.jpg)

Key Takeaways

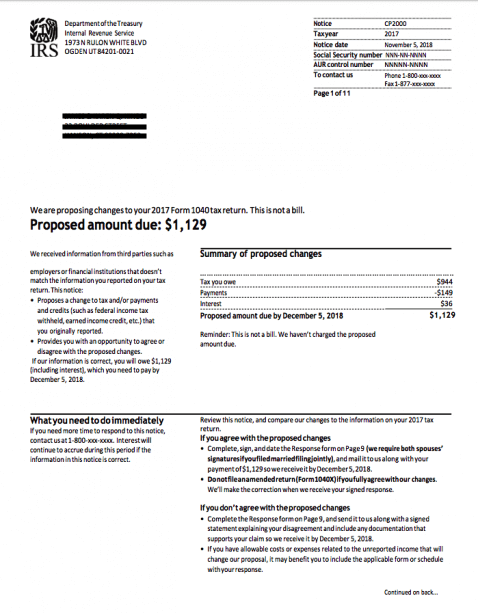

- The IRS sends you CP2000 if the agency believes you’ve underreported your crypto. The letter is considered one step away from a full audit.

- In some cases, CP2000 letters may be inaccurate. If this is the case, you should dispute the letter and calculate your tax liability within 30 days.

If you received a CP2000 for your cryptocurrency activity, you should take action immediately.

In this guide, we’ll break down everything you need to know about CP2000, and what you should do if you receive one.

What is Notice CP2000?

A CP2000 is sent automatically by the IRS to anyone with a discrepancy on their federal tax return. CP2000 is considered one step away from a full audit — which means you should respond immediately!

The letter shows how much you owe to the IRS — including interest!

It’s important to note that CP2000 letters can be disputed. These letters can be inaccurate — especially if you’ve transferred crypto into or out of the exchange (more on this in the next section).

Why is the IRS saying I under-reported when I correctly reported my taxes?

If you transferred crypto between wallets and exchanges, the IRS’s estimate of your taxable income may be incorrect.

Remember, the IRS often gets information about your gains and losses through 1099 forms sent by popular exchanges like Coinbase and Gemini. Because of cryptocurrency’s transferable nature, these forms are often inaccurate.

In this example, Jon’s capital gain should be $500. However, because Exchange B does not have complete records of his crypto transactions, Jon’s capital gain is reported as $1,500. As a result, the IRS may believe that Jon under-reported his taxes.

What should I do if I receive a CP2000?

You have 30 days to dispute CP2000.

The first thing you should do is calculate the correct amount of taxes you owe on your cryptocurrency gains. As noted earlier, tax forms provided by cryptocurrency exchanges can be inaccurate.

How do I calculate my crypto taxes?

You can try to calculate your taxes manually. However, this takes time and effort, and a simple mistake can lead to large calculation errors.

If you don’t want to do these calculations by hand, you can use cryptocurrency tax software to automate the entire tax reporting process. Then, you can submit your tax report to the IRS to dispute their claims.

You can also consider CoinLedger Done For You. A CoinLedger cryptocurrency tax expert will work with you one-on-one to answer your questions, spot mistakes, import your data, and help you generate an accurate tax report.

Once you know how much you do or do not truly owe in taxes, you will be equipped to respond to the CP2000 notice.

Should I connect with a tax professional?

We recommend connecting with a cryptocurrency tax professional with further questions on how to appropriately respond to CP2000 as situations can vary from person to person.

While hiring a crypto tax professional can be costly ($3,000+ in most cases), they are well worth the cost of avoiding an audit. If you’re looking for professional tax help, consider using CoinLedger’s full-service tax prep service.

Is the IRS sending more CP2000 letters?

Starting in 2026, cryptocurrency exchanges will be required to issue Form 1099-DA detailing capital gains and losses for all users. It’s likely that these forms will lead to more CP2000 letters being erroneously sent to investors due to the issues mentioned above.

How crypto tax software can help

Crypto tax software can help you generate comprehensive crypto tax forms in minutes.

CoinLedger allows you import transactions from hundreds of blockchains and exchanges — giving you a complete record of your gains, losses, and income.

You can simply give these forms to your accountant so that they can properly amend your previous tax returns with them, import them into popular tax filing software like TurboTax, or you can use them to amend your tax returns yourself.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)