Written by:

Miles Brooks

In this guide, we’ll break down everything Spanish crypto investors need to know to report their crypto taxes. We’ll share how Agencia Estatal de Administración Tributaria taxes cryptocurrency and break down how you can generate complete crypto tax forms in minutes.

Note: This guide is updated regularly based on the latest information from the Spanish government.

In Spain, cryptocurrency is subject to income tax, income savings tax, and wealth tax.

Income tax: When you earn cryptocurrency, you’ll recognize income based on the fair market value of your coins at the time of receipt.

Income savings tax (capital gains tax): When you dispose of cryptocurrency, you’ll recognize a gain or loss depending on how the price of your crypto has changed since you originally received it.

Wealth tax: Depending on which autonomous community you reside in, you may pay wealth tax if you meet the wealth tax threshold (€700,000 in most of Spain). Remember, the value of your cryptocurrency is part of your net wealth.

When you dispose of your cryptocurrency, you’ll incur a capital gain or loss depending on how the price of your crypto has changed since you originally received it.

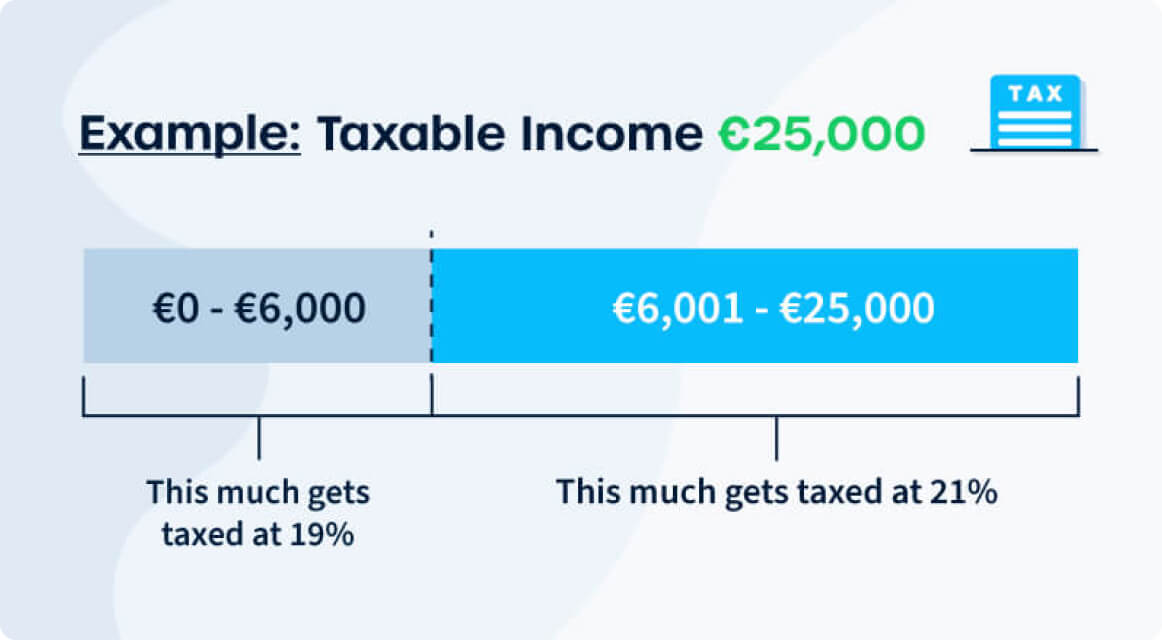

In this case, Rodrigo’s capital gain will be subject to income savings tax between 19-28% depending on his income level.

It’s important to remember that income savings tax is progressive. That means you’ll have to pay progressively larger tax rates on each portion of your yearly capital gains.

When you earn cryptocurrency income in Spain, you’ll recognize income based on the fair market value of your coins at the time of receipt. It’s likely that getting paid in crypto, cryptocurrency mining, cryptocurrency staking, and airdrops all fall into this category.

In Spain, tax rates are set by the state and individual autonomous communities. Here are tax rates that need to be paid by all Spanish residents.

Spain charges some of the highest income taxes on cryptocurrency in the world. Marginal tax rates for those earning over €300,000 are between 45-54% depending on your region of residence.

Certain regions in Spain charge a wealth tax for taxpayers with assets greater than €700,000.

You will need to sum up the value of all of your assets (including crypto-assets) at the end of the tax year. If the net result is positive after allowances, you will be required to submit a wealth tax declaration.

If you are a Spanish resident, you get an exemption against the value of your primary home (€300,000 in most of Spain).

Wealth tax can vary from 0.21% to 3.75% depending on where you live in Spain.

Madrid and Andalusia are the only regions with no wealth tax. No matter where you live, you will be required to submit a wealth tax declaration for information purposes if you have more than €2 million in assets.

It’s important to remember that governments across the world have tools to track your cryptocurrency transactions.

In July 2021, the Spanish government published Law. No. 11/2021, which increased reporting requirements for cryptocurrency exchanges like Binance and Coinbase.

In addition, DAC8 is set to go into effect across the European Union in 2026. DAC8 is designed to prevent tax evasion, and requires cryptocurrency platforms to disclose information like your personal identity and the value of your transactions to relevant tax authorities.

In Spain, the tax year runs from January 1st to December 31st.

You’re required to file your taxes by June 30th of the following year.

In Spain, the FIFO (first-in first-out) method is used to calculate your cost basis for cryptocurrency. You should use this method if you acquired the same cryptocurrency at different price points.

FIFO essentially means that the first coins that you acquire are also the first coins that you dispose of.

Buying cryptocurrency with fiat currency like EUR is not considered a taxable event.

When you sell cryptocurrency, you’ll incur a capital gain or loss depending on how its price has changed since you originally received it.

Trading one crypto for another is considered a disposal subject to income savings tax.

When you trade cryptocurrency for other cryptocurrencies, you’ll incur a capital gain or loss depending on how the price of the crypto you’re trading away has changed since you originally received it.

Receiving or inheriting a cryptocurrency gift is subject to gift tax. You’ll pay taxes based on the fair market value of your crypto-asset at the time of receipt. Gift tax currently ranges between 7 to 36.5%.

Some regions offer significant gift tax exemptions to close family members — such as children and spouses.

Getting paid in cryptocurrency in compensation for labour is considered income based on the fair market value of your crypto at the time you received it.

Using cryptocurrency to pay for goods and services is considered a disposal subject to income savings tax. You’ll incur a capital gain or loss depending on how the price of your crypto has changed since you originally received it.

Cryptocurrency mining rewards are considered income at the time of receipt. If you dispose of your coins in the future, they’ll be subject to income savings tax based on how the value of your coins has changed since you originally received them.

Cryptocurrency mining is considered a business activity in Spain. Cryptocurrency miners are required to register as a freelancer - specifically under business activity code 832.9.

Cryptocurrency mining is not subject to VAT in Spain.

Cryptocurrency staking rewards are taxed as interest income. Interest income is taxed at lower rates than normal income — between 19-26%.

If your staking operation reaches the level of sophistication where it is considered a business for tax purposes, your rewards may be subject to normal income tax rates.

At this time, Agencia Tributaria hasn’t put out any guidance on cryptocurrency airdrops.

The conservative approach is to treat crypto received from airdrops as income subject to income tax.

It’s likely that if you dispose of your airdrop rewards, you’ll be subject to income savings tax based on how the price of your crypto has changed since you originally received it.

NFTs are taxed similarly to cryptocurrencies.

Selling an NFT is considered a disposal subject to income savings tax. You’ll incur a capital gain or loss depending on how the value of your NFT changed since you originally received it.

Buying an NFT with cryptocurrency is considered a disposal of your crypto. You’ll pay income savings tax based on how the price of your crypto has changed since you originally received it.

There is no tax for buying an NFT with fiat currency.

Any proceeds from the sale of NFTs will be taxed as financial income (taxed between 19-26%).

At this time, Agencia Tributaria hasn’t put out any guidance on how transactions on DeFi protocols are taxed.

Based on existing guidance, we can assume the following.

It’s possible that in some cases, income from DeFi may be considered interest and be taxed at a lower rate (19-26%). For example, rewards earned from providing liquidity to a lending platform like Compound is likely to be considered interest income and taxed accordingly.

You should keep detailed records on your crypto transactions for at least five years after you “prepared or obtained the records”, or “completed the transactions or acts those records relate to”. These records should include:

Your records should contain the fair market value of your crypto in EUR. Even if you’ve conducted your transactions in another currency like USD, you’ll need to convert these to their EUR value to accurately report your taxes.

If you have trouble tracking your crypto transactions, crypto tax software can help. Just plug in your wallets and exchanges and the platform can automatically find historical prices and calculate your crypto tax bill for you!

In addition, you will need to submit Form 714 (Wealth Tax Declaration) if your net wealth (including the value of your crypto assets) is over €700,000.

There’s no need to track all of your gains, losses, and income manually. With CoinLedger, you can automatically import your wallets and exchanges and help you generate complete tax forms for Spain in three easy steps.

Step 1: Connect your wallets and exchanges to CoinLedger.

.png)

Step 2: Doublecheck your transaction history.

.png)

Step 3: Download your tax report.

.png)

Filing your taxes with CoinLedger just takes minutes. The platform is trusted by more than 700,000 crypto investors all across the globe!

Let’s cap things off by answering some frequently asked questions about cryptocurrency taxes.

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

This guide breaks down everything you need to know about cryptocurrency taxes, from the high level tax implications to the actual crypto tax forms you need to fill out.