.jpg)

Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. With the growth and popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. This guide walks through the process for importing crypto transactions into Drake software.

Step 1: Collect your clients tax report from CoinLedger

Because cryptocurrency trading can get quite complicated, traders often need to use specialized crypto tax software to bring all of their crypto transaction history together from each of their exchanges and wallets.

CoinLedger integrates with all major exchanges to allow users to quickly build out their necessary tax reports.

These reports include forms like IRS form 8949.

Step 2: Navigate to the Drake knowledge base to download the 8949 import format

Once you have the necessary reports built in CoinLedger, you can transfer this data into the required Drake 8949 import format.

The Drake 8949 import template can be found here.

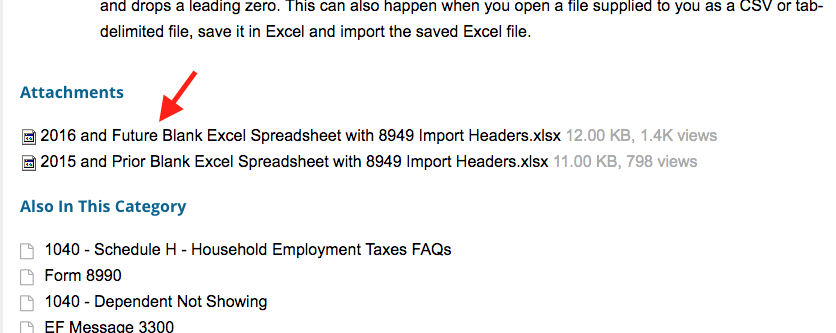

Scroll down to the attachments section and download the 2016 and Future Blank Excel Spreadsheet.

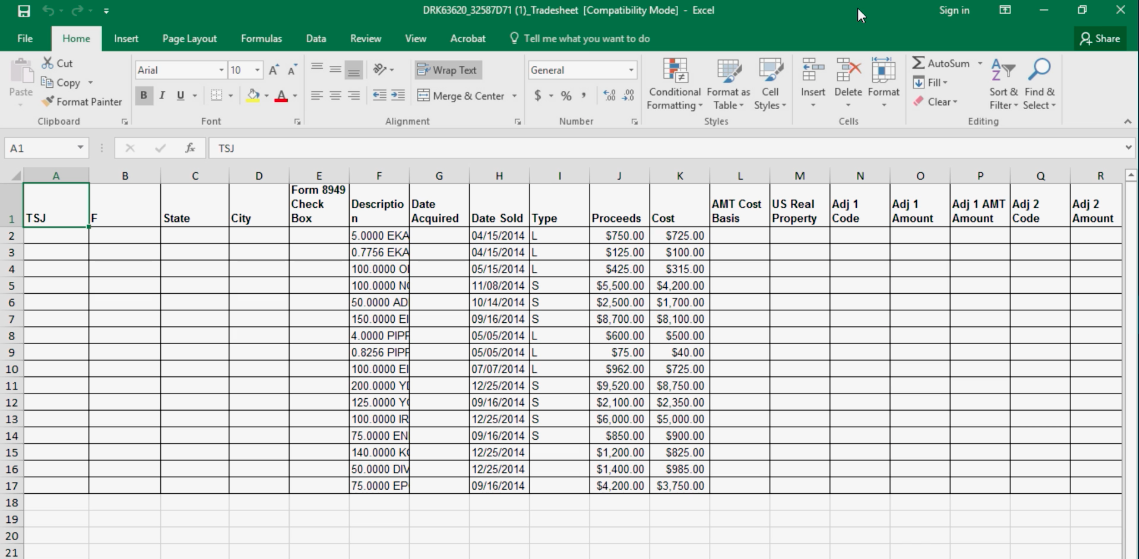

Step 3: Map data from CoinLedger report into Drake excel file format

Open the Short Term Gains CSV from CoinLedger and transfer the following fields into the Drake file downloaded in the previous step:

- Description

- Date Sold

- Proceeds

- Cost Basis

Repeat for the long term gains CSV from CoinLedger if your client has any long term gains.

Save this new file once complete.

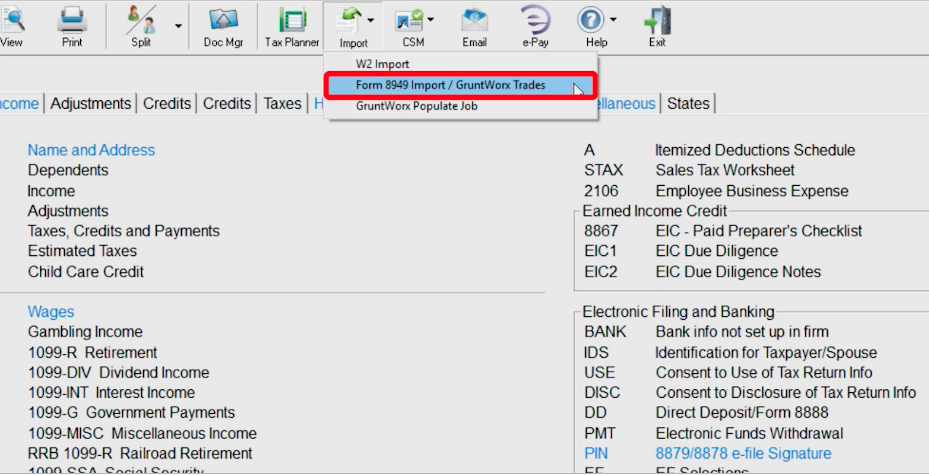

Step 4: Import the new excel file into Drake

Open the clients file to the data entry menu. Click Import > Form 8949 Import.

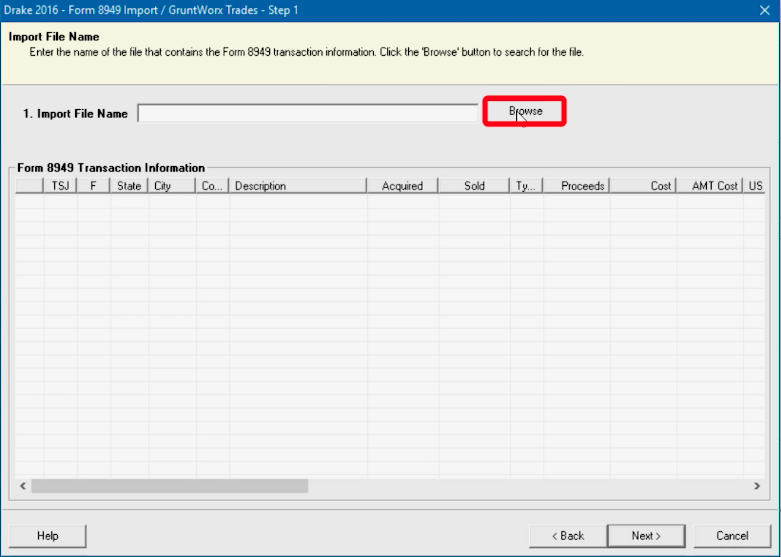

Import the file that you created here.

*Note - you will have to start the import at row 2 so that descriptive titles are not imported.

After successful import, your clients trades will populate within Drake.

Conclusion

This concludes the guide for importing cryptocurrency and bitcoin transactions into the drake accounting platform. Feel free to share this article with other tax professionals.

For a video walk through of this process, see the Drake help center video here.

CoinLedger is the leading crypto and bitcoin tax software used by traders and tax professionals alike. Learn how CoinLedger works by clicking here.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)