.jpg)

So you finished running your cryptocurrency tax reports within CoinLedger, nice work. In this article, we discuss the next steps you can take for filing your cryptocurrency capital gains and income with your taxes.

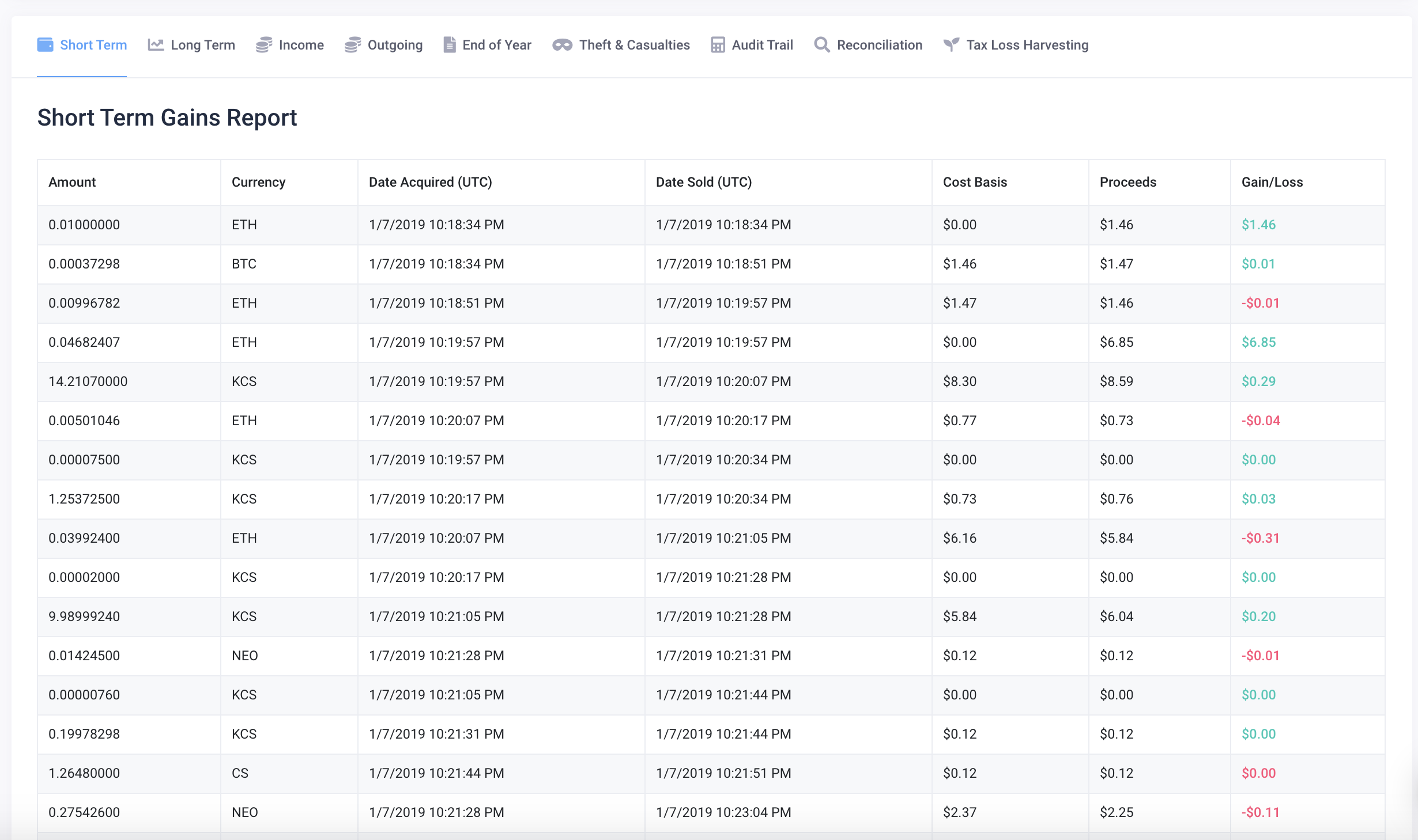

Capital Gains and Losses Reports

Your capital gains and losses are separated out by short term or long term gains. Short term capital gains are the gains and losses associated with assets that were held and disposed of in less than 12 months. Long term gains are for cryptocurrencies that were held for longer than 12 months.

Long term capital gains qualify for the capital gains tax discount within Australia. The long term capital gains tax discount percentage is 50% for individuals and trusts, and 33.33% for complying super funds and eligible life insurance companies. Learn more in our Complete Australia Crypto Tax Guide.

You can download these reports to use for yourself or send them to your accountant by clicking the “Downloads” or “Invite My Tax Professional” tab.

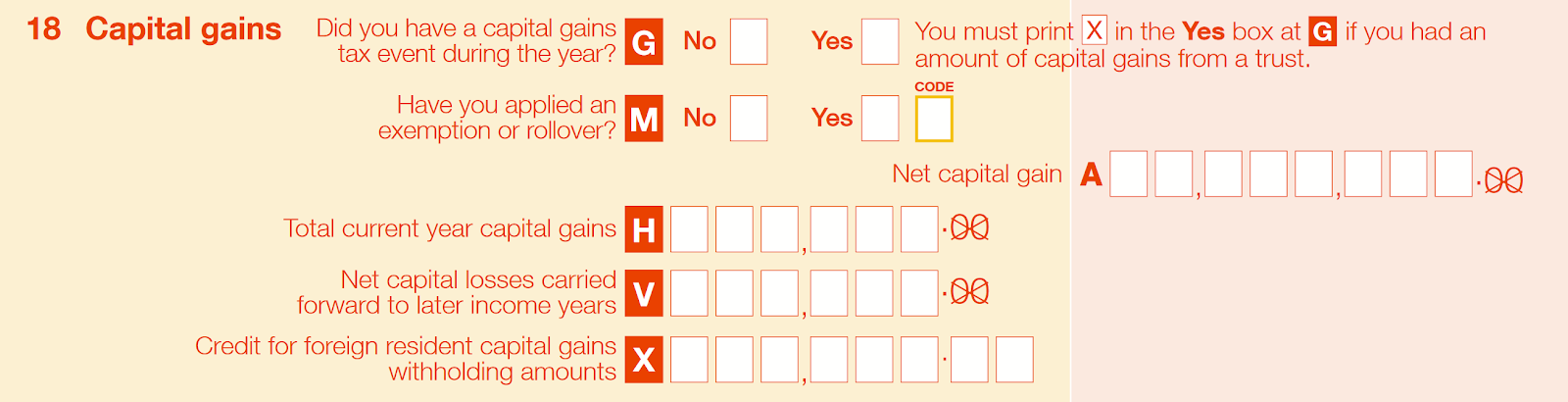

Your net capital gain is reportable under section 18 of the Australian tax forms.

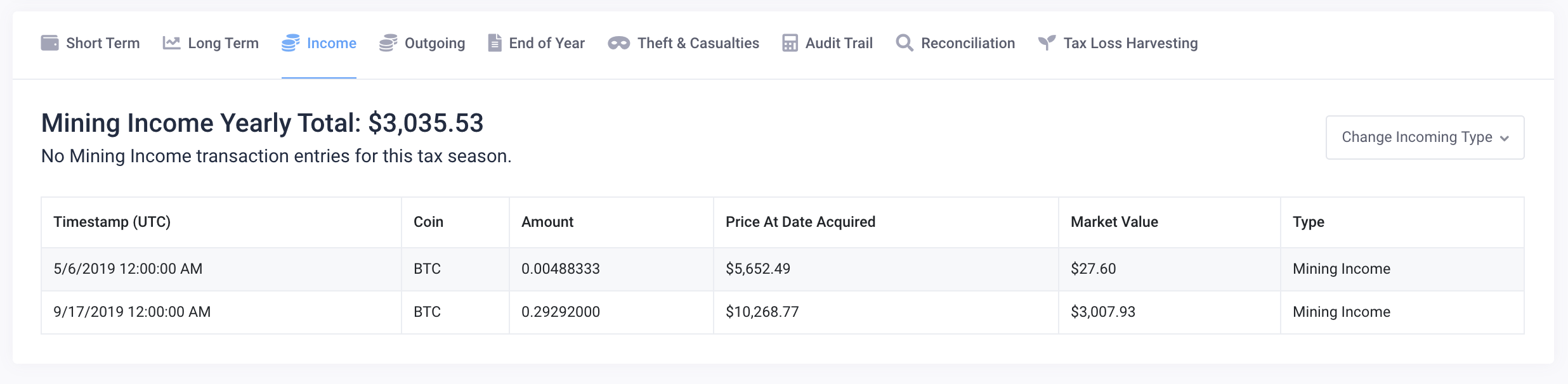

Income Report

Any cryptocurrency-related income that you recognized during the year (whether from mining, staking, or otherwise earning cryptocurrencies) will be reported in the associated Australian Dollar amounts on your income report from within CoinLedger.

You can navigate to the “Downloads” button within CoinLedger to download your complete income report. Use this report to file your income yourself or send this to your tax professional.

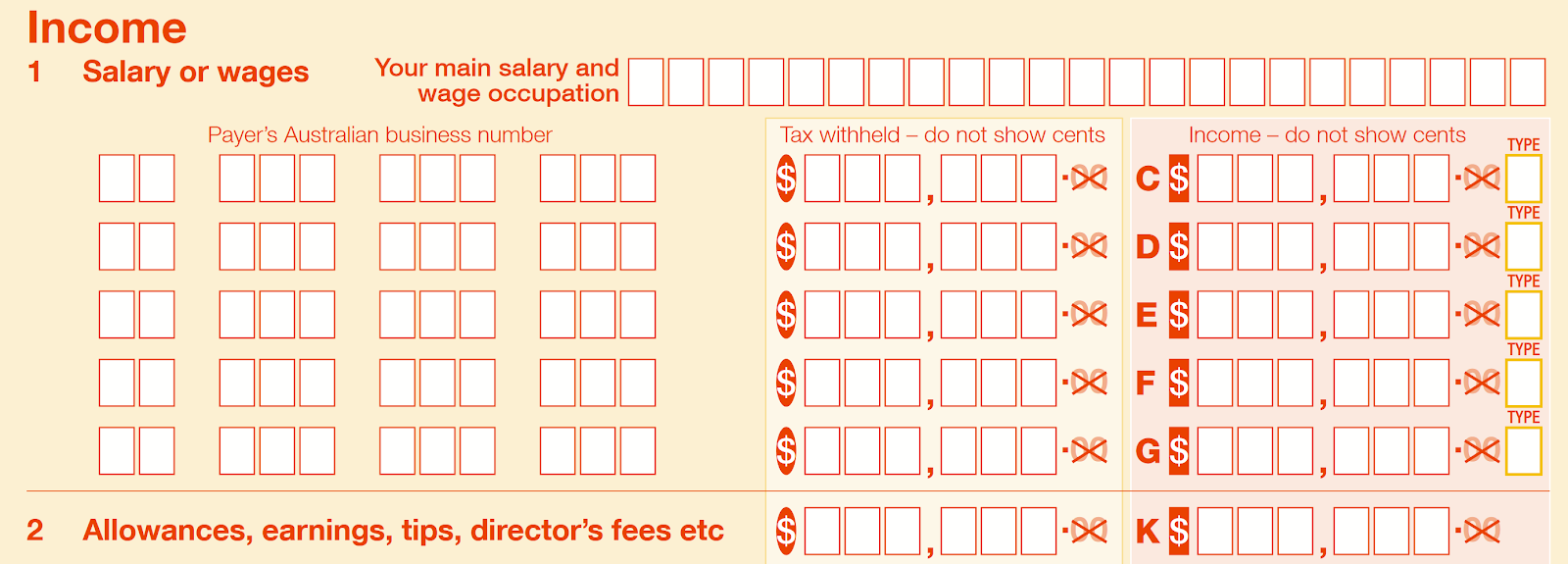

Income earned in cryptocurrency should be reported on Question 2 of the Australian tax forms. It’s on this form that you report earnings that were not salary or wages subject to standard withholdings, such as tips and other income.

Australian Tax Deadline

The Australian tax year runs from July 1 – June 30 the following year. If you are completing your tax return for July 1, 2019 – June 30, 2020, it needs to be filed by October 31, 2020. If you are completing your tax return for July 1, 2020 – June 30, 2021, it needs to be filed by October 31, 2021.

Questions?

Have any other questions? Reach out to our live chat customer support team who will be more than happy to assist you and answer any other questions you may have!

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)