Written by:

Miles Brooks

In this guide, we’ll break down everything you need to know about cryptocurrency taxes. From the high-level tax implications to the final tax forms you need to fill out, youʼll learn all about what you need to stay compliant and report your taxes properly.

In the United States, cryptocurrency is subject to capital gains tax (when you dispose of cryptocurrency) and income tax (when you earn cryptocurrency).

Here’s a few examples of transactions subject to capital gains tax and income tax.

Capital gains tax: Selling your crypto, trading your crypto for another cryptocurrency, using your crypto to buy goods and services.

Income tax: Earning crypto from staking, mining, referrals from an exchange, or as compensation for labor.

Your tax rate depends on how much you earned during the year and how long you held your cryptocurrency.

If you earned cryptocurrency income or disposed of your crypto after less than 12 months of holding, you’ll pay tax between 10-37%.

If you dispose of your cryptocurrency after 12 months of holding, you’ll pay tax between 0-20%.

.jpeg)

Income earned in the U.S. (including crypto income) isn’t subject to a flat tax rate. Rather, taxpayers pay different tax rates on each individual portion of income as they progress through tax brackets. For example, if a taxpayer has $25,000 of ordinary income for the year, they will pay 10% on the first $11,600 and 12% on the next $13,400.

You incur a taxable event when you earn or dispose of cryptocurrency.

When you dispose of cryptocurrency, you’ll recognize a capital gain or loss depending on how the price of your crypto has changed since you originally received it.

Here’s a few examples of crypto disposals subject to capital gains tax:

When you earn cryptocurrency, you’ll recognize income based on the fair market value of your crypto at the time of receipt. Examples of income include airdrop rewards, staking rewards, and mining rewards.

Not every cryptocurrency transaction is subject to tax! You do not trigger a taxable event when you:

It’s often assumed that because cryptocurrency is anonymous, evading taxes is fairly easy. This is not true.

Major exchanges like Coinbase send 1099 forms to the IRS which contain your information and records of your crypto income.

The IRS can use the information that it receives from major exchanges to match ‘anonymous’ wallets to known individuals. In the past, the agency has worked with contractors like Chainalysis to analyze the blockchain and crack down on tax fraud.

In the near future, the IRS will have even more information at its disposal to identify tax cheats. Due to the passage of the Build Back Better Act, all exchanges will be required to report 1099 forms with detailed records of capital gains and losses starting in 2025.

The IRS can enforce a number of penalties for tax fraud, including criminal prosecution, five years in prison, and a fine of up to $250,000.

Over the past several years, the IRS has aggressively cracked down on cryptocurrency tax compliance issues. It’s updated the main US income tax form (1040) to include a question that every US taxpayer must answer under penalty of perjury:

As cryptocurrency adoption accelerates, it’s likely that we’ll see more cryptocurrency tax audits and tax prosecutions.

While there’s no way to evade your cryptocurrency taxes, the strategies below can help you legally reduce your crypto taxes!

Holding your cryptocurrency for the long-term comes with tax benefits! When you dispose of crypto held for longer than a year, you pay a lower tax rate on your capital gains.

Capital losses from cryptocurrency can offset an unlimited amount of capital gains and up to $3,000 of income for the year. Additional losses can be rolled forward into future tax years.

Learn more about how you can tax loss harvest with cryptocurrency here.

If you’re planning on holding your cryptocurrency for the long-haul, a cryptocurrency IRA can be a great option. With a self-directed IRA, you can hold cryptocurrencies and dispose of them on a tax-free/tax-deferred basis once you’re near retirement age.

Donating cryptocurrency is a great way to make a positive impact and claim tax benefits. Donating cryptocurrency is not subject to capital gains tax, and you claim a tax deduction based on the value of your donation!

If youʼre like many other crypto investors, thereʼs a strong chance that you werenʼt always aware of the fact that your crypto-related income needed to be reported on your taxes.

If you are in this situation, donʼt worry. You can amend a prior year's tax return to include your crypto-related income with IRS Form 1040X.

Itʼs always better to amend your return in good faith rather than waiting for the IRS to find you. While there is never a way to guarantee that someone won’t be audited after amending their taxes, paying your taxes before the IRS begins an investigation can go a long way to demonstrate that further inquiry is unlikely to find additional reporting errors.

For a detailed guide, check out our blog post on how to amend your tax return to include your crypto.

To calculate your capital gains and losses from each of your crypto sells, trades, or disposals, simply apply the formula:

Proceeds represents how much value you received in exchange for disposing of your crypto-asset. Typically, this will be the fair market value of your assets at the time of disposal minus the cost of relevant fees.

Cost basis represents how much money you put into purchasing your property (i.e. how much it cost you). Cost basis includes purchase price plus all other costs associated with purchasing your cryptocurrency (fees, etc).

In the example above, Charlie’s cost basis is $250, while his proceeds are $400.

Applying the formula:

$400 (Proceeds) - $250 (Cost Basis) = $150 Gain

In some situations, investors buy the same cryptocurrency at multiple price points.

If you find yourself in this situation, you’ll need to use a cost basis method like FIFO, LIFO, or HIFO. These cost basis methods determine the ‘order’ in which your cryptocurrency gets disposed of.

Let’s walk through how these cost basis methods work.

FIFO: FIFO is first-in first-out. The first cryptocurrency you acquired is the first you dispose of when calculating your gain or loss.

LIFO: LIFO is last-in first-out. With this method, the last cryptocurrency you acquired is the first you dispose of. LIFO can help you save money on taxes in a period of rising prices.

HIFO: HIFO is highest-in first-out. With this method, the highest price cryptocurrency you acquire is the first you dispose of.

FIFO is considered the default method for most investors. If you choose a ‘specific identification’ method like LIFO or HIFO, you’ll need to specifically identify each individual unit of cryptocurrency.

In our example above, depending on which method he uses, Henry's gain/loss would be the following:

Cryptocurrency exchanges often send 1099 forms to users detailing capital gains and losses to users. This may include Form 1099-B, Form 1099-MISC, and Form 1099-K. Starting in 2025, exchanges will be required to issue Form 1099-DA.

Form 1099-B is a form specifically designed to report capital gains and losses from investment assets. Remember, your Form 1099-B may not be accurate if you transferred your cryptocurrency into or out of an exchange. In this case, your exchange may not have a record of your cost basis/proceeds and will not be able to accurately calculate your capital gains.

Form 1099-MISC is a form designed to report ‘miscellaneous’ income — such as income from staking and airdrops. Most exchanges will send you this form if you’ve earned more than $600 in miscellaneous income during the tax year.

Form 1099-K is a tax form designed for payment processors that was issued by cryptocurrency exchanges in the past. Form 1099-K shows the total transaction volume for transactions — which can make it appear as though the user has a significant unpaid tax liability (even when they have accurately reported their taxes). Many exchanges sent Form 1099-K in the past, but most have stopped sending this tax form due to the confusion they caused for both customers and tax authorities.

Form 1099-DA is a form designed specifically to report your gains and losses from digital assets. Of course, Form 1099-DA will still be limited when it comes to tracking wallet-to-wallet transfers. As a result, you’ll still be required to keep track of your capital gains and losses on your own.

As you can see from the examples above, calculating your capital gains and losses from your crypto trading activity requires keeping track of your cost basis, fair market value, and USD gain or loss every time you dispose of a crypto (trade, sell, spend, etc).

Without this information, you cannot accurately calculate your realized income or capital gains from your trading activity, and you won’t be able to accurately report them on your tax return.

Gathering and maintaining this information is extremely challenging for many cryptocurrency investors as most havenʼt been keeping detailed records of their investing activity. Tracking the cost basis and USD prices for every cryptocurrency across all exchanges, wallets, and protocols at any given time quickly turns into a difficult, if not impossible, spreadsheet exercise.

This is the reason why hundreds of thousands of crypto investors are turning to crypto tax software like CoinLedger to automate their crypto tax reporting. You can sign up for a free account here.

You’re required to report your capital gains income and ordinary income on your taxes. We dive into the reporting for each of these income types below.

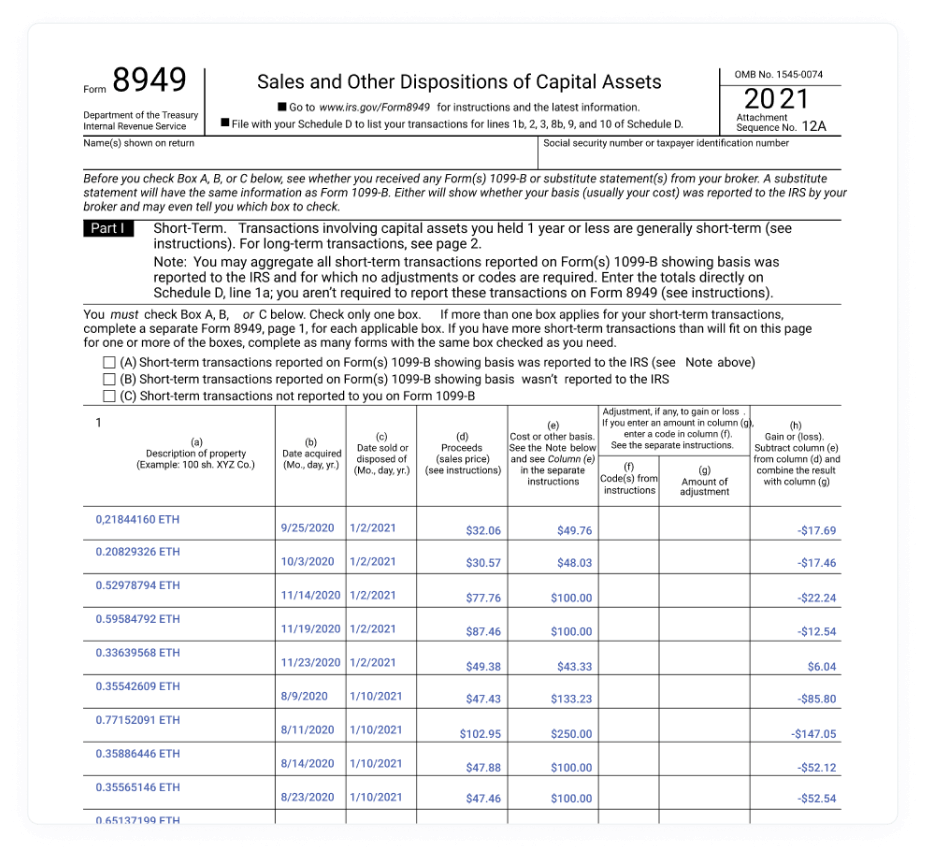

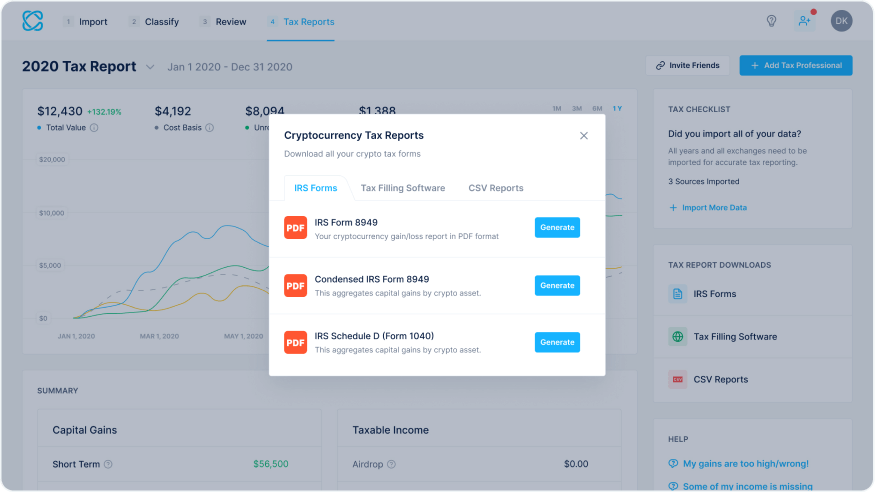

Your capital gains and losses from your crypto trades get reported on IRS Form 8949.

Form 8949 is the tax form that is used to report the sales and disposals of capital assets, including cryptocurrency. Other capital assets include stocks and bonds.

To fill out Form 8949, list all of your cryptocurrency trades, sells, and disposals into the relevant column (pictured below) along with the date you acquired the crypto, the date your crypto was sold or traded, your gross proceeds, your cost basis, and your gain or loss for the trade.

Once you have each trade listed, total them up and fill in your net capital gain or loss for the year at the bottom.

For a detailed walkthrough of Form 8949, check out this blog post: How To Report Cryptocurrency to the IRS.

Typically, you can report crypto income on Schedule 1. However, you may report your cryptocurrency income on Schedule C if you are operating a business.

Schedule 1 - If you earned crypto from staking, airdrops, forks, or other crypto hobby income, it’s generally reported on Schedule 1 as other income. (Not subject to self-employment tax.) Most investors will use this form to report crypto income.

Schedule C - If you earned crypto while operating a business, like receiving payments for contract work, running a cryptocurrency mining operation, or operating a node, this is often treated as self-employment income and is reported on Schedule C. Schedule C also allows you to deduct business expenses such as electricity used for mining.

To make things easier for investors, CoinLedger generates a complete income report that is included with your completed crypto tax reports. This report details the US Dollar value of all of your cryptocurrency income events that you received throughout the year: mining, staking, airdrops, and more. This income report can be used to complete your relevant ordinary income tax forms like Schedule 1 and Schedule C.

Buying cryptocurrency with fiat currency is tax-free.

However, you should keep detailed records of your cryptocurrency purchases for tax purposes. If you dispose of your cryptocurrency in the future, you’ll need to know your original cost for acquiring your crypto to calculate your total capital gain.

There’s no tax for simply holding cryptocurrency.

Transferring crypto between wallets that you own is tax-free. However, you may pay taxes on fees paid to transfer your crypto (this is considered a taxable disposal).

You should keep a detailed record of your cryptocurrency transfers so that you can calculate your capital gains and losses in a disposal event.

Selling cryptocurrency is a disposal event subject to capital gains tax. You’ll incur a capital gain or loss depending on how the price of your crypto changed since you originally received it.

When you spend cryptocurrency to purchase goods and services, you’ll incur a capital gain or loss depending on how the price of your crypto has changed since you originally received it.

Trading your crypto for another cryptocurrency is considered a disposal event subject to capital gains tax. You’ll incur a capital gain or loss depending on how the price of the crypto you traded away has changed since you originally received it.

Cryptocurrency losses can be used to offset 100% of your gains from cryptocurrency, stocks, and other assets and up to $3,000 of income for the year. Any additional losses can be rolled forward into future tax years.

Exchange fees and blockchain gas fees related to acquiring and disposing of your crypto can reduce your capital gains.

Fees related to acquiring your crypto can be added to your cost basis.

Meanwhile, fees related to disposing of your crypto can be subtracted from your gross proceeds.

Cryptocurrency mining rewards are considered income based on the fair market value of your crypto at the time of receipt. When you dispose of your rewards, you’ll pay capital gains tax based on how the price of your crypto has changed since you originally received it.

Mining crypto as a business: If you’re mining cryptocurrency as a business, you can deduct relevant expenses such as the depreciation of your equipment and electricity.

Mining crypto as a hobby: If you’re mining cryptocurrency as a hobby, you are not allowed to deduct relevant expenses.

You can read more in our complete guide on how crypto mining is taxed.

Cryptocurrency staking rewards are considered income based on the fair market value of your crypto at the time of receipt.

When you dispose of your rewards, you’ll pay capital gains tax based on how the price of your crypto has changed since you originally received it.

Cryptocurrency received from an airdrop is taxed as income. This means that you are liable for income taxes on the USD value of the claimed airdrop.

When you dispose of airdrop rewards, you’ll incur a capital gain or loss depending on how the price of your crypto has changed since you originally received it.

For more information, check out our guide to airdrop taxes.

In a cryptocurrency hard fork, a blockchain splits into two and an entirely new cryptocurrency is created. If you receive units of this new cryptocurrency, you’ll recognize income based on the fair market value of your coins at the time of receipt.

If you dispose of your forked cryptocurrency in the future, you’ll incur a capital gain or loss depending on how its price has changed since you originally received it.

Sometimes, a cryptocurrency will need to rebrand or change its architecture for increased functionality. When this happens, the conversion from the old version of the token to the new version of the token is not a taxable event. Similar to a stock split or a company changing tickers on the stock market, the underlying cost basis will carry through into the new asset without triggering a taxable event.

A good rule of thumb is that if you haven’t received any new cryptocurrency as a result of a fork, there is no taxable event.

Currently, platforms like Gemini offer users interest rewards for holding select cryptocurrencies. Cryptocurrency interest is considered personal income and is taxed accordingly.

When you dispose of cryptocurrency interest rewards, you’ll recognize a capital gain or loss depending on how the price of your crypto changed since you originally received it.

Today, investors can receive loans using cryptocurrency as collateral from centralized exchanges and decentralized protocols.

Generally, receiving a loan is not considered a taxable event.

However, some DeFi loan protocols use crypto-to-crypto swaps to facilitate loans. It’s possible that these swaps will be considered disposals subject to capital gains tax.

For more information, check out our guide to how cryptocurrency loans are taxed.

Cryptocurrency exchanges like BitMex and Binance.com have popularized the use of margin and futures trading. The IRS has not yet set forth explicit guidance on how these cryptocurrency transactions should be handled from a tax perspective, but it’s likely that any profits or losses from margin trading will be treated as capital gains and losses.

For more information, check out our guide to cryptocurrency margin trading taxes.

If you are feeling generous, you can send a cryptocurrency gift to a friend or family member without having to worry about paying additional taxes.

Generally, cryptocurrency gifts are tax-free for all but the most generous gift-givers. Gift taxes are not imposed until the gift-giver has gifted away over $13.61 million dollars in their lifetime. Even then, the gift recipient will never have to pay taxes for merely receiving the gift.

However, if you send a gift or gifts with a fair market value above $18,000 to any individual in a year, you will need to file a gift tax return in addition to your traditional tax returns. This form is for informational purposes and does not mean you will be required to pay taxes on your gift.

For more information, check out our guide to crypto gift taxes.

Crypto donations to registered charities come with multiple tax benefits!

If you are claiming a deduction larger than $500, you will need to report this on Form 8283.

The amount of your donation that is tax-deductible depends on how long you have held the assets:

For more information, check out our guide to how cryptocurrency donations are taxed.

Despite being explicitly designed for transactions, stablecoins are taxed the same as other cryptocurrencies. You’ll incur a capital gain or loss when you dispose of your stablecoin (though it’s likely that your capital gain will be close to 0).

For more information, check out our guide to stablecoin taxes.

Lost, stolen, and hacked cryptocurrency is no longer tax-deductible after the Tax Cuts and Jobs Act of 2017. This includes:

For more information, check out our guide to lost, stolen, and hacked crypto taxes.

In 2022, exchanges like Voyager and Celsius went bankrupt, causing millions of investors to lose access to their cryptocurrency.

Cryptocurrency that is lost after an exchange bankruptcy likely can be treated as an investment loss. However, it’s important to note that claiming these losses means that you relinquish your right to reclaim your assets once the bankruptcy process is over.

For more information, check out our guide to how exchange bankruptcies are taxed.

Cryptocurrency lending platforms and other DeFi services like Uniswap, Maker, and Compound have exploded in popularity in recent years.

It’s important to remember that the same tax rules that apply to other cryptocurrency transactions apply to DeFi. That means:

It’s important to remember that the DeFi space is constantly innovating. As a result, there are often novel investment arrangements that do not fit squarely into existing tax frameworks.

The full tax implications associated with transactions common to the DeFi landscape are outside of the scope of this piece; however, we discuss them thoroughly in our DeFi Crypto Tax Guide.

When you deposit your cryptocurrency in a decentralized liquidity pool, you’ll typically receive LP tokens that represent your position.

At this time, the IRS has not given explicit guidance on how depositing and withdrawing liquidity is taxed. You can take a conservative or aggressive approach depending on your risk appetite.

Conservative approach: Treat withdrawing and depositing liquidity as crypto-to-crypto trades subject to capital gains tax. You’ll incur a capital gain or loss depending on how the price of your crypto has changed since you originally received it.

Aggressive approach: Treat withdrawing and depositing liquidity as non-taxable.

In general, it’s recommended that you take the conservative approach. However, how to report your taxes may vary depending on the specific mechanisms of your DeFi protocol. You should reach out to a crypto tax professional if you’re unsure how to report your liquidity pool transactions.

From a tax perspective, NFTs are treated similarly to cryptocurrencies and are taxed upon disposal.

Buying an NFT with cryptocurrency: Making a purchase with cryptocurrency is considered a disposal. You’ll incur a capital gain or loss depending on how the price of your crypto has changed since you originally received it.

Selling/trading away an NFT: When you dispose of an NFT, you’ll incur a capital gain or loss depending on how its price has changed since you originally received it.

Minting NFTs: If you’re a creator, you’ll recognize income based on the revenue you receive from primary and secondary NFT sales.

The IRS has said that NFTs may be subject to the 28% collectible tax in certain circumstances. It’s possible that ‘profile picture’ and ‘art’ NFTs will be considered collectibles and taxed accordingly.

For more information, check out our Complete NFT Tax Guide.

So far, the IRS hasn’t provided any guidance on how Decentralized Autonomous Organizations (DAOs) are taxed. It’s likely that they’ll be considered ‘flow-through entities’. This means that while the DAO itself won’t pay taxes, individuals in the DAO recognize income based on their share of the organization’s profits.

For more information, check out our guide to DAO taxes.

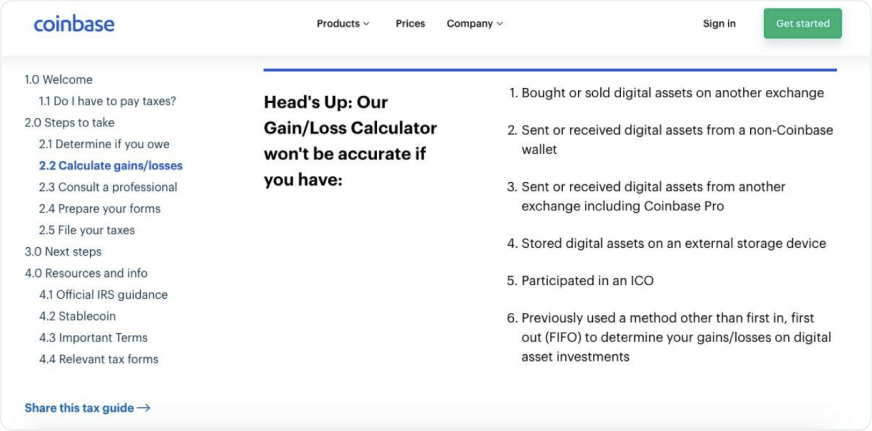

Cryptocurrency exchanges like Coinbase, Binance, and others often do not have the ability to provide their users with accurate capital gains and losses tax reports. This is not a fault of the exchanges themselves, it is simply a product of the unique characteristics of cryptocurrencies—namely their transferability.

Because users are constantly transferring crypto into and out of exchanges, the exchange has no way of knowing how, when, where, or at what cost basis you originally acquired your cryptocurrencies. The exchange only sees when crypto appears in your wallet and what the USD value was at the time of the deposit.

The second you transfer crypto into or out of an exchange, that exchange loses the ability to give you an accurate report detailing the cost basis of your cryptocurrencies, one of the mandatory components for tax reporting.

As pictured below, Coinbase explained to users how their generated tax reports wonʼt be accurate if any of them transferred crypto into/out of Coinbase. This affects over two-thirds of Coinbase users, which amounts to millions of people who cannot rely on Coinbase’s calculations to prepare their tax forms.

You can read more about the “crypto tax problem” in our blog post: Why Exchanges Canʼt Report Crypto Taxes.

You can aggregate all of your transaction history by hand by pulling together your transactions from each of your exchanges and wallets. Of course, this can take a lot of time and energy.

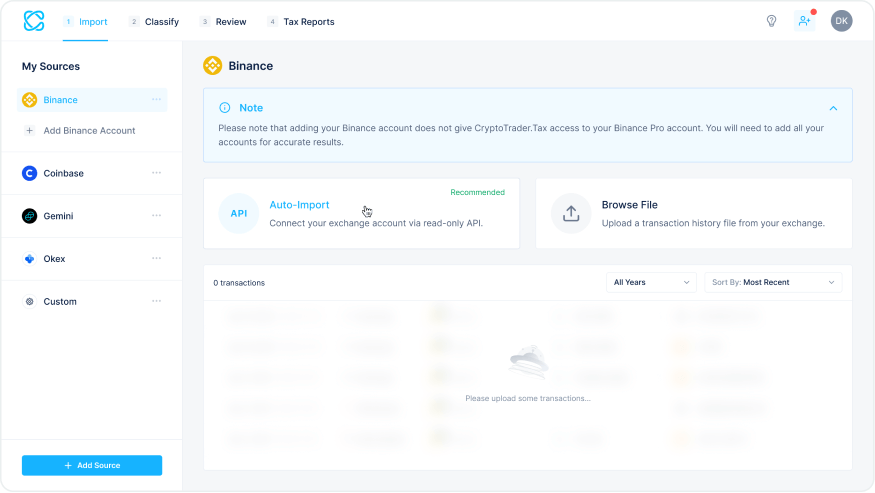

The easiest way to report your crypto taxes is to use crypto tax software. A platform like CoinLedger can automatically import your transactions from all of your wallets and exchanges. Once this is done, you’ll be able to generate an accurate tax report containing all of your transaction data.

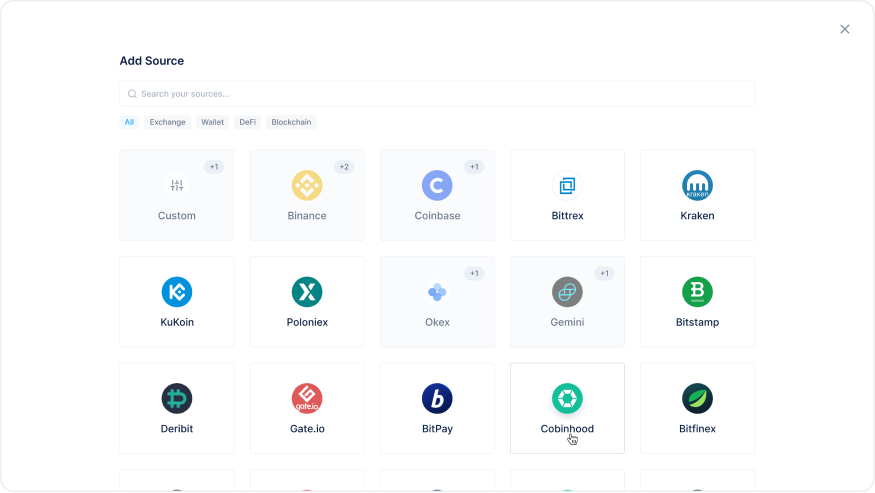

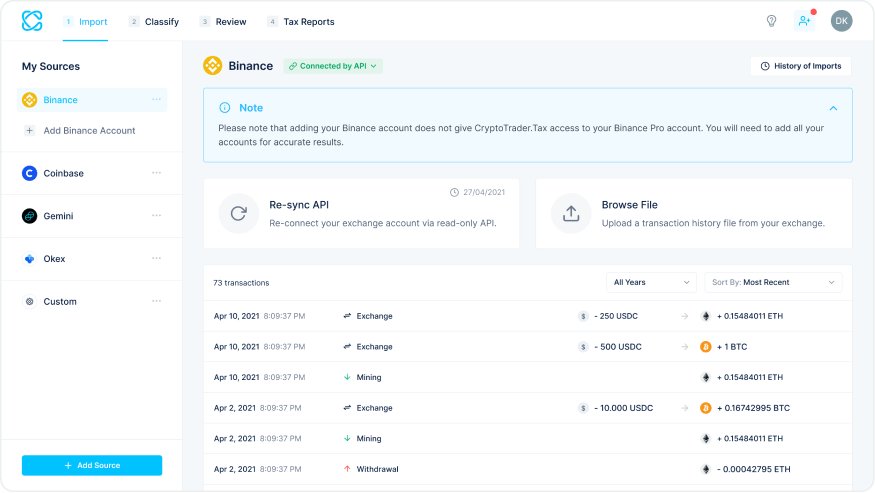

1. Select each of the cryptocurrency exchanges, wallets, and platforms youʼve used throughout the years.

2. Import your historical transactions by connecting your accounts to the CoinLedger platform or uploading the CSV transaction history report from your exchange. Note, CoinLedger requires “read only” access to your exchange account. This type of access protects your funds and does not give CoinLedger any ability to move funds or transact on your behalf.

3. Finally, generate your complete crypto tax reports with the click of a button.

Once youʼve generated your tax reports, you can send them to your tax professional or import them directly into your preferred tax filing software like TurboTax or TaxAct.

You can test out the software yourself by creating a free account here.

The entire cryptocurrency ecosystem is still in its infancy. As the industry evolves, further rules and regulations will inevitably come.

Our team tracks every update in the world of cryptocurrency regulation, and we will continue to update this blog post with the latest guidelines from the IRS. You can also follow us on Twitter for real-time updates and tax savings strategies.

Let’s cap things off by answering some frequently asked questions about cryptocurrency taxes.

Yes. In the United States, cryptocurrency is taxed as property and is subject to capital gains and income tax.

Typically, you pay taxes on cryptocurrency when you dispose of it or earn it as income.

There are some situations where you may need to pay taxes on Bitcoin even if you don’t cash out to fiat. For example, earning Bitcoin interest or trading Bitcoin for other cryptocurrencies would be considered taxable events.

Tax evasion is a federal crime with serious consequences. The maximum penalty is a fine of $250,000 and a prison term of up to 5 years.

All cryptocurrency disposals should be reported on Form 8949. Cryptocurrency income events should be reported on Schedule B, Schedule C, or Schedule 1 depending on your situation.

You can calculate your capital gains and losses on cryptocurrency through the following formula: Capital Gain/Loss = Proceeds - Cost Basis

All of your taxable income from cryptocurrency must be reported on your taxes — regardless of the total amount.

All CoinLedger articles go through a rigorous review process before publication. Learn more about the CoinLedger Editorial Process.

CoinLedger has strict sourcing guidelines for our content. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets.

This guide breaks down everything you need to know about cryptocurrency taxes, from the high level tax implications to the actual crypto tax forms you need to fill out.