Written by:

Miles Brooks

In this guide, we’ll break down everything you need to know about how cryptocurrency is taxed in Australia. We’ll explain the fundamentals of how cryptocurrency is taxed, how the ATO can track your transactions, and a few simple strategies to help you legally reduce your tax bill!

Yes. The ATO considers cryptocurrency a form of property subject to both capital gains and income tax.

Here are some examples of taxable crypto transactions:

The amount of tax you’ll pay on your cryptocurrency is dependent on your total income during the year. Here’s a breakdown of tax rates by income level in the 2024-2025 tax year.

In addition, there’s a tax benefit when you hold crypto for the long-term. If you hold your crypto for longer than 12 months, you’re eligible for a 50% long-term capital gains discount. For example, if you sell cryptocurrency for a $10,000 profit, only $5,000 will be subject to tax.

Not every cryptocurrency transaction is subject to tax. Here are a few examples of tax-free transactions in Australia.

All cryptocurrency exchanges operating legally in Australia are required to report customer information to the ATO — including names, addresses, and IP addresses. According to reports, the ATO has access to transaction data from millions of crypto investors.

The ATO’s assistant commissioner has been quoted saying, “There isn’t a game of hide and seek. We have got that information and all we are asking people to do is follow the rules.”

In recent years, ATO has sent thousands of warning letters telling crypto investors to report their taxes. If you received one of these letters, you should make sure to accurately report your capital gains and income from the current as well as prior tax years.

It’s important to note that these warning letters are sent as a blanket notice to crypto investors. It’s possible that you may have received this letter even if you do not have any cryptocurrency tax liabilities — however, you should double-check your transactions to be sure you do not have any taxable income.

Capital gains tax applies when you dispose of your cryptocurrency. Examples of disposals include selling your crypto, trading it for another cryptocurrency, gifting it, or using it to make a purchase.

Your capital gain is simply the difference between the AUD value of the cryptocurrency at the time you disposed of it minus the AUD value of the cryptocurrency at the time it was acquired.

It’s important to remember that relevant exchange fees and blockchain network fees can be added to your cost base or subtracted from your proceeds. This can reduce your capital gains tax.

Income taxes apply for cryptocurrencies that you have earned — whether that is through a job, mining, staking, or other means. Your income is determined based on the fair market value of your cryptocurrency at the time of receipt.

To calculate your capital gains, you can use the following formula.

Capital Gain/Loss = Proceeds - Cost Base

In this case, your cost base is how much it cost you to acquire your cryptocurrency. This should be how much you paid for your crypto at the time of receipt plus any relevant fees related to acquisition.

Meanwhile, your proceeds are how much you earned when disposing of your cryptocurrency. This should be the fair market value of your crypto at the time of receipt minus any relevant fees related to disposal.

Here are a few strategies that can help you reduce your cryptocurrency taxes.

.jpeg)

It’s important to remember that your cryptocurrency will be taxed differently based on whether you are considered to be an investor or a trader.

Here’s a breakdown of the differences between investors and traders as per the ATO’s guidelines.

Investor: Investors typically buy cryptocurrencies for the long-term and are primarily interested in building up their wealth over time. Most retail crypto investors would likely fall into this category.

Trader: If you’re mining or trading cryptocurrency in what the ATO describes as an “organized, business-like manner”, you may be considered a trader. Here are a few signs that you may fall into this category:

Of course, the lines between what constitutes a “trader” and an “investor” can get fuzzy at times. If you’re not sure which category you fall under, you should consult a tax professional.

While traders and investors are both subject to tax requirements, there are some differences in how the two groups are taxed.

Traders: Traders are not eligible for the 50% long-term capital gains discount. However, any relevant costs can be deducted as expenses.

Investors: Investors are eligible for the 50% long-term capital gains discount, but cannot deduct relevant expenses.

In certain scenarios, it is possible to be both a trader and an investor. For example, a businessperson that owns a crypto mining business but also has personal crypto investments would most likely fall into this category.

If you are both an investor and a trader, you will need to report all your transactions as an investor and all your transactions as a trader separately. This means that it's important to keep your trading and investing wallets separate to prevent confusion when it’s time to lodge your tax return.

If you’re lodging your taxes for the financial year of July 1, 2024 – June 30, 2025 by yourself, it needs to be submitted by October 31, 2025.

Australians who lodge their tax return with an accountant have slightly more time. This deadline varies depending on your specific circumstances but can be as late as May 15, 2026. However, you’ll need to be registered as a client with an accountant by October 31 to qualify for the extended deadline.

Not paying your taxes on time can be expensive. The ATO may apply a “failure to lodge on time” (FLT) penalty. The longer it takes for you to lodge your tax return past the deadline, the higher this tax penalty will become.

If you have a circumstance that caused you to file your taxes after the deadline, you can make a request to remit the penalty. According to the ATO, taxpayers with a history of complying with tax law and being forward with unreported income are treated more leniently.

Calculating your crypto gains and losses can be tricky if you’ve made several purchases at different times. Consider the example below:

The answer is dependent on what accounting method James chooses to use: FIFO (first-in, first-out), LIFO (last-in first-out), or HIFO (highest-in, first-out). Depending on which method he chooses, he may get a different capital gain calculation. For more information, check out our guide to FIFO, LIFO, and HIFO.

What method you’re allowed to use depends on whether you’re classified as an investor or a trader. If you’re an investor, all three of these methods are allowed as long as you’re able to individually identify your cryptocurrency assets. However, traders can only use FIFO.

You can read the ATO’s guidance on this issue here.

Buying cryptocurrency with fiat currency like AUD is a non-taxable event.

You should keep detailed records of your cryptocurrency purchases so you can easily calculate your capital gains and losses in the case of a future disposal.

Transferring your cryptocurrency to another wallet that you own is not a taxable event.

However, you will need to pay taxes on any fees you paid to transfer your cryptocurrency. Spending cryptocurrency on transfer fees is considered a disposal subject to capital gains tax.

In addition, you should keep a record of your wallet-to-wallet transfers so that you’ll be able to calculate your taxes in the case of a future disposal.

In this case, Rian’s capital gain is $5,000. However, Exchange B may not know his original cost basis and won’t be able to send Rian an accurate tax report.

You should keep records of all of your crypto gains and losses across exchanges to accurately calculate your crypto taxes. Alternatively, you can use crypto tax software like CoinLedger to automatically sync your transactions and generate a complete tax report in minutes.

Selling your cryptocurrency or converting your cryptocurrency to fiat currency like AUD is a taxable disposal. You will incur a capital gain or loss based on how the price of your asset has changed since you originally received it.

Trading one cryptocurrency for another is a taxable disposal. You will incur a capital gain or loss based on how the price of the crypto you are trading away has changed since you originally received it.

Cryptocurrency losses can help you save money on your tax bill.

If you have recorded a loss on a cryptocurrency sale, you can claim this as a capital loss. Capital losses come with tax benefits — losses can offset any gains you have during the year. If you end up with a net capital loss for the year, you can roll this over indefinitely to offset future capital gains.

Some investors intentionally choose to sell their cryptocurrency at a loss during the tax year to claim the tax benefits. This is a strategy known as tax-loss selling.

The ATO has restrictions on ‘wash sales’. This means you cannot sell cryptocurrency, claim the tax benefit, and buy back the same asset immediately.

While the ATO does not define any specific timeframe for when a transaction counts as a ‘wash sale’, it’s best to avoid selling and re-buying assets simply for tax benefits.

If you’re receiving cryptocurrency as payment for your work, you will recognize ordinary income based on the fair market value of your crypto on the date you received it.

If you dispose of your crypto in the future, you will incur a capital gain or loss depending on how its price has changed since you originally received it.

The tax treatment of cryptocurrency mining varies depending on whether you are mining as a hobby or as a business. Not sure which category you’ll fall into? Check out the ATO’s website on the distinction between the two.

If you are mining cryptocurrency as a hobby, your mined coins are considered a new asset with a cost base of $0. When you dispose of it, you incur a capital gains tax event.

You’ll fall into this category if you are mining cryptocurrency as a pastime and are not seeking to make profits.

If you are mining cryptocurrencies as a business, you recognize income equal to the fair market value in AUD of the cryptocurrencies at the time you receive them.

If you are running a large-scale mining operation, it will likely be considered a business by the ATO.

The ATO has stated that cryptocurrency earned from staking and other forms of earned interest on your cryptocurrency is subject to income tax based on its fair market value at the time of receipt.

If you dispose of your staking and interest rewards in the future, you’ll incur a capital gain or loss depending on how the price of your crypto has changed since you originally received it.

Like cryptocurrencies, NFTs are subject to capital gains tax and income tax.

If you buy an NFT with cryptocurrency, you will incur capital gains or losses. In this case, you are ‘disposing’ of the coins you use to purchase the NFT and you will be taxed accordingly.

On the other hand, buying an NFT with fiat currency like AUD is not considered a taxable event.

If you sell an NFT, you’ll incur a capital gain or loss based on how much the price of the NFT has changed since you originally received it.

If you have sold an NFT that you have minted, the proceeds of the sale will be considered ordinary income. Any revenue you receive from secondary sales will also be considered ordinary income.

Transactions on DeFi protocols follow the same rules as other taxable cryptocurrency events.

Forks are taxed differently in different scenarios.

Soft fork: If the cryptocurrency you earn post-fork has the same rights and relationships as the cryptocurrency you held pre-fork, it is considered a continuation of the original asset and does not trigger a capital gains tax event.

Hard fork: If you receive a new cryptocurrency with new rights and relationships as a result of the fork, these will be considered new tokens with a cost base of 0. You will not incur tax when the fork occurs. However, you will need to pay capital gains tax when you dispose of your new tokens.

Cryptocurrency earned through airdrops is considered ordinary income based on its fair market value at the time of receipt. If you dispose of your airdrop rewards in the future, you’ll incur a capital gain or loss depending on how the price of your crypto changed since you originally received it.

Many popular crypto applications offer referral bonuses for new users. These bonuses are considered ordinary income based on the fair market value of the coins at the time of receipt and are taxed accordingly.

Gas fees and transaction fees can be added to your cost base and can reduce your total capital gain in a disposal event.

%2520(1).jpeg)

Donating cryptocurrency to a deductible gift recipient (DGR) is tax free!

Additionally, you will be able to deduct the value of your cryptocurrency based on its fair market value in Australian dollars at the time of the donation.

If you’ve lost cryptocurrency assets as a result of a hack or a theft in the past tax year, you may be able to claim a capital loss and reduce your total tax liability.

Of course, the ATO requires proof that your cryptocurrency has really been lost and cannot be replaced. Here’s the evidence they require, as stated directly on the ATO’s website:

%2520(1).jpeg)

Did you send or receive a cryptocurrency gift sometime this year? Let’s break down how gifts are taxed for both gift givers and recipients.

In Australia, gifting cryptocurrency is considered a taxable event. You will incur a capital gain or loss based on how the crypto you are gifting has changed since you originally received it.

Receiving cryptocurrency as a gift is not considered a taxable event. You will only need to pay taxes once you dispose of the cryptocurrency you were gifted.

If you receive a crypto gift, you should keep records of the date of receipt, the number and units of cryptocurrency you received, and the fair market value of your gift at the time of receipt so you can easily calculate your capital gains/losses upon disposal.

Typically, there are no taxes on loans.

However, many DeFi protocols require you to swap one token for another if you wish to borrow/lend. This is considered a crypto-to-crypto trade subject to capital gains tax.

If you own a business that accepts cryptocurrency for payment, you will need to keep track of the fair market value of your crypto at the time you receive it. You will then report this as part of your business income.

If you’re running a business that involves trading or mining cryptocurrency, you can write off related expenses. This might include the cost of electricity and necessary software and hardware.

To claim this deduction, you will need an Australian Business Number (ABN). That means you will fall into the trader category and will not be eligible for the long-term capital gains discount available to investors.

Individual investors cannot write off expenses.

Platforms like Binance allow investors to trade cryptocurrency on margin — in other words, borrow funds to trade crypto. It’s likely that gains from cryptocurrency margin trading will be taxed as capital gains for investors and income for traders.

With crypto futures, you can speculate on whether the price of a cryptocurrency will rise or fall in the future.

At this time, the ATO has not given guidance on how crypto futures are taxed in Australia. It’s likely that gains from crypto futures will be taxed as capital gains for investors and income for traders.

Holding cryptocurrency directly in an SMSF can be a great strategy to save money on taxes in the long run! If you hold cryptocurrency in a self-managed super fund (SMSF), you’ll be able to access your cryptocurrency gains at retirement age while paying the concessional tax rate (15%).

While most super funds don’t allow you to buy cryptocurrency directly, you can purchase shares in a Bitcoin ETF.

Remember, SMSFs are designed for long-term investors — you can only withdraw when you reach preservation age. There are only a limited set of circumstances where you can withdraw early — such as a terminal medical condition or severe financial hardship.

The Australian tax code has an exemption for assets bought for personal use. If you buy less than $10,000 worth of cryptocurrency for the specific purpose of buying items for personal use or consumption, you may be eligible for this exemption.

Of course, most cryptocurrency purchases are not subject to the personal asset use exemption. According to the ATO, the personal asset use exemption cannot be claimed if the purchase was originally made for investment purposes.

It’s important to be cautious when claiming this exemption. In the case of an ATO investigation, the burden of proof is on you to prove that you purchased the cryptocurrency for personal use.

Remember, the longer you hold your cryptocurrency, the less likely it is to be accepted as a personal use asset.

Most countries have similar crypto tax rules as Australia.

Typically, disposals are subject to capital gains tax, while income is subject to ordinary income tax. If you’re interested in learning more, check out our international guides to crypto taxation!

The ATO has the following guidelines in place for keeping track of your taxes. It’s recommended that you keep records of crypto transactions for at least 5 years after you prepared/acquired your records or 5 years after you completed your transactions (whichever comes later).

The ATO recommends that you follow best practices for keeping records — such as exporting your transaction history from your exchanges and wallets every three months and using crypto tax software.

Once you’ve collected the relevant information, you have three different options for lodging your crypto taxes

You can test out CoinLedger and import all of your cryptocurrency transaction history completely for free here. No personal information or credit card required! You only need to pay when you want to download your forms.

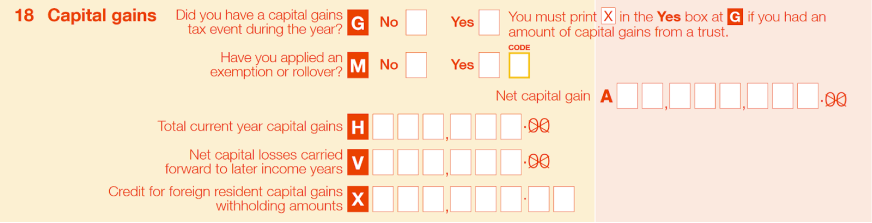

Once you have calculated your gain/loss from each transaction, add up all of your gains and losses to arrive at your net capital gain or loss for the full tax year. Report this net capital gain under section 18 of the Australian tax forms.

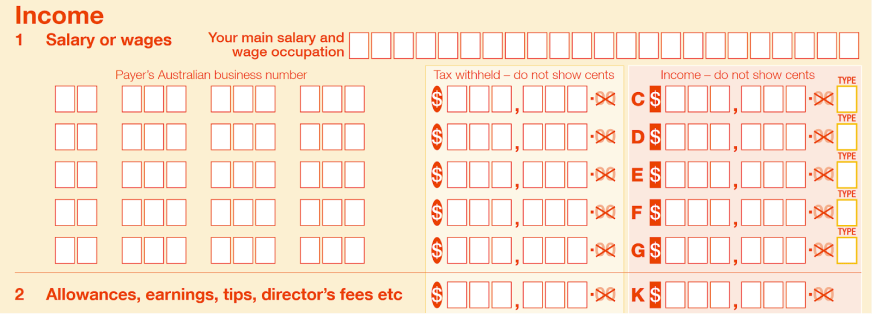

Cryptocurrency income should be reported on Question 2 of the Australian tax forms.On this form, you report earnings that were not salary or wages subject to standard withholdings such as tips and other income.

In the case of a sudden market downturn, some investors find themselves in the unfortunate situation of not being able to pay their taxes on their capital gains and income.

If you find yourself in this situation, you can pay off your tax bill over time. Individuals and businesses that owe less than $200,000 in taxes can potentially set up a payment plan with the ATO online and pay their taxes in installments.

If you owe more than $200,000, you can still set up a payment plan. However, you’ll need to call the ATO with records of your current financial situation — including your income, expenses, and bank records — and an explanation of why you can’t pay your taxes by the due date.

Here’s how CoinLedger can help you generate a complete crypto tax report!

Step 1: Connect your CoinLedger account to your exchanges and wallets. The platform will sync your transactions automatically.

.png)

Step 2: Watch the platform calculate your gains, losses, and income!

.png)

Step 3: Click the View Report button to download your gains, losses, and income tax reports in AUD.

.png)

Looking for an easy way to lodge your taxes? Try CoinLedger, the crypto tax software for Australia trusted by 700,000+ investors.

You can use the software to import your historical cryptocurrency transactions and generate a complete capital gain and income tax report. You’ll only need to pay when you want to download your tax forms.

Watch the explainer video below to learn more about how CoinLedger works.

Let’s cap things off by answering some frequently asked questions about cryptocurrency taxes.

Cryptocurrency is subject to capital gains tax and ordinary income tax in Australia.

Cryptocurrency income and capital gains on any platform is subject to tax in Australia. In addition, Binance reports taxes to the ATO.

There is no way to legally evade paying taxes on your cryptocurrency. However, strategies like tax-loss selling can help you legally minimize your tax bill.

Tax on cryptocurrency and other sources of income ranges from 0-45%. How much tax you pay on cryptocurrency is dependent on several factors — such as your income bracket, whether you are classified as an investor or a trader, and the market value of the crypto you’ve disposed of in the past tax year.

If the ATO believes that a taxpayer has committed tax fraud or tax evasion, there is no time limit for conducting an audit.

There are some situations where you need to pay taxes on your cryptocurrency even if you do not “cash out” to a fiat currency. Crypto-to-crypto transactions and earning crypto income both fall into this category.

While investors can use FIFO, LIFO, or HIFO to calculate cryptocurrency taxes, traders can only use FIFO.

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

This guide breaks down everything you need to know about cryptocurrency taxes, from the high level tax implications to the actual crypto tax forms you need to fill out.