Written by:

Miles Brooks

Indian investors who buy and sell cryptocurrency face some of the harshest taxes in the world. Still, millions of investors around the country continue to participate in the crypto ecosystem.

In this guide, we’ll break down everything you need to know about how cryptocurrency is taxed in India. We’ll also discuss strategies to minimize your tax liability and protect yourself from the 30% cryptocurrency tax.

In India, income from the sale or receipt of crypto-assets is subject to a 30% flat tax. You will be required to pay this tax whether you’ve disposed of cryptocurrency (sold crypto or traded it for another cryptocurrency) or earned crypto (received crypto through airdrop or staking rewards).

Unlike other asset classes, there is no tax benefit for holding your cryptocurrency for the long term. You’ll pay the 30% tax on cryptocurrency income regardless of your holding period.

In addition, you’ll pay a TDS tax of 1% when you buy or sell cryptocurrency above a certain threshold (yet to be defined).

The following transactions are not subject to the 30% flat tax on cryptocurrency.

The 30% tax on cryptocurrency went into effect on April 1, 2022. From this date onwards, crypto investors in India are required to pay this tax rate on all cryptocurrency income.

During his 2022-2023 Budget speech, India’s Minister of Finance claimed that the taxation of virtual assets was necessary because of the ‘magnitude and frequency of these transactions’.

However, it’s important to note that other asset classes, such as stocks and real estate, are not subject to the same 30% flat tax.

If you dispose of your cryptocurrency, you can calculate your income by subtracting your cost basis from the proceeds of your disposal.

For example, imagine that you buy Bitcoin for 1,500,000 INR. Years later, you sell it for 2,000,000 INR. In this case, you’ll have 500,000 INR of income.

Examples of disposals include selling your cryptocurrency, trading your cryptocurrency for another cryptocurrency, and using cryptocurrency to make a purchase.

Your cost basis is your cost for acquiring your cryptocurrency. This includes any fees you paid to acquire your crypto, including gas fees and exchange fees.

If you earn cryptocurrency from means such as staking or airdrops, it will be taxed as income based on its fair market value at the time of receipt.

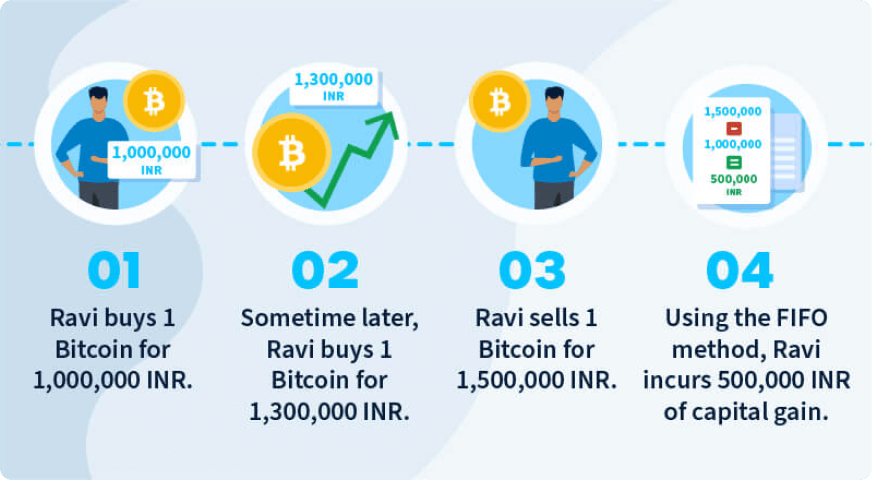

In India, the cost basis for capital assets such as stocks is determined through the FIFO (first-in first-out) method. It’s reasonable to assume that you can determine your cost basis in cryptocurrency using the same method.

When you dispose of cryptocurrency, your cost basis will be that of the first coins that you acquired.

Remember, trying to evade your cryptocurrency taxes is illegal and risky.

Prominent exchanges like WazirX collect information from customers and are required to report to the IRS upon request.

In recent years, the Indian government has paid close attention to the crypto ecosystem. In 2022, the IRS seized more than 95 crore INR from 11 crypto exchanges that were accused of tax evasion.

While there is no way to legally avoid the 30% tax, strategies like buying and holding your cryptocurrency for the long term can help you minimize your tax liability and benefit from the continued appreciation of your coins.

Unfortunately, India does not allow taxpayers to deduct capital losses from cryptocurrency. While you will not pay taxes when you sell crypto at a loss, it cannot be used to offset gains from cryptocurrency or other income sources.

Just like cryptocurrencies, NFTs are classified as Virtual Digital Assets and subject to the same 30% tax as well as the 1% TDS tax above a certain threshold.

Earning cryptocurrency income from DeFi protocols is subject to the same 30% cryptocurrency tax.

DeFi protocols like Uniswap and Compound allow users to add liquidity and in exchange, receive liquidity tokens. While the federal government hasn’t provided clear guidance on this issue, it’s reasonable to assume that adding and removing liquidity will be considered a crypto-to-crypto swap subject to the 30% tax.

Gifting cryptocurrency is a taxable event for both the gift giver and the recipient.

Gifting crypto is considered a disposal event and any gain is subject to 30% tax.

In the case of receiving a cryptocurrency gift, the recipient is required to pay a 30% tax based on the fair market value of their gift at the time of receipt.

Let’s cap things off by answering some frequently asked questions about cryptocurrency taxes.

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

This guide breaks down everything you need to know about cryptocurrency taxes, from the high level tax implications to the actual crypto tax forms you need to fill out.