.jpg)

Did you receive a Form 1099 from your cryptocurrency exchange?

In this guide, we’ll break down everything you need to know about Form 1099 as it relates to cryptocurrencies and digital assets. By the time you’re finished reading, you’ll learn how 1099s are reported to the IRS and how you can use the information from Form 1099 to complete your tax return.

Do I have to report cryptocurrency on my taxes?

Yes. Cryptocurrency is considered a form of property by the IRS and is subject to capital gains tax upon disposal and ordinary income tax when earned.

Remember, when major exchanges send you a Form 1099, they file an identical copy with the IRS. If you don’t report income on your tax return from the platform that filed a 1099 on your behalf, your tax return may be flagged and you could automatically be sent Notice CP2000 about your unpaid tax liability.

For more information detailing exactly how cryptocurrency is taxed, check out our complete guide to cryptocurrency taxes.

What is Form 1099?

1099 forms are designed to report non-employment-related income to the IRS (income you receive outside of your job). 1099 forms are issued to taxpayers and the IRS.

While there are more than twenty types of 1099 forms, we’ll focus on the forms crypto investors are most likely to encounter: Form 1099-MISC, Form 1099-K, Form 1099-B, and Form 1099-DA.

What happens if I don’t report income from my 1099 form?

When major exchanges send you a Form 1099, they file an identical copy with the IRS. If you don’t report income on your tax return from the platform that filed a 1099 on your behalf, your tax return will likely be flagged and you could automatically be sent Notice CP2000 about your unpaid tax liability.

How do I get a cryptocurrency 1099 form?

In the past, there hasn’t been explicit guidance on whether cryptocurrency exchanges are required to provide 1099 forms to customers.

As a result, there’s very little consistency in terms of 1099 reporting between exchanges. Different exchanges report different forms, and some don’t report at all.

This is likely to change due to the passage of the American infrastructure bill. Starting in the 2025 tax year, crypto exchanges will be required to issue Form 1099-DA to customers and the IRS. However, this may cause additional tax reporting problems due to cryptocurrency’s unique properties (more on this later).

Note - you do not need a 1099 Form to file your crypto taxes. All gains and losses from crypto sales get reported on Form 8949. You can read more on how to report crypto on your taxes here.

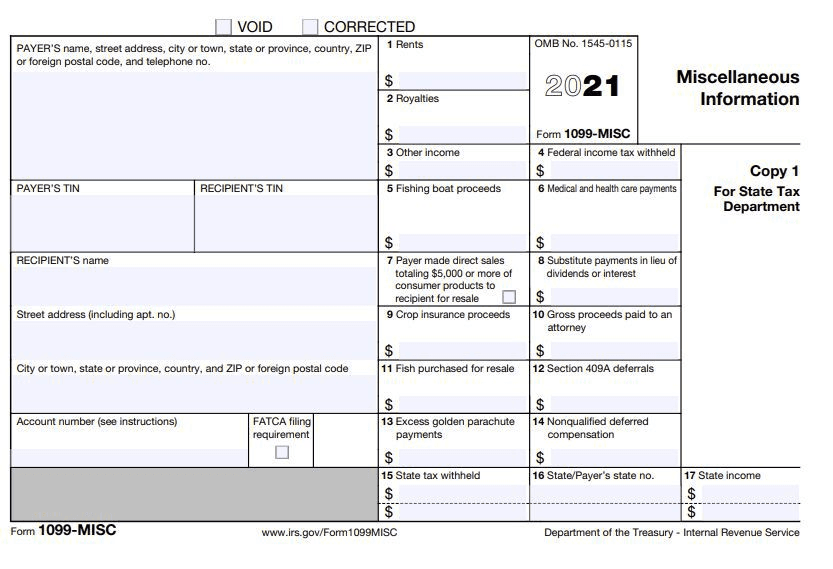

What is Form 1099-MISC?

Form 1099-MISC is designed to report ‘miscellaneous’ income to taxpayers and the IRS. This form is typically used by cryptocurrency exchanges to report interest, referral, and staking income to the IRS.

In most cases, exchanges send Form 1099-MISC when a customer has earned at least $600 of income.

Form 1099-MISC does not contain information about cryptocurrency capital gains and losses.

Which exchanges send Form 1099-MISC to customers?

- Binance.US

- Crypto.com

- Coinbase

- Gemini

- Kraken

What should I do if I receive Form 1099-MISC?

If you receive Form 1099-MISC, you should report the associated cryptocurrency income on your tax return. Most individual taxpayers report crypto income on Schedule 1.

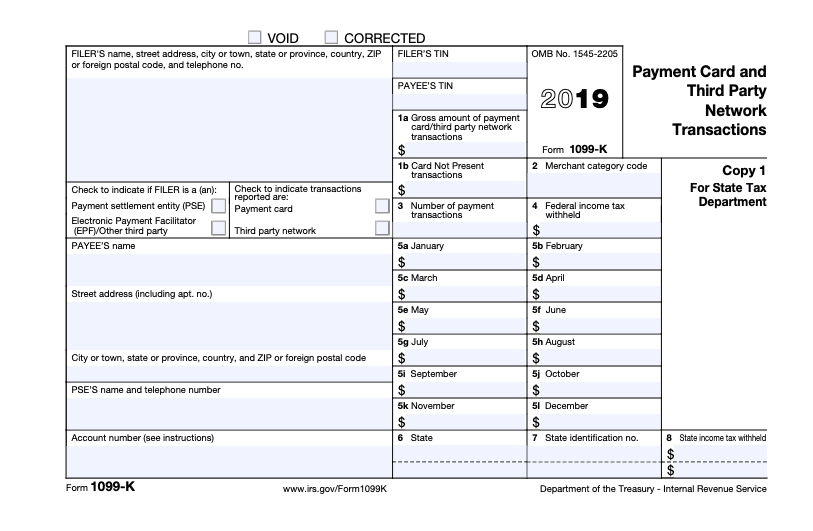

What is Form 1099-K?

Form 1099-K is a form designed to help payment settlement networks report customer transactions to the IRS.

Prior to 2022, some cryptocurrency exchanges issued Form 1099-K to customers with at least $20,000 in transaction volume and at least 200 transactions.

It’s important to note that Form 1099-K was not designed to be used by cryptocurrency exchanges. Form 1099-K shows the gross volume of all of your transactions with a given exchange — whether or not they are taxable.

In recent years, cryptocurrency exchanges like Gemini and Coinbase have stopped issuing Form 1099-K because of the confusion they cause. Most exchanges no longer send Form 1099-K to customers.

In the past, the IRS issued thousands of warning letters to crypto investors who had filed their taxes accurately because Form 1099-K erroneously showed large amounts of unpaid tax liability.

Since 2022, the threshold for Form 1099-K has lowered. Payment networks are now required to issue Form 1099-K if customers have at least $600 in transaction volume and any number of transactions.

Which exchanges send Form 1099-K to customers?

- Crypto.com

- eToro USA

- Venmo

What do I need to do if I receive a Form 1099-K?

Form 1099-K does not show your income, gains, and losses from individual transactions. However, it does show the IRS that you’ve traded digital assets during the tax year.

If you receive Form 1099-K, you should report your crypto capital gains on Form 8949 and your crypto income on Schedule 1.

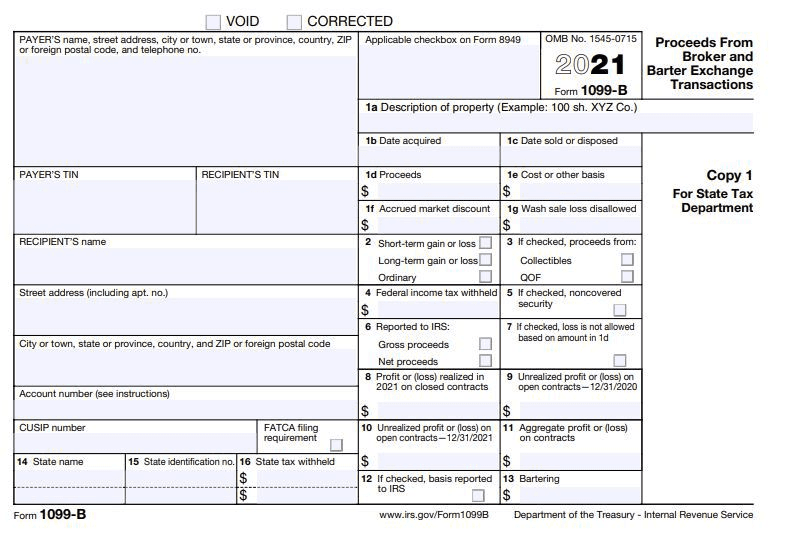

What is Form 1099-B?

Form 1099-B is designed to report capital gains and losses. Form 1099-B contains information such as your cost basis and gross proceeds for disposals of property, as well as the date you bought and disposed of your assets.

Does Coinbase issue Form 1099-B?

Currently, exchanges are not required to issue Form 1099-B. As a result, Coinbase does not issue Form 1099-B to users.

For more information, check out our article: Does Coinbase Report to the IRS?

Which exchanges send Form 1099-B to customers?

- Cash App

- eToro USA

- Robinhood

- Uphold

What do I need to do if I receive a Form 1099-B?

If you receive Form 1099-B from your cryptocurrency exchange, you should make sure to report your capital gains and losses from your cryptocurrency disposals on Form 8949.

It’s possible that your Form 1099-B may have inaccurate or incomplete information if you transferred your cryptocurrency between different wallets that you own. In this case, you should find the original cost basis (cost of acquisition) for your cryptocurrency to determine your capital gains or losses.

What is Form 1099-DA?

Form 1099-DA (digital asset) is a yet-to-be-released tax form designed for cryptocurrency and digital assets.

Starting the 2025 tax year, exchanges will be required to send Form 1099-DA to report capital gains and losses.

While Form 1099-DA was made specifically for crypto, it’s not likely to solve the problems around crypto tax reporting (more on this in the section below).

How will mandatory 1099 forms impact tax reporting?

As discussed earlier, the 2021 American infrastructure bill will make it mandatory for all cryptocurrency exchanges that are considered “brokers” to issue Form 1099-DA.

While 1099 reporting is already mandatory for stockbrokers, there are potential issues that may arise for ‘crypto brokers’ due to cryptocurrency’s unique properties. Unlike equities, cryptocurrencies are designed to be transferable and interoperable. This means that 1099 forms issued by crypto exchanges may contain incomplete/inaccurate information.

For example, consider the scenario pictured below.

.jpeg)

In this example, David should have $0 of capital gain. However, because the exchange may not have information about David’s cost basis, his Form 1099-DA will likely only contain the following information:

Gross Proceeds: $10,000

Cost Basis: UNKNOWN

If the IRS scrutinizes the transaction, David will need to prove that he bought his Ethereum for $10,000. Otherwise, he may be on the hook for $10,000 of capital gains.

In a case like this, cryptocurrency tax software like CoinLedger can help.

With the platform, you’ll be able to aggregate your transactions from all of your wallets and keep a complete record of all of your taxable events. Our Audit Trail Report records all the numbers used to calculate your trading gains and losses and can help you track all of your crypto transactions across different platforms.

What should I do if I see a different fair market value on my 1099 forms?

Occasionally, you might see that the income reported on your Form 1099 is slightly different than your own calculation. This difference is likely due to the several different markets used to price cryptocurrencies.

In these cases, it’s recommended that you report the fair market value that’s stated on your Form 1099 on your tax return since this is what has been reported to the IRS.

How do I report transactions on Form 1099 on my tax return?

If you’ve received a Form 1099, it’s important to accurately report your cryptocurrency transactions on your taxes to avoid IRS scrutiny.

Remember, Form 1099 is not an “entry form”, meaning you don’t actually include it with your tax return. Instead, you use the information on the form to complete the relevant portion of your tax return.

The gains and losses reported on Form 1099-DA and Form 1099-B should be included on Form 8949 of your tax return. This form reports your total capital gains and losses from all of your investments. Once this form is complete, your net gain or loss should be reported on Schedule D.

The cryptocurrency income (staking, etc.) that’s reported on a 1099-MISC should be reported on Schedule 1, Schedule B, or Schedule C of your tax return depending on the specifics of your situation.

We know all of this can get confusing. For more information, check out our step-by-step guide to reporting your cryptocurrency taxes.

Are stablecoins and NFTs reported on Form 1099?

The IRS released guidelines that income from stablecoins and NFTs will be reported to the IRS via Form 1099-DA starting in 2025. Let’s walk through the thresholds for 1099 tax reporting.

Stablecoin: If you earn more than $10,000 from stablecoin in a year, your transactions will be reported to the IRS.

NFTs: If you earn more than $600 from NFTs in a year, your transactions will be reported to the IRS.

How CoinLedger can help

Trying to file your tax return manually can be overwhelming. CoinLedger can help simplify the process.

With CoinLedger, you can automatically import transactions from exchanges like Coinbase and blockchains like Ethereum. Once you’re done, you can generate completed tax forms like Form 8949 with the click of a button.

Frequently asked questions

- Do I get a 1099 for crypto?

Currently, most major exchanges issue 1099 forms to customers. Starting in the 2025 tax year, all crypto exchanges operating in the United States will be required to issue Form 1099-DA to report capital gains and losses from crypto.

- Where can I get a crypto 1099?

1099 forms are typically issued by your crypto exchange. However it’s important to remember that you don’t need a 1099 form to report your crypto transactions on your tax return.

- Do I need to report crypto if I didn’t sell?

There are some cases where you’re required to report cryptocurrency on your tax return even if you didn’t convert to fiat currency — such as crypto-to-crypto trades and earning crypto income.

- Does Crypto.com send Form 1099?

Crypto.com sends Form 1099-MISC for cryptocurrency. For more information, check out our guide to Crypto.com taxes.

- How much crypto do I need to sell to get a 1099?

At this time, different exchanges issue different 1099 forms to customers. While some exchanges may issue Form 1099-B may issue a tax form for a single sale, other exchanges may not issue any tax form for your cryptocurrency disposals.

- How do I fill out a Form 1099 for crypto?

There is no need for taxpayers to fill out Form 1099 or attach Form 1099 to their tax return. Exchanges send forms like Form 1099-MISC and Form 1099-DA to users and the IRS for tax reporting purposes.

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)