8 Best USA Crypto Exchanges in 2026 (Expert Reviewed)

%201%20(1).jpg)

%201%20(1).jpg)

Key Takeaways

- Coinbase is the best exchange overall, while Kraken is the best low-fee alternative.

- If you’re looking for an app that supports stocks & cryptocurrencies, eToro or Robinhood may be the best choice for you.

Let’s walk through the 8 best cryptocurrency exchanges in 2026 — ranked based on factors like user-friendliness, fees, and security.

Quick Look: Best U.S. Exchanges

Methodology

The CoinLedger team looked at dozens of exchanges and used the following factors to determine inclusion on this list:

- User interface

- Reputation

- Third-party reviews

- Trading fees

- Asset selection

- Unique features

- Advanced features

Are crypto exchanges safe?

All the crypto exchanges listed above are considered safe options. The platforms above use security measures like encryption, cold storage, and two-factor authentication to keep customers safe.

However, it’s important to note that many cryptocurrency exchanges have faced hacks and security breaches in the past. If you’re worried about security, consider using a cold storage wallet — which keeps your private keys offline and safe from online attacks.

Why are some crypto exchanges not available in the United States?

Cryptocurrency exchanges that operate in the United States are subject to regulation by the Commodity Futures Trading Commission (CFTC), which enforces various anti-money laundering programs and requirements, FinCEN regulation, as well as other rules and regulations across various government agencies.

Because of these regulations, some exchanges — like Binance.com and KuCoin — are not available in the US.

Some exchanges are not available in certain states. For example, New York has some of the strictest cryptocurrency regulations in the country — which means that many exchanges are unavailable.

How to choose a US crypto exchange

There are a number of factors to consider when choosing the right crypto exchange, such as trade limits, currency support, and trading fees.

When assessing a US-compliant crypto exchange, it’s important to assess the following factors:

Reputation

It’s important to find an exchange with a stellar reputation. In recent years, crypto investors have lost access to millions of dollars worth of holdings after exchanges like BlockFi, FTX, and Voyager went bankrupt.

Fees

Different exchanges charge varying fees on trades, deposits, and withdrawals. Make sure you understand your exchange’s fee structure before you get started.

Trade Limits

Some crypto exchanges that are available in the United States place restrictions on the amount of cryptocurrency that can be purchased or traded in a single day. If you’re a high-volume trader, you should pay attention to trade limits.

Cryptocurrency Selection

If you want to trade a specific cryptocurrency, you should make sure that the exchange supports the asset you’re looking for.

Hacks and Security

Cryptocurrency exchanges and traders alike are frequently targeted by hackers. It’s important to ensure that your exchange possesses a strong track record of security offers features such as two-factor authentication.

Do crypto exchanges report to the IRS?

Starting in 2026, all centralized cryptocurrency exchanges in the US will be required to issue Form 1099-DA to customers and the IRS. If you don’t report taxable income that's been reported to the IRS, it’s likely you’ll automatically get sent a warning letter about your unpaid tax liability.

What are the best crypto exchanges in the world?

Not based in the United States? Here’s a list of the best crypto exchanges for you — no matter where you’re located.

- The Best Crypto Exchanges in the World

- The Best Crypto Exchanges in Australia

- The Best Crypto Exchanges in Canada

- The Best Crypto Exchanges in Germany

- The Best No-KYC Exchanges

- The Best Decentralized Exchanges

What are the best crypto websites?

Once you’ve found the right exchange, you should find a site to help you stay-up-to-date on the latest crypto news! Check out our guide to the best crypto news sites.

How crypto tax software can help

To accurately report your taxes, you’ll need to keep a detailed record of your capital gains, losses, and income.

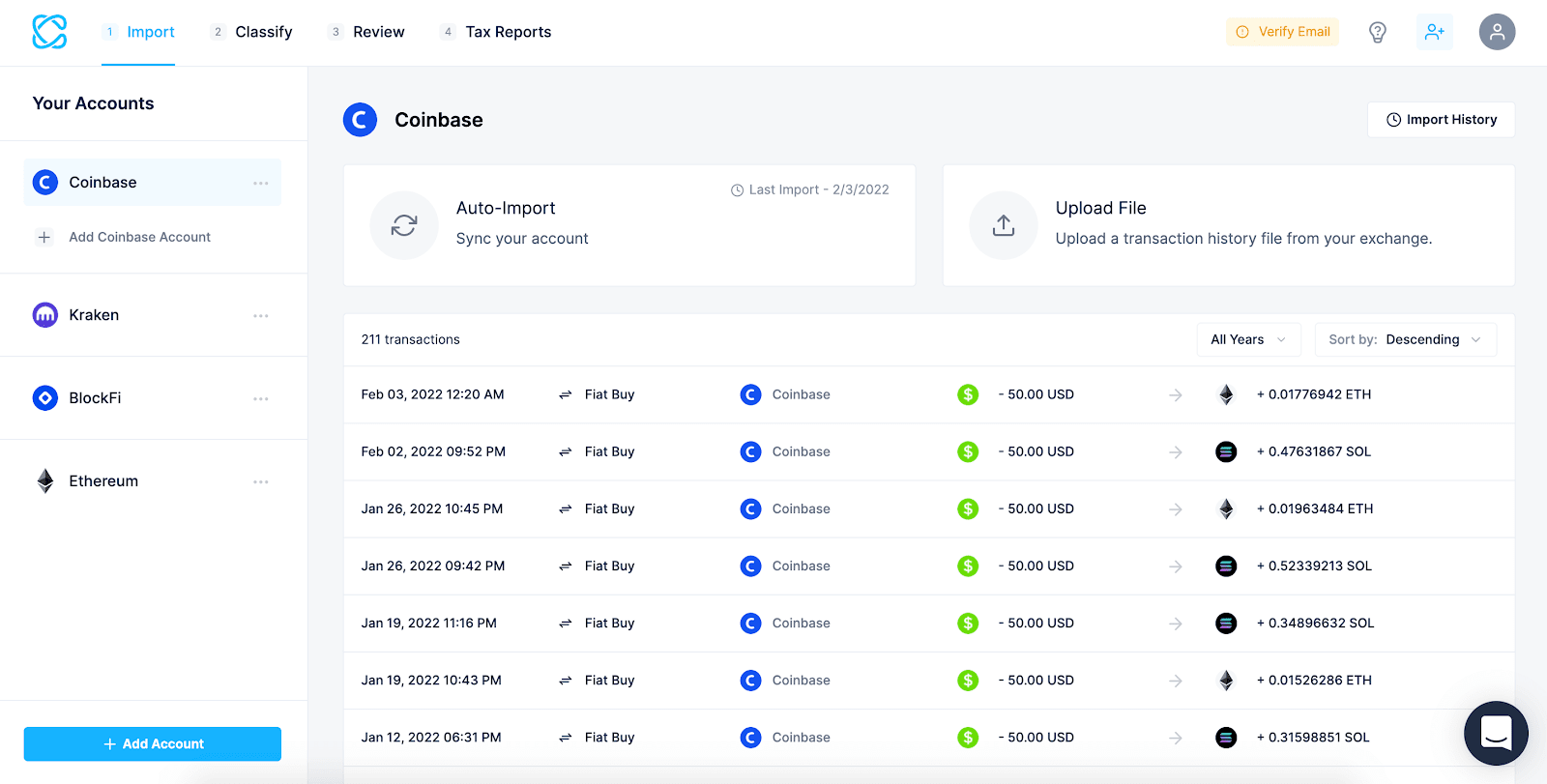

CoinLedger is the leading cryptocurrency tax software platform that streamlines the process of collecting crypto trading information for tax reporting, making it easy to quickly import entire trading histories from blockchains and exchanges automatically. You’ll be able to calculate your crypto taxes in minutes!

CoinLedger automatically generates your crypto tax forms in a few simple clicks!

Interested in getting started? Create a free CoinLedger account today.

Frequently asked questions

- Which crypto exchange is best?

Kraken is considered the best choice for investors due to its low fees and its security.

- Is Binance or Coinbase better?

While both Binance and Coinbase offer fantastic platforms for crypto investors, Coinbase is considered a better option due to regulatory compliance and superior user interface.

- What is the largest exchange?

Binance is currently the largest exchange in the world by trading volume.

- What is the biggest options trading exchange in the world?

Binance is the largest options trading exchange in the world (though options trading is not available on the American version of the platform).

- Which crypto exchange has never been hacked?

Kraken is one of the only major exchanges that has never been hacked.

.png)