.jpg)

Can you avoid cryptocurrency taxes in Canada?

Remember, there’s no way you can legally evade taxes. Governments across the globe are paying closer attention to the crypto ecosystem than ever, and Canada is no exception.

However, there are simple strategies that you can use to reduce your crypto tax bill legally. In this guide, we’ll cover 7 tactics that you can use to save thousands of dollars while staying compliant with the Canadian tax code.

How is cryptocurrency taxed?

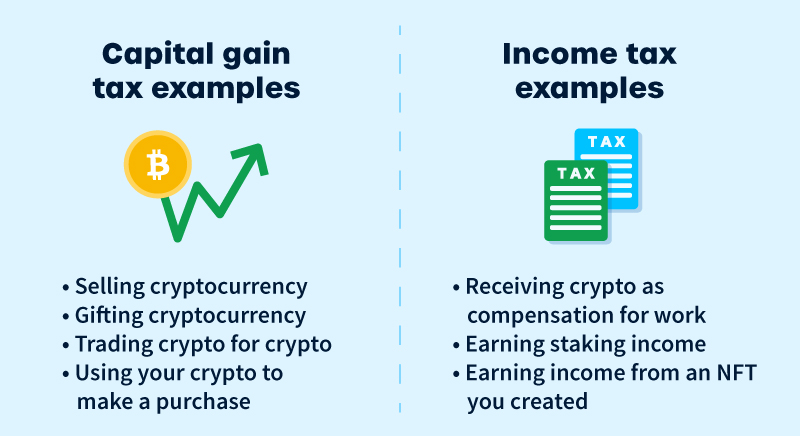

In Canada, cryptocurrency is subject to capital gains and business income tax.

For more information, check out our complete guide to how cryptocurrency is taxed in Canada.

Can you avoid cryptocurrency taxes in Canada?

There is no way to completely evade taxes on cryptocurrency legally. The maximum penalty for tax evasion is 200% of the taxes evaded and a jail sentence of up to 5 years.

Although cryptocurrency is anonymous, it’s important to remember that the Canadian government can track crypto transactions.

Cryptocurrency exchanges are required to report transactions worth more than $10,000 to the CRA. Even if you don’t have any transactions exceeding this amount, cryptocurrency exchanges operating in Canada are required to collect your customer information and are compelled to release this information upon request.

If you are looking to reduce your cryptocurrency taxes, you can try one of the seven strategies listed below. Each one is legal and used by thousands of crypto investors every year.

#1: Hold your cryptocurrency

The easiest way to reduce your tax bill is to hold your cryptocurrency for the long term.

Remember, there is no tax for simply holding cryptocurrency. You will only be taxed when you dispose of your crypto — for example, when you sell it for Canadian dollars or trade it for another cryptocurrency.

#2: Harvest your losses

Selling your cryptocurrency at a loss comes with tax benefits!

50% of the value of your capital losses can be used to offset taxable capital gains from cryptocurrencies, stocks, and other investments.

.jpeg)

If you have a net capital loss for the year, you can use it to offset capital gains for any of the three preceding tax years or any future tax year.

#3: Hold cryptocurrency in a TFSA/RRSP

Every Canadian above the age of 18 is eligible for a tax-free saving account (TFSA). You can use this account to grow your savings without paying capital gains tax. For the 2022 tax year, the TFSA contribution limit is $6,000.

Alternatively, you can contribute to a Registered Retirement Saving Plan (RRSP). For the 2022 tax year, the RRSP contribution is 18% of your earned income or $29,210 — whichever is lower. In addition, all contributions are tax-deductible. However, withdrawals are subject to income tax.

.jpeg)

At this time, you can’t directly hold cryptocurrencies in a TFSA or RRSP. However, you can hold ETFs that track the price of assets like Bitcoin and Ethereum.

#4: Take profits in low-income years

The lower your income, the less tax you pay on your cryptocurrency transactions. For the 2022 tax year, your first $14,398 of income is considered completely tax-free.

As a result, some investors choose to realize profits in years when their income is low — for example when they are in-between jobs or in school full-time.

#5: Donate your cryptocurrency to charity

Donating your cryptocurrency to a registered charity is considered tax-deductible.

Most Canadian taxpayers will receive tax credits of 15% for the first $200 of donations, and 29% for all donations above this amount.

However, donating cryptocurrency is considered a disposal. You will incur a capital gain or loss depending on how the price of your coins has changed since you originally received them.

In addition, you can only deduct the full fair market value of your cryptocurrency if you donate it after three years of acquiring it. If you donate crypto within three years of receiving it, you can only write off your original cost for acquiring it.

.jpeg)

#6: Take out a loan on your cryptocurrency

Instead of disposing of your cryptocurrency, consider taking out a loan using your cryptocurrency as collateral.

While selling your cryptocurrency will be subject to capital gains tax, taking out a loan is not considered a taxable event.

Still, it’s important to weigh potential risks before taking out a crypto loan. Your cryptocurrency may be subject to liquidation if its value drops significantly.

#7: Use a crypto tax calculator

If you’re using multiple wallets and exchanges, it may be difficult to calculate your tax liability. Crypto tax software like CoinLedger can help.

You can link your exchanges and wallets to CoinLedger and generate a comprehensive crypto tax report with the click of a button. You’ll also be able to view your biggest tax-saving opportunities at a glance!

Get started with a free CoinLedger account today.

Frequently asked questions

Do you have to pay taxes on cryptocurrency in Canada?

Yes. In Canada, cryptocurrency can be subject to capital gains and business income tax.

Can you hold cryptocurrency in a TFSA?

While you can’t directly hold cryptocurrency in a TFSA, you can hold ETFs that track the price of cryptocurrencies like Bitcoin and Ethereum.

How much tax do you pay on cryptocurrency in Canada?

How much tax you pay on cryptocurrency transactions varies based on several factors such as your income level and your holding period for your crypto.

Can the CRA track your cryptocurrency?

Yes. Tax agencies around the world use data matching to match known investors to ‘anonymous’ cryptocurrency wallets.

Do you have to pay tax in cryptocurrency if you reinvest?

Any disposal of cryptocurrency is considered taxable. If you sell or trade your cryptocurrency, you’ll incur capital gains or losses.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)