that selling and then re-purchasing crypto after a few days has ‘economic substance’.

Will the wash sale rule apply to cryptocurrency?

The Biden Administration’s proposed 2025 fiscal budget would introduce the wash sale rule to cryptocurrency. This is the latest in a series of attempts by legislators to close the wash sale ‘loophole’ — though none have passed into law.

According to experts, it’s very likely that the wash sale rule will be introduced to cryptocurrency in the near future. However, any formal law restricting cryptocurrency wash sales would not be retroactive — meaning that investors can still claim capital losses from wash sales on their taxes until restrictions are put in place.

Am I allowed to claim cryptocurrency wash sales?

Some taxpayers choose to be extremely conservative and avoid cryptocurrency wash sales entirely. However, most tax experts agree that losses from cryptocurrency wash sales can be claimed on your tax return until formal guidance is passed into law.

If the wash sale rule is changed, what does it mean for crypto investors like me?

At this time, the wash sale rule has not yet been expanded to apply to cryptocurrency. As a result, investors can sell their cryptocurrency at a loss, claim a capital loss on their tax return, and re-enter the position shortly after.

Still, investors should be prepared for potential changes at some point in the future. If the wash sale rule is introduced to cryptocurrency, investors will need to record the dates they bought and sold their coins if they wish to re-enter the market while still claiming their capital losses.

How can I tell which one of my assets is currently trading at a loss?

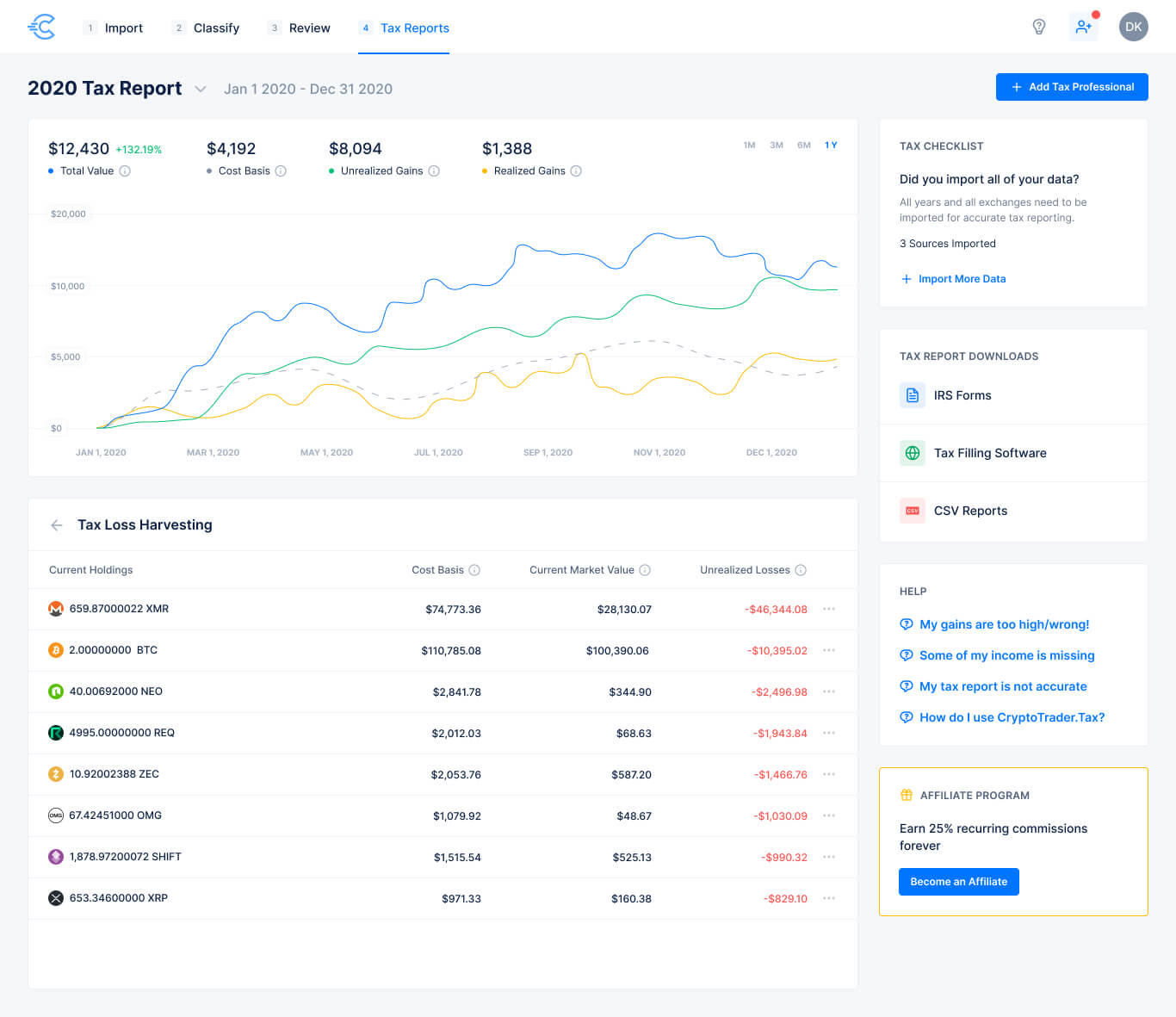

If you hold cryptocurrency in multiple wallets and exchanges, it can be difficult to tell which one of your assets is currently trading at a loss.

Crypto tax software like CoinLedger can help. Once you import your cryptocurrency transaction history, you’ll be able to view all of your tax-loss harvesting opportunities at a glance.

How can I manage my crypto taxes?

If you’re looking for an easy way to manage your crypto taxes and harvest your losses, try CoinLedger. More than 700,000 investors use the platform to save money and simplify the process of crypto tax reporting.

Get started with a free preview report today — there’s no need to add your credit card details until you’re 100% sure your transaction history is accurate.

Frequently asked questions

- Does the 30 day rule apply to crypto?

At this time, the 30-day rule — or wash sale rule — does not apply to cryptocurrency.

- Are crypto sales subject to the wash sales rule?

At this time, crypto sales are not subject to the wash sale rule. However, crypto wash sales may be disallowed if they are found to not have ‘economic substance’.

- How does the holding period impact application of the wash sale rule?

The wash sale rule applies if you hold a security for 30 days before or after a sale. If you held a security longer than 30 days, the wash sale rule no longer applies. If the wash sale rule is applied to cryptocurrency in the future, it’s likely that similar rules will apply.

- Does the wash sale rule carry over to the next year?

The wash sale rule does carry into the calendar year. For example, if you buy a stock on December 31, you won’t be allowed to sell the security and claim a capital loss until 30 calendar days pass.

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)