.jpg)

The IRS has doubled down on its cryptocurrency tax enforcement efforts by moving the infamous cryptocurrency question to the main American tax form: 1040.

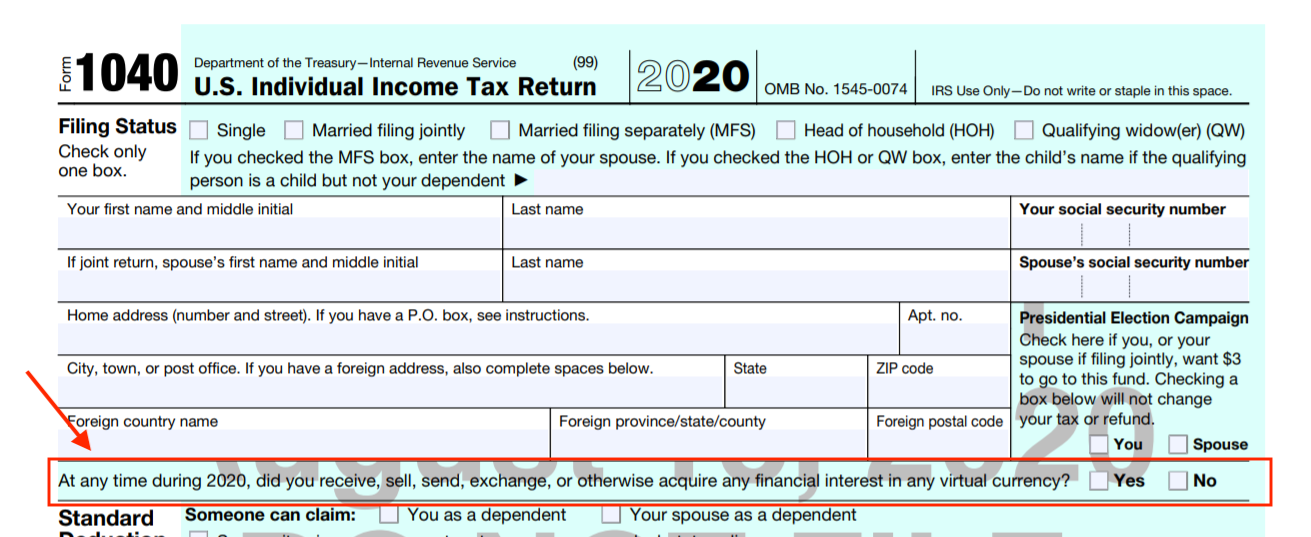

On August 18, 2020, they released a draft of the proposed future 1040 (pictured below). The question reads as follows:

“At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

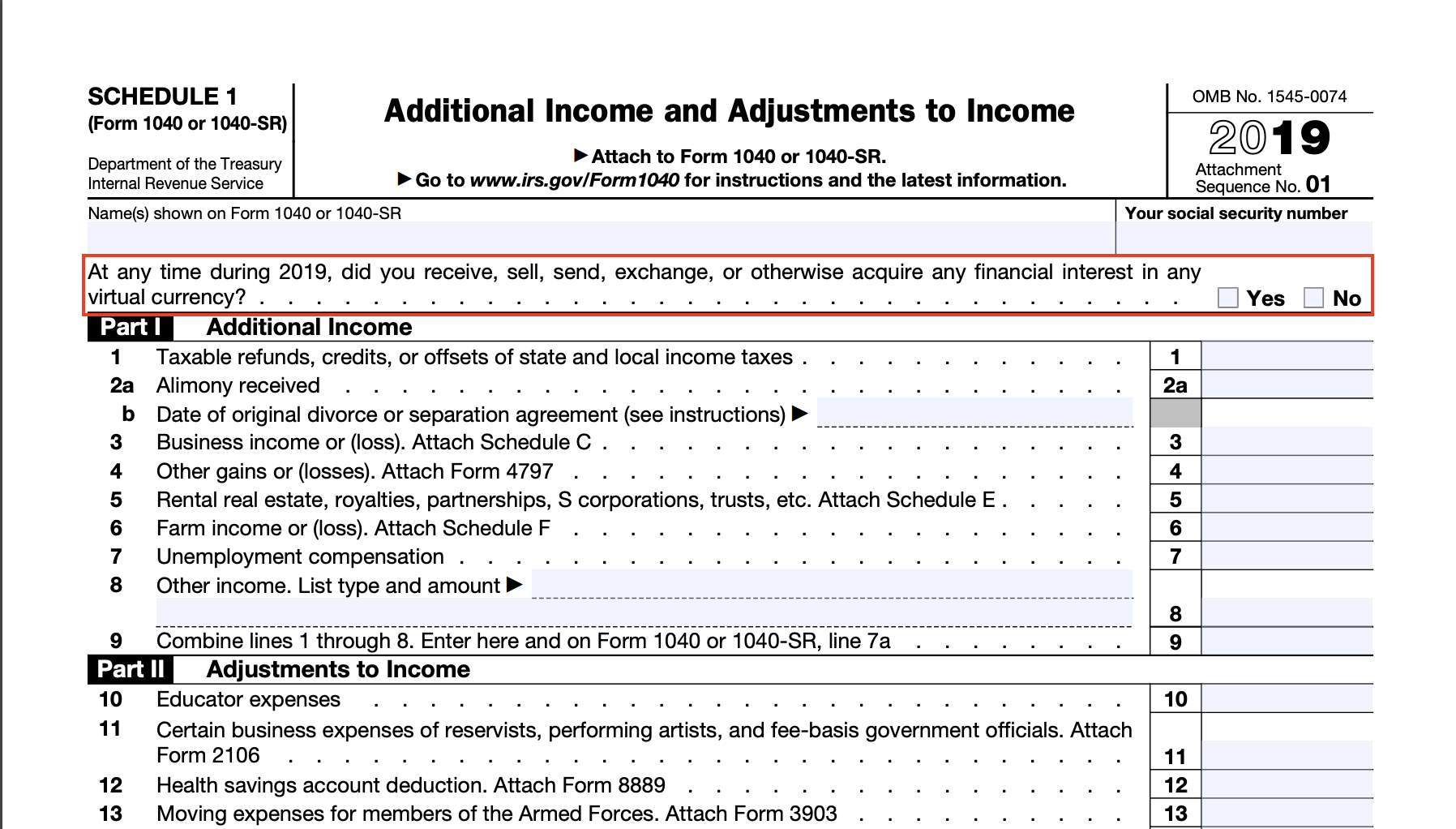

The IRS first introduced this question in 2019 as part of its larger campaign to crack down on the lack of reporting for cryptocurrency-related income. In 2019, the cryptocurrency question above was included on Schedule 1, a form that you only need to fill out if you have additional forms of income (outside of W2 income). By moving it to the front and center of Form 1040, every single person who files a personal tax return will have to answer this question—more than 150 million Americans.

By forcing all Americans to check either "yes" or "no" to this question, the IRS will have more concrete data as well as the ability to criminally prosecute those who intentionally answer this question untruthfully.

The Recent IRS Crackdown

The past twelve months have seen the most cryptocurrency tax related activity from the agency since the dawn of the asset class.

Over the past year, the IRS has sent over 10,000 warning and action letters to cryptocurrency holders, released additional cryptocurrency tax guidance for the first time in more than five years with Revenue Ruling 2019-24, and started soliciting private contractors to aide in cryptocurrency tax audits.

IRS Assistant Deputy Commissioner John Cardone has made it clear that the agency is making cryptocurrency tax enforcement one of its top priorities for the coming years.

Cryptocurrency-related audits have already started flooding in, and it is likely this trend will continue to accelerate.

An Overview of Cryptocurrency Tax Implications

The IRS treats cryptocurrencies as property for tax purposes, not as currency. Just like other forms of property—stocks, bonds, real estate—you incur a tax reporting requirement when you sell, trade, or otherwise dispose of your cryptocurrency for more or less than you acquired it for.

For example, if you purchased 0.1 bitcoin for $2,000 in June of 2020 and then sold it two months later for $3,000, you would have a $1,000 capital gain. This gain needs to be reported on your tax return, and depending on what tax bracket you fall under, you pay a certain percentage of tax on the gain. Rates fluctuate based on your tax bracket as well as depending on whether it was a short term vs. a long term gain. This applies for all cryptocurrencies.

Alternatively, if you sold your cryptocurrency for less than you acquired it for, you can write off that capital loss to save money on your crypto taxes.

We discuss the detailed mechanics of crypto taxes in our blog post, The Complete Guide to Cryptocurrency Taxes.

Cryptocurrency Tax Software

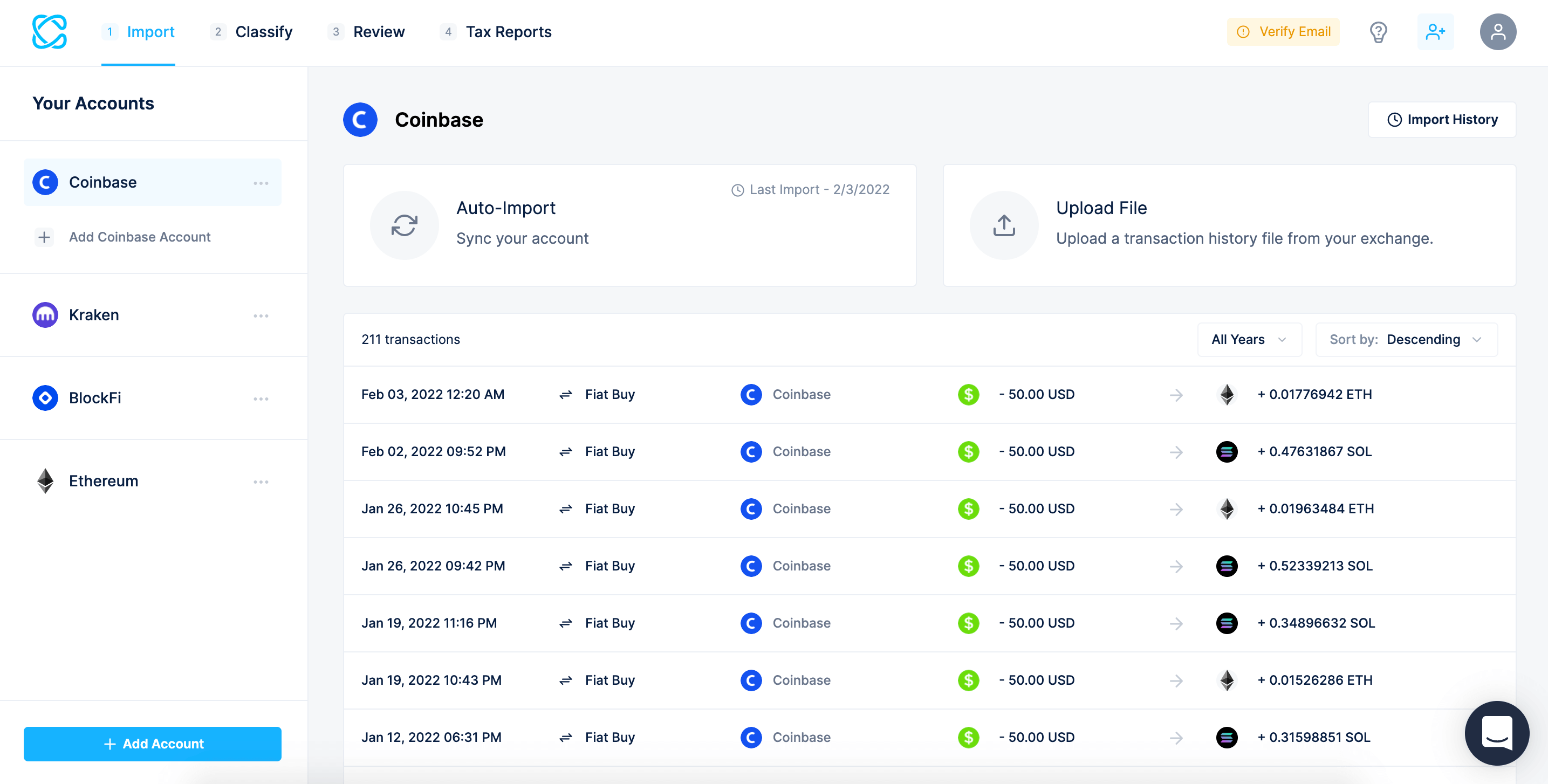

CoinLedger is a cryptocurrency tax software platform built to automate the entire crypto tax reporting process. Tens of thousands of crypto and bitcoin investors from all over the world use the platform today to handle their tax reporting.

By integrating with major exchanges and platforms, CoinLedger allows users to import their historical transactions directly into their account. Once this data is imported, users can generate capital gains and losses reports as well as an auto-filled Form 8949 with the click of a button.

The tax reports that CoinLedger generates are based on your historical data and can be taken to your tax professional or imported directly into your preferred tax filing software like TurboTax or TaxAct.

You can import all of your transactions and get a preview of your capital gains and losses completely for free with CoinLedger. Learn more about how it works here.

Disclaimer: This guide is provided for informational purposes only. It is not intended to substitute tax, audit, accounting, investment, financial, nor legal advice.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)