.jpg)

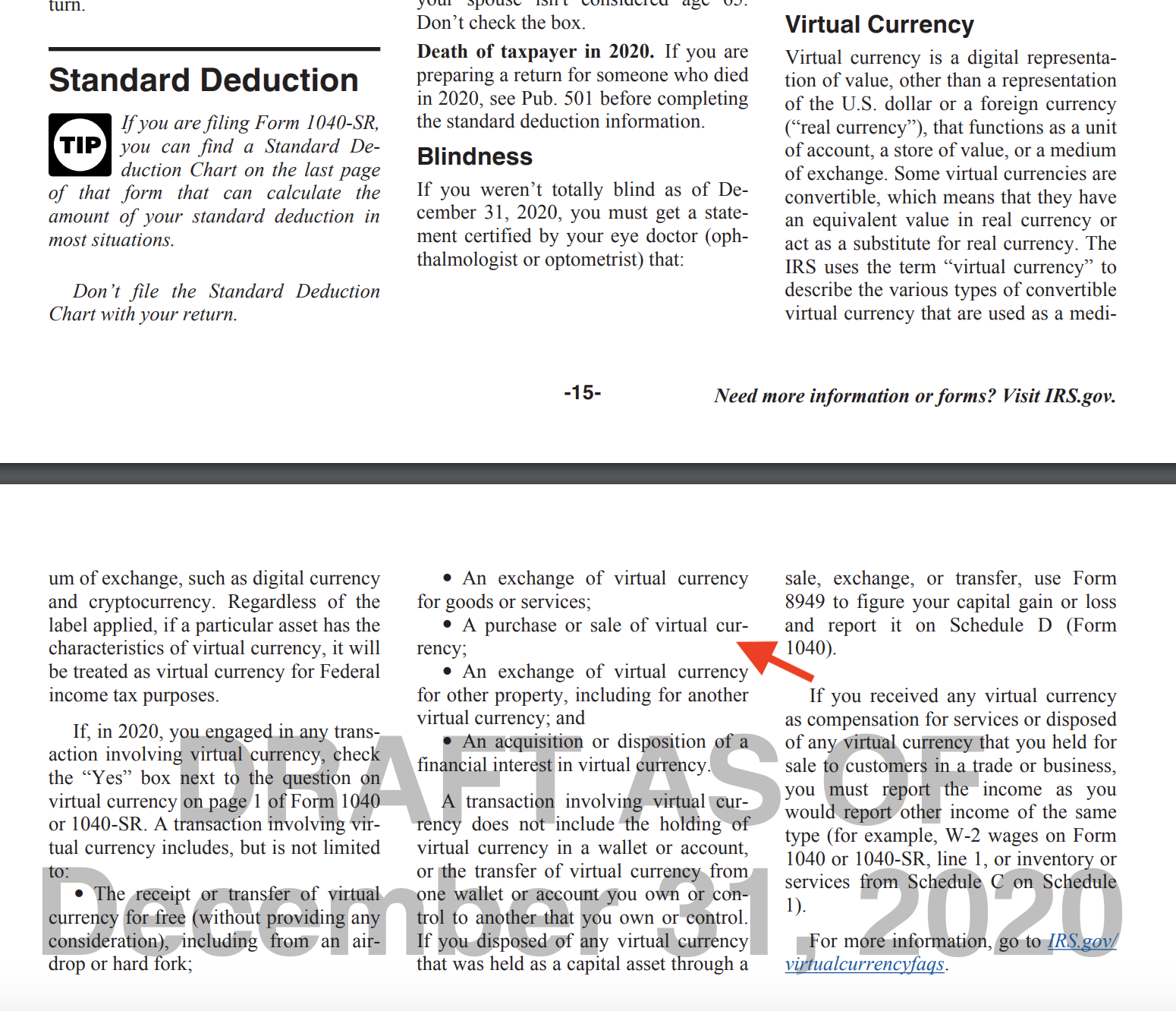

On December 31, 2020, just before the new year, the IRS released a second draft of Form 1040 for the 2020 tax season. This second draft differed from the one released in October 2020 in that it provided even further clarity as to who needs to check ‘yes’ to the virtual currency (cryptocurrency) question that now exists at the top of Form 1040:

“At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

Updated 1040 Virtual Currency Guidance

The new guidance now declares that those who purchased cryptocurrency in 2020 (not just sold, traded, or exchanged) must answer ‘yes’ to the question.

This language was not present in the prior instructional guidance that was released in October.

The IRS will now know everyone who purchased cryptocurrency in 2020 as all taxpayers must answer this question under penalty of perjury.

When Must You Answer ‘Yes’ to the 1040 Virtual Currency Question?

You must answer yes to the virtual currency question if in 2020 you,

- purchased crypto

- received crypto (including if you received from an airdrop or fork)

- sold crypto for fiat currency (like USD)

- exchanged one crypto for another

- used cryptocurrency to buy goods and/or services

Keep in mind, just because you select ‘yes’ to the virtual currency tax question, does not necessarily mean you owe taxes on your crypto. For a complete breakdown of how cryptocurrency taxes work and when you do or do not owe taxes, check out our Complete Crypto Tax Guide.

When Can You Answer ‘No’ to The 1040 Virtual Currency Question?

The new 1040 instructions also clarified that you do not need to check ‘yes’ to the virtual currency question if in 2020 you only:

- held cryptocurrency in wallets or

- transferred them between their own wallets

This is valuable clarification for long-term holders who were unsure if they needed to select yes or no to the question.

The IRS Is Cracking Down on Crypto Tax Compliance

It’s clear that the IRS is cracking down on crypto tax compliance. From the tens of thousands of CP2000’s that got sent out to the updated regulation, the agency is making a huge push.

Don Fort, the chief of the Internal Revenue office, recently made a public statement explaining that the agency is switching from “education to enforcement” in 2021 as reported by CoinTelegrah.

Questions?

If you have any question regarding cryptocurrency taxes and your specific position, feel free to reach our tax team via live-chat on our homepage. We have been doing this for a long time and are happy to help!

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)