.jpg)

Many tax professionals are having to learn about the world of cryptocurrencies and the associated tax implications as their clients have increasingly started to invest, trade, and transact in the digital asset. Cryptocurrency tax software like CoinLedger is specifically built to help consumers and tax professionals address this problem and automate the entire tax reporting process. The company also offers a full software suite to help tax professionals manage their cryptocurrency clients.

This article walks through crypto taxes at a high level. It also discusses how tax professionals should handle the crypto tax reports that they receive from their clients so that they can include them with the holistic tax return.

Cryptocurrency and Taxes

In the U.S, the IRS treats cryptocurrencies as property for tax purposes as per Notice 2014-21. Just like other forms of property—stocks, bonds, real estate—you incur a tax reporting liability when you sell or trade cryptocurrency for more or less than you acquired it for.

In this sense, cryptocurrency trading looks similar to trading stocks for tax purposes.

For example, if you purchased 0.1 Bitcoin for $1000 in April of 2018 and then sold it two months later for $2,000, you have a $1,000 capital gain. You report this gain on your tax return, and depending on what tax bracket you fall under, you will pay a certain percentage of tax on the gain. Rates fluctuate based on your tax bracket as well as depending on if it was a short term vs. a long term gain.

On the flip side, if you sold your cryptocurrency for less than you acquired it for, you can write off that capital loss to save money on your crypto taxes.

In addition, certain cryptocurrency activities like mining or being paid in crypto need to be treated as income and reported as such for tax purposes.

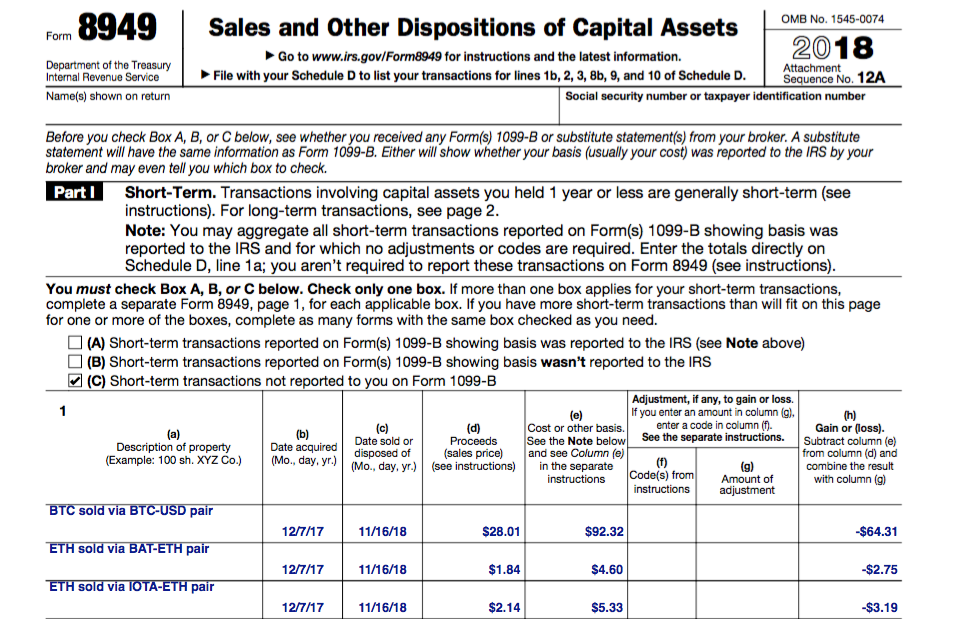

Form 8949

In the U.S, Form 8949 is used to report transactions involving capital assets. Because cryptocurrency is a capital asset, each taxable event from transacting with cryptocurrency needs to be reported on this form. Once completed, the net gain should be transferred to 1040 Schedule D.

CoinLedger automatically builds out this necessary form for its users, and you will receive a copy of this 8949 when your client sends you their cryptocurrency tax report from within the application.

You can import the 8949 into your preferred tax preparation software by using the Short Term Gains CSV and Long Term Gains CSV that you will also receive. These CSV files contain the data that makes up the 8949 in spreadsheet format.

Checkout our complete guide on how to import your clients cryptocurrency forms into Drake accounting software here.

Income Report

If your client received crypto from events like mining, airdrops, or fork events, they will also receive an income report that reports the fair market value of this cryptocurrency at the time it was received.

You can use the income report to report on the amount of income earned in the form of cryptocurrency for the given year. This should be reported within the clients tax return.

Cryptocurrency Specialized Accountants

As the crypto economy continues to unfold and accelerate, many accountants are starting to specialize in crypto taxes and build their tax practice around it. Currently, the demand for cryptocurrency tax services largely outweighs the supply, so educated professionals are picking up highly profitable clients at a fast rate.

If you would like to be added to our directory of crypto tax professionals to start servicing these clients, please reach out to our team today at [email protected].

For a deeper dive into cryptocurrency taxes, please read our Guide to Cryptocurrency Taxes.

Disclaimer - This post is for informational purposes only and should not be construed as tax or investment advice. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies.

Frequently asked questions

How we reviewed this article

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

.png)