.jpg)

Wondering which cryptocurrency exchange is best for you? In this guide, we’ll break down the best cryptocurrency exchanges — based on factors like user experience, fees, and customer support!

Quick look: The best cryptocurrency exchanges

Why you can trust CoinLedger’s crypto exchange rankings

As one of the top crypto tax software and portfolio tracker providers in the space, our team has extensive knowledge of the hundreds of cryptocurrency exchanges on the market. We’ve compiled this list based on feedback from our customer base of 500,000+ as well as the unique features that each exchange provides.

What is the best crypto exchange?

Choosing the right cryptocurrency exchange for your needs depends entirely on your personal needs.

If you’re a professional trader and require advanced trade functionality, you may want to consider an exchange like Kraken or Binance. Beginner investors however, may benefit from the simple and streamlined trade interface offered by Coinbase.

What is the difference between a centralized and decentralized exchange?

What is a centralized exchange?: Centralized exchanges act as middlemen to facilitate trades. Exchanges use ‘order book’ technology to match buyers and sellers and allow transactions to happen quickly and seamlessly.

What is a decentralized exchange?: In decentralized exchanges like Uniswap, users supply the liquidity and all transactions are managed by smart contracts. This means that there is no middle man facilitating transactions.

What are the advantages of the different types of exchange?: Centralized exchanges often have friendlier user interfaces and stronger regulatory compliance than their decentralized counterparts. However, decentralized exchanges are a better choice for users who believe in values like transparency and independence.

Previously, decentralized exchanges were not required to collect Know Your Customer (KYC) information. However, this will likely change in 2026 when 1099-DA reporting requirements go into effect for centralized and decentralized exchanges.

How do crypto exchange fees work?

Transaction fees

When you buy, sell, and/or trade cryptocurrency, you’ll pay transaction fees.

Certain platforms distinguish between maker and taker fees — meaning you’ll pay a different fee depending on how your transaction is characterized. ‘Makers’ add liquidity to an exchange by creating new orders, while ‘takers’ remove liquidity by completing existing orders. Typically, maker fees are lower than taker fees.

Withdrawal fees

If you withdraw your cryptocurrency from an exchange, you may be charged a withdrawal fee.

Other fees

It’s possible that you may pay additional fees for other types of transactions — such as buying cryptocurrency on margin, paying for cryptocurrency with a credit/debit card, or using an exchange’s ‘Quick Buy’ feature.

What to consider when selecting a crypto exchange

Here’s a few factors you may want to consider before you get started with an exchange:

Identification requirements: Reputable cryptocurrency exchanges are required to comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. When creating an account, crypto exchange users must provide identity documentation such as photo ID or proof of address.

Geographic limitations: Some exchanges are available only in certain countries. US-based crypto traders, for example, may not be able to access certain exchanges due to US cryptocurrency regulation. If you’re in the US and are looking for a comprehensive guide to the best crypto exchanges for US-based traders, see our United States-specific crypto exchange guide here.

Trade limits: Some exchanges may set limits or create tiered account levels depending on identity verification.

Trading fees: Crypto exchanges charge fees to make money. Some exchanges charge a flat percentage of all trades, while others offer a “maker/taker“ model that offers different fees depending on the type or trade orders users make.

Fiat currency support: Some crypto exchanges don’t support fiat currency, such as USD, EUR, or GBP and deal only in cryptocurrency. If you want to exchange cryptocurrency for USD, for example, you’ll need an exchange that supports fiat currency.

Deposit & withdrawal methods: Exchanges that support fiat currency will offer multiple options for deposit and withdrawal, such as credit card, bank transfers, or wire transfer.

Trading pairs: If you want to trade a specific cryptocurrency, it’s important to check whether the exchange you are considering currently lists it.

Hacks and security: Hacks occur frequently in the cryptocurrency ecosystem. It’s important to select an exchange with a strong security track record. Reliable exchanges offer security features such as two-factor authentication.

Do I need to report my crypto exchange activity on my taxes?

Major exchanges like Coinbase and Kraken report your cryptocurrency taxes to the IRS.

However, exchanges often have trouble providing accurate tax forms due to the transferable nature of cryptocurrency. If you transferred your crypto, it’s likely that your exchange won’t be able to accurately calculate your capital gains and losses.

Consider the following example.

In this case, Brian should have $500 of capital gain. However, Exchange B doesn’t have records of his original cost basis. If Brian hasn’t kept records of his original purchase, he may have to recognize the full $1,500 of capital gain.

If you find yourself in this situation, consider using crypto tax software like CoinLedger. These platforms can aggregate your transactions across your wallets and exchanges and generate a complete crypto tax report in minutes.

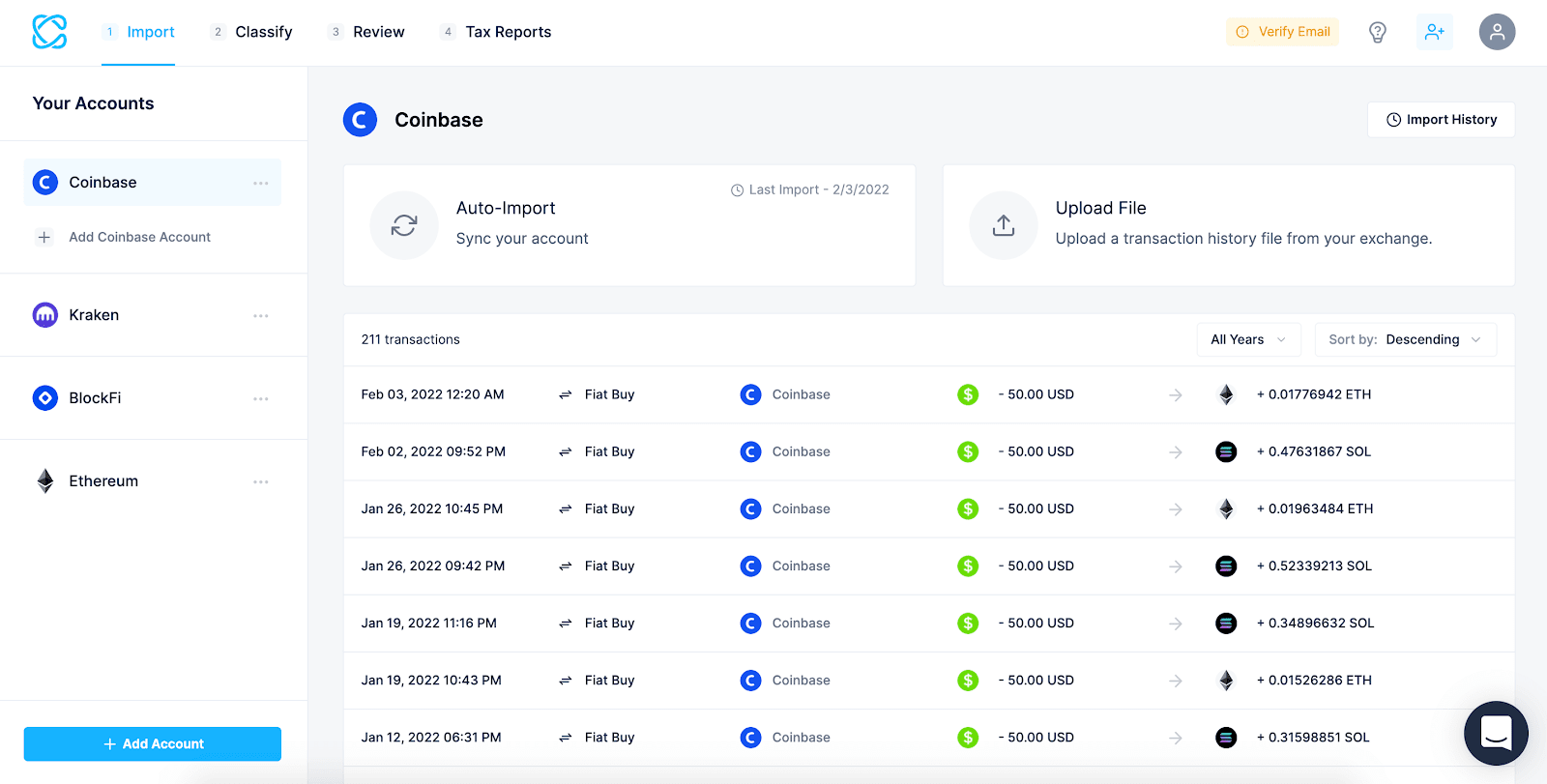

How crypto tax software can help

Cryptocurrency tax software platforms like CoinLedger can make it easier than ever to generate a crypto tax report. Just import your wallets and exchanges and let the platform calculate your gains, losses, and income!

More than 500,000 investors across the globe trust CoinLedger.

You can take your tax reports to your accountant or simply import them into your preferred tax filing software such as TurboTax or TaxAct.

Frequently asked questions

- Which cryptocurrency exchange is best?

Coinbase is often considered the best exchange overall due to its user-friendly interface and security features. However, the platform is catered towards beginners, and it may not be the best choice for intermediate and advanced features.

- How do cryptocurrency exchanges work?

Cryptocurrency exchanges allow users to buy, sell, and trade cryptocurrencies. Exchanges like Coinbase and Kraken make the process quick and user-friendly.

- What are the top cryptocurrency exchanges by volume?

Currently, the top 5 cryptocurrency exchanges by volume are Binance, Bybit, Coinbase, OKX, and Upbit. It’s important to note that many top exchanges are subject to geographic restrictions — for example, Binance.com is not available in the US.

- What is the safest cryptocurrency exchange?

Kraken is one of the only major exchanges that have never been hacked in its history.

- Which cryptocurrency exchange has the lowest fees?

Kraken and Crypto.com offer low fees to users!

.png)