In prior years, Form 1099-K has caused significant confusion amongst crypto investors and has even led the IRS to send out thousands of warning letters to taxpayers suspected of noncompliance.

If you received a Form 1099-K this year, you might be wondering whether the numbers on the form are accurate — and whether you can use the information on the form to file your tax return.

In this guide, we’ll answer all the questions you may have about Form 1099-K. We’ll also break down a simple method that can help you accurately report your cryptocurrency income on your tax return.

How is cryptocurrency taxed?

The IRS treats cryptocurrency as property. This means that cryptocurrencies like Bitcoin, Ethereum, XRP, and others must be treated like other forms of property (stocks, gold, real-estate) for tax purposes.

Just like with other forms of property, you incur capital gains or losses when you dispose of your cryptocurrency and recognize income when you earn crypto.

For an in-depth overview of this process, please read our guide covering the fundamentals of crypto taxes.

What is a 1099-K, and why did my exchange send me one?

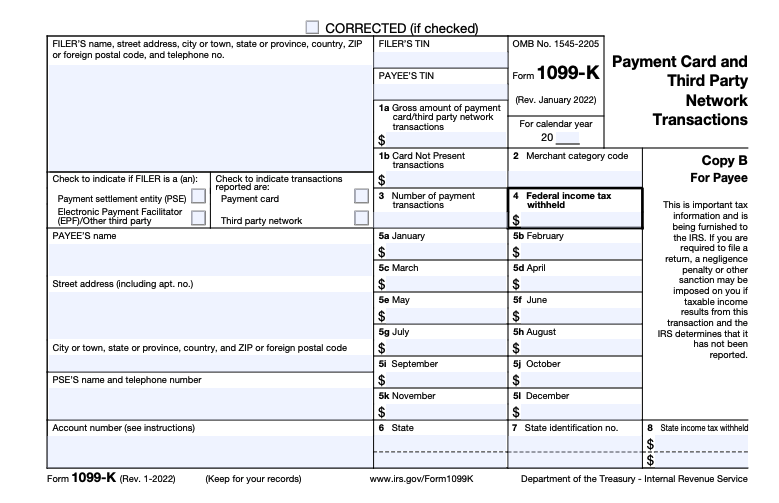

A 1099-K is an informational form to report credit card transactions and third party network payments that you have received during the year. It is not an "entry" document, meaning you don't need to attach or "include" it in your tax return.

Certain cryptocurrency exchanges (Crypto.com, eToroUSA, etc.) will send you a 1099-K if you have more than 200 transactions with more than $20,000 in volume.

For example, if you made 250 trades on Crypto.com and all of these trades add up to over $20,000 in volume when summed together, you will receive a 1099-K.

It’s important to remember that Form 1099-K was designed for payment companies, not cryptocurrency exchanges. As a result, the form shows your gross transaction volume rather than taxable gains and losses.

Why is my Form 1099-K wrong?

The number that’s reported on Form 1099-K may be significantly higher than your tax liability. Don’t be alarmed — this number does not represent any gains or losses you may need to report to the IRS, it simply represents your gross transaction volume.

In addition, it’s important to remember that information on 1099 forms may be inaccurate if you’ve ever transferred cryptocurrency into or out of an exchange. In cases like these, your form may contain inaccurate or incomplete information about your cost basis.

You can calculate your capital gains and losses based on how the price of your crypto has changed since you originally received it. Here’s an infographic that can help you better understand how to calculate and report capital gains and losses.

.jpeg)

Why did Coinbase stop issuing Form 1099-K?

In previous tax years, Coinbase issued Form 1099-K to customers. However, Coinbase stopped issuing the form after 2020.

Because Form 1099-K shows gross transaction volume instead of capital gains and losses, thousands of Coinbase customers who accurately filed their tax returns received CP2000 warning letters from the IRS warning them about their unpaid tax liability.

For more information, read our guide: Why Coinbase Stopped Issuing Form 1099-K.

Are cryptocurrency exchanges required to send 1099 forms?

At this time, there is no clear guidance on which 1099 forms exchanges are explicitly required to issue to their customers. While exchanges like Crypto.com send 1099-K to customers, other exchanges choose to send other 1099 forms.

Due to the American infrastructure bill, all exchanges operating within the U.S. will be required to send Form 1099-B beginning in the 2023 tax year. Unlike Form 1099-K, Form 1099-B is designed to report capital gains and losses. However, transfers into and out of exchanges will continue to cause inaccuracies within these forms.

For more information, check out our complete guide to cryptocurrency 1099 forms.

I didn’t receive a 1099-K. Do I still have to report my crypto gains and losses on my taxes?

Yes, it is required to report your cryptocurrency transactions on your taxes. Every sale and every coin-to-coin trade is a taxable event. These should all get reported on your Form 8949. Whether or not you actually receive a 1099-K or other 1099 form, you still need to be filing your crypto taxes.

If I can’t use 1099-K, how do I report my cryptocurrency transactions on my tax return?

You need two forms to properly report your crypto trade transactions: Form 8949 and 1040 Schedule D. List all trades onto your 8949 along with the date of the trade, the date you acquired the crypto, the cost basis, your proceeds, and your gain or loss.

Once you have listed every trade, total them up at the bottom, and transfer this amount to your 1040 Schedule D. Include both of these forms with your yearly tax return.

For more information, read our guide to reporting crypto on your tax return.

A story from a CoinLedger customer who received a 1099-K

We thought it was relevant to share the story below that was emailed to us from one of our customers. He received a letter from the IRS that was completely inaccurate as a result of the misleading 1099-K.

It's important to note that you are not alone in navigating the murky tax waters. There are thousands of others out there like you. Our team here at CoinLedger is here to help. You can reach out to us directly!

"David,

This is some long overdue positive feedback that you and your company deserve. I will keep this story as short as I can.

In 2017, I traded various crypto currencies with Coinbase and CoinbasePro. My initial investment was $100 and I (after many trades) would end the year with total gains of $456. The following tax season, I did report my short term gains (though, not correctly) on my 2017 return.

In early August of 2019 I received a letter from the IRS stating that, due to info received from a third party, I owed $17,318. Not cool!

Coinbase had provided info to the IRS that didn’t match with what I’d entered in my return. The return not being correct was, of course, my mistake. However, I was certain of my $456 gain—not $17,318!

After calls to the IRS and a second letter from them I began to seek out help from CPAs to resolve the issue. One CPA was familiar with crypto issues and estimated that his services would cost $1600. (4 hrs. @$400/hr.). I called around to find an accountant who would charge less. I did take the advice from that CPA and request from Coinbase a copy of what was sent to the IRS. This was a 1099k as I learned from the “letter”. This tax info was not visible anywhere in my Coinbase account, so I asked Coinbase support for a copy. It took 5 weeks for them to email this info to me.

After calling without success to get an accountant who knew or understood crypto issues, I learned about your service and CoinLedger. I signed up for a demo, liked what I saw and paid $86 for my report. Your company’s total for my net gain was $454.99 vs. my $456. and that was for hundreds of trades. Excellent work to you all!

With this info from you and another call to the IRS, I was able to finally fix this misunderstanding by faxing over a few forms to the gov’t. I’d add that the last day to petition the tax court was Monday 1/13/20, and I was on the phone with the IRS on the Friday before. I faxed over to them a copy of the correctly filled out form 8949 your company generated and about four other pages.

The whole mess has been closed by the IRS and I have a letter from them stating that.

Thank you!!"

Generate your crypto tax report today

Want to report your crypto taxes in time for tax season? Crypto tax software like CoinLedger can help.

More than 700,000 investors use CoinLedger to simplify crypto tax reporting. With integrations to exchanges like Coinbase and Crypto.com, the platform can help you file your tax return in minutes.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)