.jpg)

Key Takeaways

- Bitcoin is notoriously volatile, but historically has rewarded patient, long-term investors!

- Consider the tax implications of selling your BTC before making your decision!

Wondering whether you should sell your Bitcoin?

Whether you decide to sell or hold, you should make sure that you’ve considered your own financial situation as well as the potential tax implications. In this guide, we’ll go through five essential questions you should ask yourself before you sell your BTC (and a few action items after you’ve made your decision).

Five essential questions to ask before you sell your Bitcoin

What was your original motivation for buying Bitcoin?

Before you decide to sell, remember your original reasons for buying BTC — Did you buy Bitcoin for its potential for long-term growth, or were you looking to turn a short-term profit?

Remember Bitcoin, unlike traditional stocks, operates within a highly volatile market environment. This volatility isn't merely a hurdle; for many, it's seen as an opportunity for substantial returns in the long-run.

Historically, long-term Bitcoin investors have been rewarded for their patience, riding out significant price fluctuations to see considerable profits. If you originally invested because you believed in Bitcoin's long-term value, then selling during a downturn may contradict your original investment strategy.

.jpeg)

What is your risk tolerance?

Before you make any crypto investment decision, you should consider your risk tolerance. The cryptocurrency market is known for its sharp rises and dramatic falls, testing the determination of even seasoned investors.

Some investors may not be able to tolerate a large dip in value and may consider selling during a market downturn. However, it's essential to approach this reflection without panic, grounding your decision in a rational evaluation of your own financial situation.

Remember, Bitcoin’s history is filled with periods of significant volatility, followed by recovery and growth. Consider your personal breaking point —in other words, the level of market turbulence you can tolerate without risking being unable to afford short-term expenses and losing peace of mind.

How will my profits/losses on Bitcoin be taxed?

Before you make the decision to sell your Bitcoin, it’s important to keep in mind the possible tax ramifications of your decision.

When you sell your Bitcoin, you’ll incur a capital gain or a capital loss based on how the value of your BTC has changed since you originally received it.

You can calculate how much capital gains/capital losses you’ll incur through this simple formula:

If the value of your BTC has gone up in value since you originally received it, you’ll be required to pay capital gain tax on your profits. If you are planning to sell your Bitcoin at a profit, you may want to consider how much money you’ll be left with after taxes.

If the price of your BTC has gone down in value since you originally received it, you will be able to claim a capital loss and offset your capital gains for the tax year and up to $3,000 worth of income. If you are planning to sell your Bitcoin at a loss, you should consider how it may reduce your tax liability.

Looking for an easy way to calculate your gains and losses from Bitcoin? Check out our free online crypto profit calculator.

Will you be paying short-term or long-term capital gains?

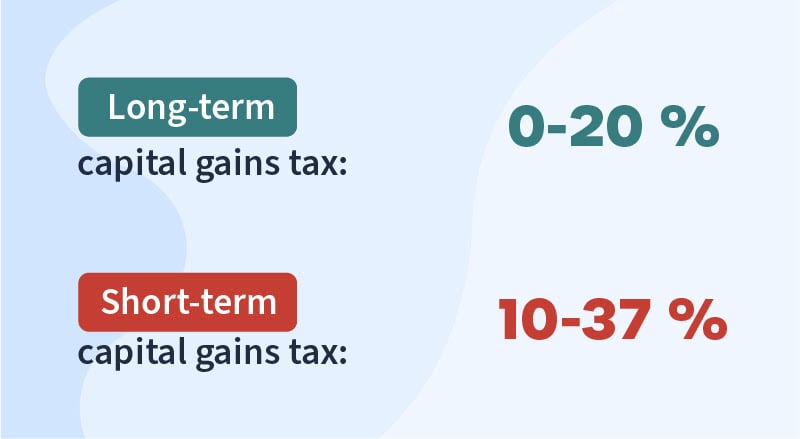

Depending on how long you’ve held your Bitcoin, your gains may be taxed as long-term or short-term capital gains.

If you’ve owned your Bitcoin for 12 months or less, you’ll need to pay the higher short-term capital gain tax rate. If you’ve owned your Bitcoin for more than 12 months, you’ll pay the lower long-term capital gain tax rate.

Some investors choose to hold on to their BTC for a year or longer to take advantage of lower tax rates.

Can I leverage Bitcoin’s unique tax-loss harvesting advantages?

If you’re thinking about selling your BTC at a loss, you should keep in mind that Bitcoin and other cryptocurrencies have a unique characteristic that make them a better candidate for tax-loss harvesting than traditional equities.

At this time, the IRS has a wash sale rule in place that says that a capital loss cannot be claimed on securities if they are bought 30 days before or after a sale. However, IRS guidance has labeled cryptocurrencies like Bitcoin as property, not securities.

Based on current IRS guidance, it’s reasonable to assume that the wash sale rule does not apply to Bitcoin at this time. Many investors choose to sell their BTC, claim a capital loss, and buy back their coins shortly afterwards.

For more information, check out our complete guide to tax-loss harvesting.

What to do when you’ve decided to sell/hold your Bitcoin

What should I do if I don’t want to sell my Bitcoin?

Some investors don’t want to sell their Bitcoin but still need fiat currency for their own personal use. In this case, many investors choose to leverage cryptocurrency loans.

With a cryptocurrency loan, you’ll be able to receive fiat money as a loan using your Bitcoin as collateral. Typically, you’ll be required to pay your loan with interest on a monthly basis.

How can I sell my Bitcoin?

If you make the decision to sell your Bitcoin, you can sell your coins through exchanges such as Coinbase, Gemini, and Kraken. Keep in mind that these platforms typically charge fees on your transactions.

How can I manage my Bitcoin taxes?

To report your Bitcoin taxes after a sale, you’ll need detailed records of your transactions — including your cost basis, the price of BTC when you sold it, as well as the date you acquired and disposed of your Bitcoin.

It can be difficult to track this information on your own. Luckily, there’s an easier way: using crypto tax software like CoinLedger. CoinLedger integrates with hundreds of blockchains and exchanges — including Bitcoin and Coinbase! The platform can plug into your cryptocurrency platforms and automatically generate a complete crypto tax report.

Looking for a stress-free way to manage Bitcoin taxes?

Interested in joining the 700,000+ other investors using CoinLedger? Try a free preview report - there’s no need to enter your credit card details until you’re 100% sure your transaction history is accurate.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)