💸 Lost money in crypto last year? You can save thousands on your taxes.

Learn more🔍 SURVEY: Most investors don’t know that crypto losses can lead to massive tax savings!

Learn moreWe’re partnering with the leading exchanges, wallets, protocols, and NFT communities to solve tax reporting at scale.

Schedule a Demo

The transferability of digital assets makes it difficult for any single third-party to track cost basis and provide holistic tax reports to users. CoinLedger solves this by integrating data across the entire crypto-economy to enable quick and easy tax reporting.

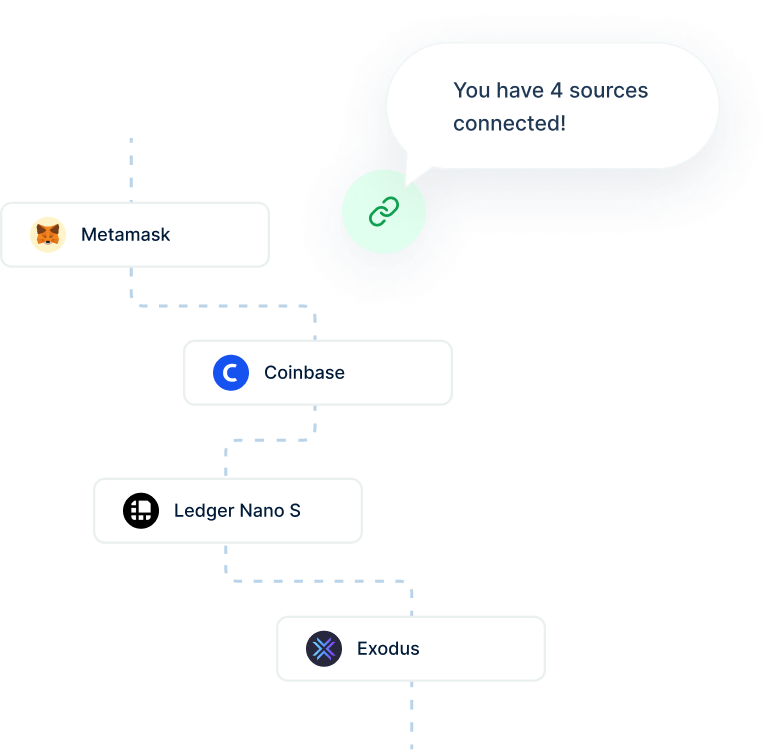

See How It WorksWith your wallet, DeFi protocol, or NFT project integrated into CoinLedger, your users can import and view their entire transaction history with the click of a button, track their cost basis as assets move from wallet-to-wallet, and instantly generate tax-compliant reports from their historical data.

Schedule a Demo

CoinLedger’s tax reports can be imported directly into the tax filing software that your users already use including TurboTax, TaxAct, and many others.

Contact SalesGive your users a simple and effective way to automate their digital asset tax reporting. Offload the burden from your customer support team, and enable them to focus on higher value activities when serving customers.

Schedule a Demo

Bring exclusive discounts and automated tax reporting to the holders of your NFT.

Contact UsGet in touch with our partnerships team today to discuss how you can enable seamless digital asset tax reporting for your exchange, wallet, or NFT platform.

Schedule a Demo